Appen Limited

Appen Limited (ASX:APX), based in Chatswood, Australia, is engaged in the development of advanced, human annotated datasets for machine learning and artificial intelligence (AI) applications for customers in Australia, the United States, and other countries as well.

Appenâs ESG (Environmental, Social, Governance) priorities are focussed on the diversity of its workforce, social responsibility, environmental footprint, corporate governance and risk management.

Source: Annual Report 2018

Source: Annual Report 2018

Appen has a current market capitalisation of around AUD 3.05 billion with ~ 120.93 million outstanding shares. The APX stock price closed the market trading today (24 May 2019) at AUD 25.090, dipping 0.555% by AUD 0.140 with ~ 465,958 shares traded. In addition, APX has generated a positive and high YTD return of 97.11%.

In its Annual Report for 2018, the company reported excellent progress, both financially and strategically. The total revenue was recorded at $ 364.3 million, which is way higher (119%) as compared to FY2017. The underlying EBITDA was posted at $ 71.3 million, also staggeringly up 153% on the previous year. The net profit after tax also increased by 148% to $ 49 million.

REA Group Ltd

The Richmond, Australia-based REA Group Limited (ASX:REA) is a subsidiary of News Limited, and provides advertising services to the real estate industry in Australia as well as across Asia. It advertises the property and property-related services on Websites and mobile apps.

The Groupâs market capitalisation stands around AUD 12.04 billion, and it has ~ 131.71 million outstanding shares. The REA stock price closed the trading session on 24th May 2019 at AUD 90.620, down 0.853% by AUD 0.780 with ~ 271,975 shares traded., The stock has a 52-week high of AUD 94.370 and a 52-week low of AUD 69.230. REAâs YTD return is also positive at around 23.08%.

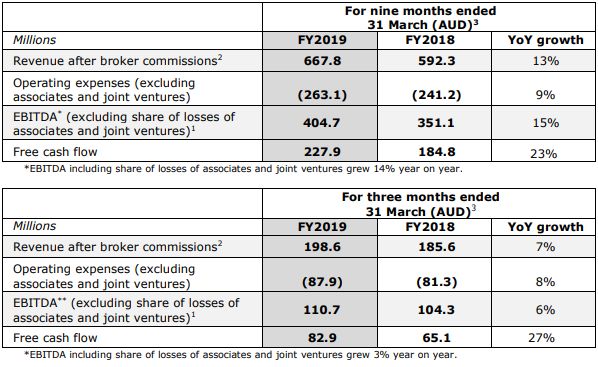

Recently, the REA Group disclosed its results for the nine months ended 31st March 2019 as reported by News Corporation (ASX:NWS). The Groupâs financial highlights from the period include total revenue growth of 13% to $ 667.8 million from core operations and an EBITDA growth from core operations of 15% to $ 404.7 million.

The summary of the key metrics is tabulated as below:

Source: Q3 FY 2019 financial information

ResMed Inc

The Bella Vista, Australia-based ResMed Inc (ASX: RMD) is engaged in the development, manufacturing and commercialisation of medical devices and cloud-based software applications which support diagnosis, treatment and management of sleep apnea, chronic obstructive pulmonary disease, and other chronic diseases.

The companyâs market capitalisation stands at around AUD 23.37 billion with ~ 1.43 billion outstanding shares. On 24th May 2019, the RMD stock price settled the dayâs trading at AUD 16.380, edging up 0.43% by AUD 0.070 with ~ 651,817 shares traded.

Recently, ResMed announced its results for the third quarter of the fiscal year 2019, posting the revenue at $ 662.2 million, which is 12% higher than the prior corresponding period (pcp) in FY2018. The gross margin also improved by 100 basis points to 59.2%, and the net operating profit was also up 15%. There was top line growth across all business categories, including a major contribution from the recently acquired SaaS companies and growth recorded in the international device sales.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.