As per market forecast, the Australian foodservice market is expected to witness a CAGR of 5.1% (2019 - 2024), reaching USD 80.7 billion by 2024.

The food and beverages industry include the companies which are involved in the end-to-end business of processing, packaging and distribution of fresh food, prepared foods and packaged foods along with alcoholic and non-alcoholic beverages.

Coca-Cola Amatil to sell SPC business; profit of ~10-15m expected by end of JuneCoca-Cola Amatil Limited (ASX: CCL) caters to the Asia Pacific region and manufactures and distributes ready-to-drink beverages and ready-to-eat food snacks. It is the authorised manufacturer and distributor of The Coca- Cola Companyâs beverage brands in Fiji, Samoa, Australia, New Zealand, Indonesia and Papua New Guinea.

CCL products (Source: Company website)

The company announced on 4th June that it had finalised the sale of the SPC fruit and vegetable processing business to Shepparton Partners Collective Pty Ltd and Shepparton Partners Collective. The consideration amount is $40 million, to be paid upon completion of the deal. Targeted to be completed before the end of June 2019, the profit on sale of $10-15 million is being anticipated (after considering predicted working capital balances and working capital changes to the sale price and costs of disposal).

Besides this, subject to business performance, the agreement is inclusive of a four-year deferred payment that could result in (up to) an extra $15 million worth sale proceeds at that time. Given the realisation of recognised deferred tax assets, the companyâs capability to frank dividends would have a notable effect in the short to medium term.

Looking back in time, the company had acquired the SPC business in 2005. Ever since, CCL has made investments of almost $250 million in areas like technology, equipment, operational and energy efficiencies. In 2014 to 2018, there was a co-investment program worth $100 million, which modernised the businessâ snack cup and tomato manufacturing, apart from having a pouch line and a new sterile fruit processing system at the Shepparton site on board. The divestment process for the business began in November 2018.

The Shepparton Partners Collective Pty Ltd and its group aim to grow the Goulburn Valley-based business and provide employment to the permanent staff.

Group Managing Director, Alison Watkins stated that the deal was for the business to continue its transformation and receive opportunities in domestic and global markets. He mentioned that the companyâs award-winning functional food range - ProVital⢠has been garnering support with dieticians. The processing and automation capability had opened new export markets.

Looking at the Shepparton Partners Collective, it is a JV between The Eights and Perma Funds Management. It holds Australian and global experience in finance, food, retail, supply chain, agri-business and technology.

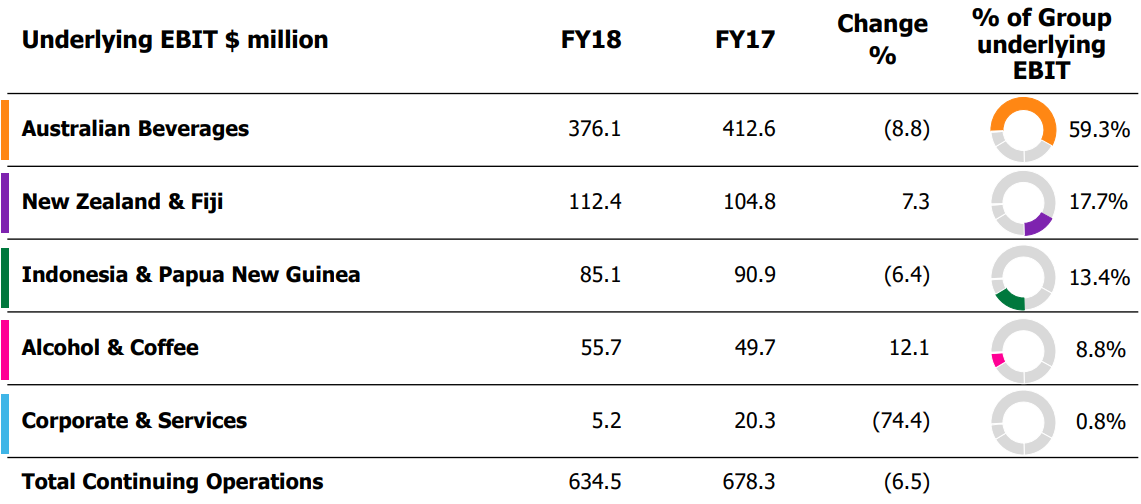

The company conducted its AGM on 15th May 2019. The trading revenue was $4.75 billion (increase of 1.1%) whereas the underlying earnings before interest and tax amounted to $634.5 million. The company is aiming to target medium term dividend payout ratio of over 80% for 2019.

