The tech stocks had recently slipped down, after Nasdaq declined on the back of renewed concerns, associated with the leap in the US-China trade war and a drop observed in the Chinese currency - Yuan against the US dollar. Besides, the US President Donald Trump had taken a decision to put 10 percent tariffs on a further $300 billion worth of products from China. Also, it had been observed that tech stocks were impacted by the above-mentioned factors, in the global arena as well.

Meanwhile, the market is anticipating a solid performance from the companies like- Appen Limited (ASX:APX), WiseTech Global Ltd (ASX:WTC), Altium Limited (ASX: ALU), Afterpay Touch Group Ltd (ASX:APT), Nearmap Limited (ASX:NEA) and Xero Limited (ASX:XRO) during this earnings season.

Let us now discuss these stocks in detail and look at their updates:

Appen Limited

China is the largest market for Artificial Intelligence outside US:

Appen would be greatly affected by the US-China trade war since China is the largest market for Artificial Intelligence outside US.

As per the companyâs presentation from AGM, held on 31 May 2019, the company had planned to offer Chinese language data to clients situated in US. For this purpose, Appen is investing in China and would offer the consumers with âAir gappedâ technology and the operations related to data and IP security. On the other hand, the company for FY 19 anticipates underlying EBITDA to be in the range of $85M - $90M.

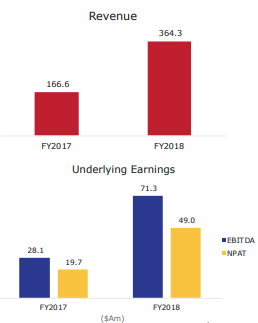

The company has taken into account Figure Eight and made the projection based on A$1 = US$0.74 May-Dec 2019. The company till mid-May in 2019 had revenue and orders in hand including Figure Eight for delivery of approximately $270M. For fiscal year 2018, Appen has recorded 119 percent rise in the topline to $364.3M, 153% increase in the Underlying EBITDA to $71.3M, growth of Underlying EBITDA margins to 19.6 percent from 16.9 percent and 148% increase in the Underlying NPAT standing at $49.0M.

Source: Companyâs Report

On 14 August 2019, APX stock was trading at A$25.75, up by 0.704 percent (at AEST 1: 25 PM).

WiseTech Global Ltd

Investments:

As per 6 June 2019 release by WTC, for Fiscal year 2019, WTC was anticipating the revenue to increase, and fall in the range of 47% to 53% on pcp and expects it to be in between $326 m to $339m. For the financial year 2019, WTC anticipates the EBITDA to rise, and fall in between 28% - 35% and is anticipated to be in between $100m to $105m.

Moreover, according to the 1H19 results presentation, dated 20 February 2019, WTC has invested $51.2 million for development of the pipeline and upgraded more the 240 goods throughout its CargoWise One global platform. WTC has taken initiatives for upgradation, which comprises of concluding the other China solution interface and the localised CargoWise and growth of global address validation (GAV) with other nations like China, enhancing the performance of the processing, and a fresh API that further enhances the access of GAV to obtained applications.

Outlook for FY 19 (Source: Companyâs Report)

WTCâs shares on 14 August 2019, was trading at A$28.24, up by 1.038 percent (at AEST 1:42 PM).

Altium Limited

Outlook for FY 20 & FY 25:

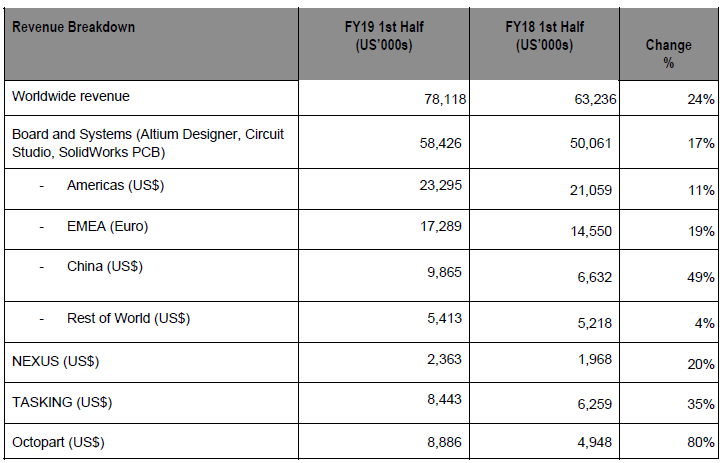

Altiumâs revenue in China can be affected due to escalation of tension regarding US-China trade war. According to an announcement made on 18 February 2019, the company in the first half of 2019 had reported 49% growth in revenue in China. The company had planned to open an office in Beijing in the second half of 2019. The company is already having its office at Shanghai and Shenzhen in China.

