On Australian Stock Exchange, the health care sector of Australia is represented as S&P/ASX 200 Health Care index, which is trading in the green zone at 35,656.9 with a rise of 1.24% at the time of writing on 17th September 2019 (AEST 2:19 PM). In the article, we will be looking at the well-known company in the industry, i.e. Ramsay Health Care Limited. In the trading session of 17th September 2019, the stock witnessed a fall of 4.601%, primarily due to dumping of shares by one of its prominent holders (Discussed below).

When it comes to the operating and financial performance, the company delivered decent results as per its latest earnings release. The company has provided a good dividend to its shareholders with decent growth. Letâs get into details of the company:

Ramsay Health Care Limited (ASX: RHC) is a hospital group globally, which operates and owns numerous healthcare facilities throughout Australia, France, and the United Kingdom etc. The market capitalization of Ramsay Health Care Limited stood at A$13.18 billion as on 17th September 2019.

A Look at transactions of Paul Ramsay Holdings Pty Limited.

- As per the release dated 16th September 2019, Paul Ramsay Holdings Pty Limited had entered into an entered into a block trade agreement in order to sell 22 million ordinary shares in the company with two financial institutions, which represents around 10.9% of the issued share capital.

- However, the company has informed the market today on 17th September 2019 that Paul Ramsay Holdings Pty Limited has successfully wrapped up the block trade agreement, wherein 22 million ordinary shares in the company have been sold to institutional investors at the consideration of $61.80 per share.

- It was mentioned in the release that Paul Ramsay Holdings Pty Limited would continue to hold around 21% of the issued share capital in RHC, after the completion of the transaction.

- The company further stated that settlement of shares is being anticipated to occur on 19th September 2019.

Understanding of Directorâs Interest

In recent times, the company has updated the market about key directorâs interest as follows:

- The company stated that Bruce Roger Soden has ceased to be a director in the company, with effect from 12th September 2019. Bruce Roger Soden was designated as Group Finance Director and Chief Financial Officer of the company.

- Previously, Bruce Roger Soden had made a change to his holdings in the company by purchasing 28,843 ordinary shares at the consideration of $67.0787 average price per share on 30th August 2019.

- On 30th August 2019, Craig Ralph Mcnally made a change to his holdings by acquiring 18,216 ordinary shares at a price of 67.0787 average price per share.

Appointment of Director

As per the release dated 10th September 2019, RHC announced that it has appointed Mr James McMurdo and will be assuming the role of a Non-Executive Director in the company. The appointment of Mr James McMurdo became effective on 11th September 2019.

Operational and Financial Performance

Ramsay Health Care Limited, recently updated the market player with its results for the financial year 2019, wherein, it communicated about its operational and financial performance for the period.

- The company stated that it has adopted new lease accounting standard AASB16 on 1st July 2019. It added that the adoption of AASB16 would have no effect on debt covenants, debt facility headroom and net cash flow.

- However, there would be a significant non-cash impact on the consolidated income statement and consolidated statement of financial position. The company anticipates a decline in the core net profit after tax of around $40 million-$50 million for FY 20.

Group Performance

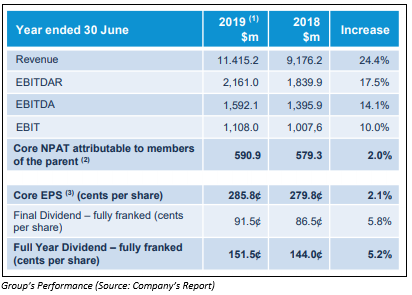

Ramsay Health Care Limited had reported results marginally above the guidance for the financial year 2019 notwithstanding the acquisition of the pan European operator Capio, which was wrapped up during the period.

- For the year ended 30th June 2019, the company reported core net profit after tax amounting to $590.9 million, reflecting a rise of 2.0% on prior corresponding period.

- The core net profit after tax of the company has delivered core earnings per share of 285.8 cents for FY19, which represents a rise of 2.1% on the 279.8 cents, which was recorded in the previous year.

- The statutory net profit after tax of the company stood at $545.5 million, reflecting a rise of 40.5% in comparison to the previous year.

- Excluding the acquisition of Capio, the core net profit after tax amounted to $593.9 million and Core EPS stood at 287.3 cents, reflecting a rise of 2.5% and 2.7%, respectively.

- The revenue and EBITDA of the company stood at $11.4 billion and $1.6 billion, with an increase of 24.4% and 14.1%, respectively.

Understanding of Segments Performance

- The Australia business of the company reported revenues amounting to $5.18 billion with a rise of 4.1% and EBITDA stood at $950.5 million up 6.0%. over the corresponding prior-year period. It added that equity accounted share of Asian joint venture net profits witnessed a rise of 15.5% and the figure stood at $19.4 million

- The financial performance of Continental Europe business including acquisition of Capio since 7 November 2018 witnessed a decent growth. The revenue and EBITDAR witnessed a rise of 51.7% and 32.6%, and the figures stood at â¬3.4 billion and â¬590.9 million, respectively.

- When it comes to the business of the United Kingdom, the revenue stood at £444.3 million with a rise of 4.7% and EBITDAR amounted to £99.8 million, representing a fall of 2.8%.

- With respect to the growth strategy, its Australian brownfield programme remains strong with a total of 16 projects wrapped up in its Australian business during the financial year 2019 amounted to $242 million. It expects to witness the completion of $170 million worth of brownfields in FY20.

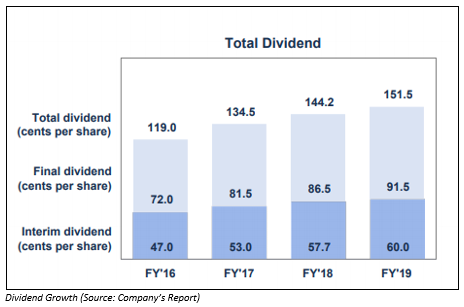

Dividend

The Board of Directors of the company have declared a final dividend amounted to 91.5 cents per share, fully franked, reflecting a rise of 5.8% in comparison to prior corresponding period. The full-year dividend was 151.5 cents per share. It was 100% franked and reflected an increase of 5.2% on the previous year. The Record Date for the dividend was 6th September 2019 and payment dated stood at 30th September 2019. The Dividend Reinvestment Plan will remain suspended. It was stated that the full-year dividend payout ratio was 53% of Core EPS, with the balance reinvested into the business.

When it comes to the price performance of the stock, Ramsay Health Care Limited was last traded at a price of A$62.200 per share with a decline of 4.601% on 17th September 2019. It witnessed a rise of 4.03% in the time frame of six months. On Year to date basis, the stock produced a return of 13.05%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.