Segment EBIT Contributions (Source: Companyâs report)

Segment EBIT Contributions (Source: Companyâs report)

As on 4th June 2019, CCL settled the dayâs trade at A$9.610, up by 2.56%. With a market cap of A$6.78 billion, it has generated a YTD return of 14.83%. The 6-month return has been 7.09%.

Australian Foodservice Market

The Australian Foodservice Market is segmented by Type and Structure. The different types of market include Fast Food, Bar and Cafe, Full-Service Restaurant, Self Service based Restaurant, Street Kiosk and Stall and fully catered Home Delivery Restaurant. Structure wise, it includes Independent Consumer Foodservice and Chained Consumer Foodservice.

There is a rise in the number of chained consumer foodservice restaurants across the globe. Furthermore, as per a market research, Australians, specifically, eat out averagely two to three times a week, which is more than 50 million meals per week. In the country, the market is highly fragmented, with the presence of many local and independent restaurants.

Key products in Australian Foodservice market

Some of the major players of the Australian market in the F&B sector are McDonaldâs Corp., Yum! Brands, Dominoâs Pizza, StarBucks Corp. and Nandoâs. With a rising demand for healthy food consumption, these brands are focussed on strategically developing new products with functional benefits.

McDonald's had been the most preferred restaurant by the consumers, followed by KFC, fish and chip shops, and chains offering Asian food. In the past decade, Dominoâs has been expanding in Australia, and as of 2018, it had 693 outlets located across the country.

Few key players in Australiaâs F&B

The most popular cuisines in the Australian consumers are Indian, Korean, Japanese, Thai, Italian, Chinese, Vietnamese and Mexican. There is an abundance of opportunities in the Australian foodservice market, with the increase in the population eating away from home and a rise in interest in speciality niche products in the market.

Collins Foods Limited

Operational from Brisbane, Collins Foods Limited (ASX:CKF) operates food service retail outlets. It is the KFC franchisee in Europe and Australia, Taco Bell franchisee in Australia and Asiaâs franchisor for Sizzler. Besides this, it is also the owner of Sizzler restaurants in Australia.

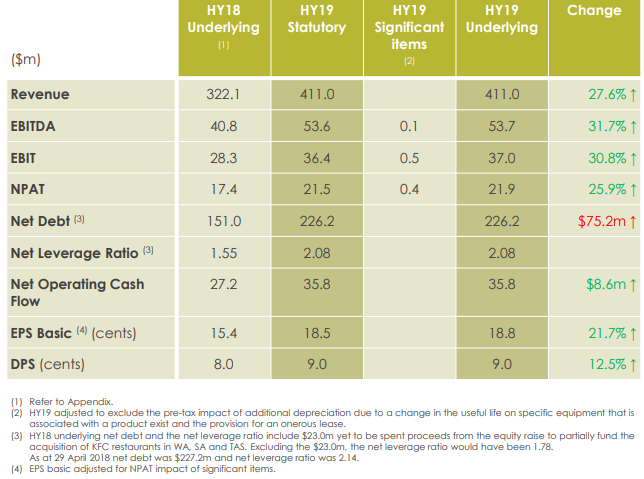

As per companyâs recently released HY19 results, its revenue was up by 27.6% to $411.0 million on pcp. The KFC revenue growth in Australia alone was 21.9% to $330 million. In Australia, final 3 KFC restaurants were acquired from Yum! and two new restaurants were built and opened. The sales in the Netherlands and Germany had an adverse impact of an unusually hot summer, though two new restaurants were built and opened in Germany. Taco Bell is progressing well with preparation for ramped up development in 2019, as per the company. The Sizzler Asia witnessed growing sales and earnings and had 73 restaurants in Asia at the half year.