On the other hand, the company for fiscal 2020 expects the revenue to be US$200 million and intends to deliver an EBITDA margin of 35% or even higher. The company has the target to reach the revenue of $500 million by 2025 and aims that the number of Altium Designer subscribers reach 100,000 before 2020.

Revenue Breakdown for 1H FY 19 (Source: Companyâs Report)

On 14 August 2019, ALUâs stock was trading at A$33.270, up by 0.332 percent (at AEST 1:51 PM).

Afterpay Touch Group Limited

Afterpay Day:

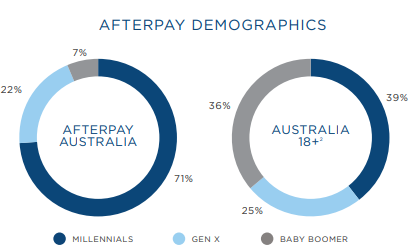

On 9 August 2019, APT notified the market on the second biannual Afterpay Day to take place on the two days on 14 and 15 August in the US market. On these days, the companyâs products will be offered to more than 2 million U.S. active customers in partnership with top fashion and beauty brands and retailers. The company has partnered with 6,500 local retailers, that forms more than 10% of USâ online fashion and beauty industry.

Source: Companyâs Report

On the other hand, the company is restructuring the organisation. On 2 July 2019, APT announced that Anthony Eisen, the cofounder of the company would be the CEO & Managing Director of the Company. Elana Rubin, will be the Interim Chair until a new independent Chair gets hired. Frerk-Malte (Malte) Feller is now the Global Chief Operating Officer of the company.

On 14 August 2019, APTâs shares were trading at A$24.63, up by 4.586 percent (at AEST 2:09 PM).

Nearmap Ltd

Cashflow to breakeven in FY 19:

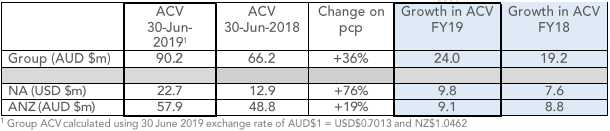

On 12 July 2019, NEA for FY 19 period in the preliminary report has reported 36% growth in the Annualised Contract Value (for the period ended 30 June 2019) to AU$90.2 million, which means that ACV of $24 million has been added in FY 19 versus $19.2 million in FY 18. In North America for FY 19, the company has reported 76% increase in ACV portfolio to AU$22.7 million. This reflects that North America ACV now forms 36% of the companyâ s portfolio. Australia & New Zealand ACV in FY 19 has reported 19% rise in the ACV portfolio to AU$57.9 million. Moreover, for FY 19 the company expects cashflow to breakeven, after excluding raising of capital.

Source: Companyâs Report

On 14 August 2019, NEAâs stock was trading at A$3.05, slipping by 1.447% from the prior close (at AEST 2:18 PM).

Xero Limited

Strong FY 19 Performance:

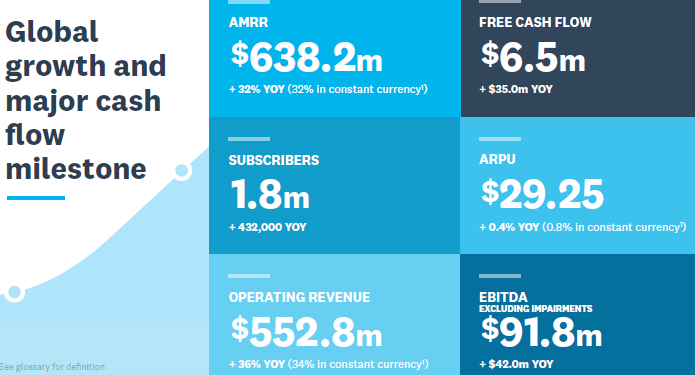

On 16 May 2019, XRO had released annual report for the period ending 31 March 2019, wherein it stated that it was expecting FY 20 free cash flow to be similar proportion of total operating revenue in FY 19. Moreover, for FY 19 period, Xero has recorded 36% increase in the operating revenue standing at $552.8 million. Further, the Annualised Monthly Recurring Revenue rose up by 32% in 2019 to $638.2 million. Free cash flow in 2019 has increased by $35.0 million compared to the prior year to $6.5 million. Moreover, during 2019, the subscribers of North America grew by 48% in 2019 and the revenue from this region grew by 39%.

FY 19 Financial Performance (Source: Companyâs Report)

On 14 August 2019, XROâs stock was trading at A$62.84, up by 1.289 percent (at AEST 2:29 PM).

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.