Financial Summary (Source: Companyâs report)

Financial Summary (Source: Companyâs report)

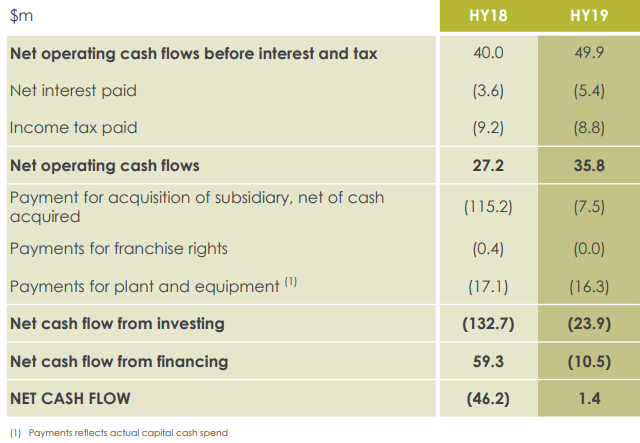

The company had a strong operating cash flow (up 31.6% to $35.8 million) which supported its growth.

Cash flow highlights (Source: Companyâs report)

As on 4th June 2019, the stock is trading at A$7.950, down by 0.25%. With a market cap of A$928.6 million, it has generated a YTD return of 32.61%. The 6-month return has been 9.93%.

Dominoâs Pizza Enterprises Limited

Australiaâs largest pizza chain (in terms of network store numbers and sales), Dominoâs Pizza Enterprises Limited (ASX:DMP) is a major player in the consumer discretionary sector, operating retail food outlets.

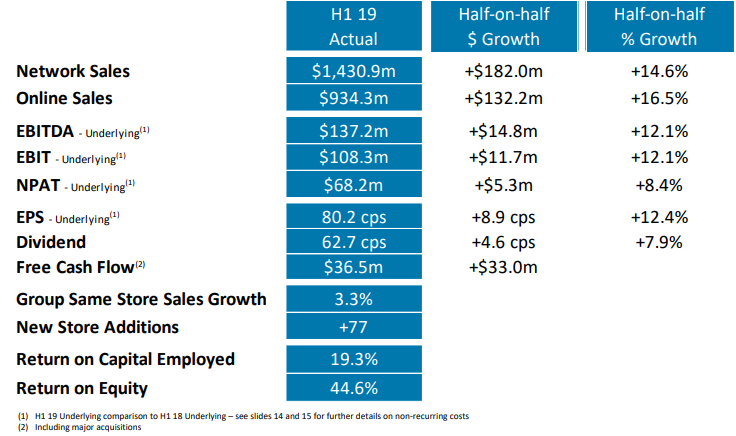

As per its half year results for the period ending 30th December, the company recorded Network Sales of $1,430.9 million, up by 14.6% (Half-on-Half growth). The online sales were up by 16.5% (Half-on-Half growth) to $934.3 million. The company continued to grow its sales and market share. The performance was sturdy in New Zealand, Belgium, Germany, Japan and Netherlands. There was however a slower than expected performance in France and a soft season in Australia too.

Financial highlights (Source: Companyâs report)

Financial highlights (Source: Companyâs report)

In the first weeks of trade in H2 19, DMP opened more than 13 new organic stores, recording a same store sales growth of more than 4.0%. On the cash flow side, the Underlying operating cash flow was up by more than 26.2% to $139.8 million. The ROE increased to 44.6%.

As its guidance, the company is focussing on increasing its Franchisee profitability. The company is also aiming to launch a next gen mobile app. In H219, a new cheese is most likely to be introduced.

On 10th April 2019, the company announced that it had entered into a binding agreement for the acquisition of the Master Franchise rights for Dominoâs Pizza in Denmark and assets previously owned by DPS.

As on 4th June 2019, the stock is trading at A$37.700, down by 3.24%. With a market cap of A$3.34 billion, it has generated a negative YTD return of 4.28%. The 6-month return has been negative at 17.75%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_09_03_2024_01_03_36_873870.jpg)