Technology Stocks

The companies falling under this sector are associated with computers or offer services concerning the IT domain, production of electronic items and so forth. The sector contains a vast range of companies that deals with an array of products from mobile phones to the home appliances.

Amid, the ongoing trade war between China and the US, and the renewed concerns related to it, along with the fall of yuan against the US dollar, technology stocks have been witnessing a trend of sharp decline in terms of their performance. Globally, technology stocks are not doing that great as was seen at Nasdaq which has maximum number of tech stocks listed on it, plunging down further on 5 August 2019.

The Australian benchmark index S&P/ASX200 was at 6482.6 points, down by 2.4 percent compared to its last close, on 6 August 2019. Also, S&P/ASX 200 Information Technology (Sector), that trades under the code XIJ was at 1,253 points, down by 3.79 percent from the prior close.

Letâs now delve into some of the ASX listed technology stocks, by looking at their updates and performances.

Appen Limited

Appen Limited (ASX:APX), an Australian company that improvises data, so that it can be used for developing the machine learning and products related with Artificial Development.

APX Core business Performing strongly:

The company released the Annual General Meeting Presentation, on 31 May 2019, wherein it stated that China presents the largest market for Artificial Intelligence outside US. It also mentioned that APX was building its team, customer base and operations in Shanghai. The company will be offering Chinese language data to the customers situated in US. For this the company is making investment in China and will provide the customers with âAir gappedâ technology along with the operations for data and IP security.

FY2018 Highlights

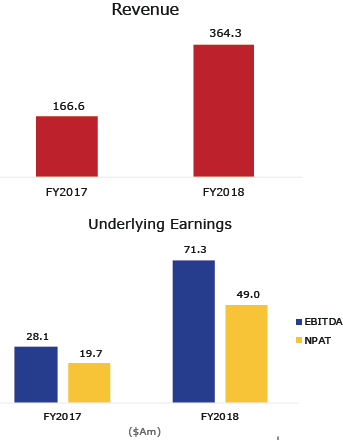

The company for FY 18 period had reported 119% growth in the revenue to $364.3 million, 153% increase in the Underlying EBITDA to $71.3M, expansion of Underlying EBITDA margins to 19.6% from 16.9% and 148% rise in the Underlying NPAT to $49.0M.

FY 18 Financial Performance (Source: Companyâs Report)

Outlook

As mentioned in the presentation, APX YTD revenue along with orders in hand also comprised of Figure Eight for delivery in 2019, of around $270 million. For financial year 2019 that ends on 31 December 2019, APX anticipates the underlying EBITDA including Figure Eight to be between $85 million - $90 million. The projection is based on A$1 to be approximately equal to US$0.74 for the period of May-Dec 2019.

On the other hand, APX core business is performing strongly and machine learning software platform, Figure Eightâs (acquired by APX in April this year) is fulfilling the expectations. Figure Eightâs founder Lukas Biewald has concluded the share purchase of APX shares to the value of ~USD1.5 million, as per the agreement (as announced on 12 June 2019). The securities would be held escrow for twenty-four months after the acquisition concluded date - 2 April 2019.

On 6 August 2019, post the market session, the companyâs stock was at A$25.9, down by 3.61 percent from the prior closing price.

WiseTech Global Ltd

WiseTech Global Ltd (ASX:WTC), the leading Australian company that develops and provides supply chain software to the logistics industry worldwide. The companyâs flagship product, CargoWise One, has the ability for execution of more than 54 billion data transactions annually.

Expansion, Upgradation of Global Platform and Aggressive Growth Outlook for FY 19:

As mentioned in the Investor conference and briefing materials released on 6 June 2019, the company plans to expand new geographic markets with its integrated global CargoWise One platform all over 130 countries, increase the innovation pipeline significantly with the use of the more than 12,000 logistics organisations that are currently using the companyâs solutions worldwide.

International platform expansion

On the other hand, as mentioned in the 1H19 report of the company, released on 20 February 2019, it has made an investment of $51.2 million for expansion of the pipeline and upgrading beyond 240 products across its CargoWise One global platform. The initiatives taken by the company for upgradation includes completing the additional China solution interface and the localised CargoWise One platform and increase of global address validation (GAV) with additional countries like China, increasing the performance of the processing, and a new API that increases the access of GAV to acquired applications.

The company has extended the localisation of the accounting solution to other countries and has completed the early adopter phase of the companyâs global netting solution with very big global 3PL. WTC has accelerated the rates for automation and bookings, this comprised of the integration of individual sign-on with CargoSphereâs international ocean rates solution. WTC had completed the market border compliance engine, BorderWise, in the USA and plans the development launch during the second half period of 2019. The company has already made the development and embedded the international automation throughout air freight platform worldwide. The company plans to fully commercialise in the second half of 2019, which will cover the topmost fifty airlines, cargo carrying flights and air waybills.

Also, WTC has added new features to denied party screening (DPS) and made upgradation as per the different regulatory requirements in UK, Canada, Malaysia Australia, EU, South Africa etc.

Outlook

Moreover, for FY 19, WTC expects the topline to grow in the range of 47% to 53% over FY 18 and expects it to be in the range of $326 m to $339m. For FY 19, the company expects the EBITDA to grow in the range of 28% to 35% and is projected to be in the range of $100m to $105m.

Outlook for FY 19 (Source: Companyâs Report)

The stock of the company, by the end of the trading session, on 6 August 2019, was at A$26.95, down by 8.02 percent from the last close. WTCâs stock in the last three months, has given a return of 33.18 percent.

Hub24 Ltd

Hub24 Limited (ASX: HUB) is the company that offers platform for investment and superannuation.

June Quarter Results

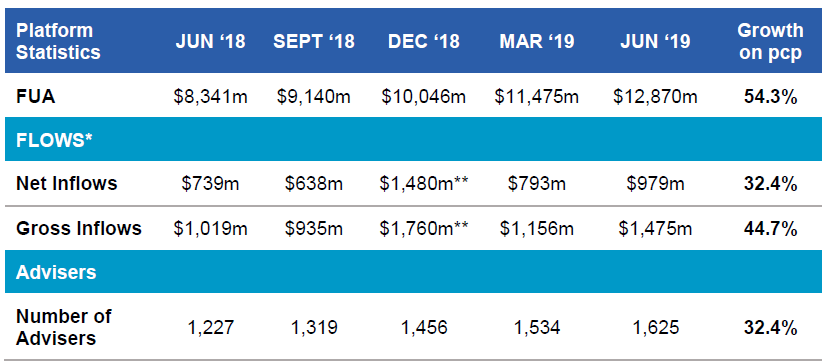

On 16 July 2019, HUB released June 2019 quarter report for the period ended 30 June 2019. The company mentioned that there has been 32.4% rise in the quarterly net inflows to $979 million, while there was 60.6% rise in the annual net inflows to $3.9 billion. In the June quarter, there has been 54.3% increase in the Funds Under Administration (FUA) to $12.9 billion. During the quarter, the company has added 91 new advisors and inked 24 new licensee agreements.

June 2019 Quarter Performance (Source: Companyâs Report)

1HFY19 Results

Moreover, for the first half of 2019 report, released in February 2019, the company had reported 16% rise in the group revenue to $47.1m, 32% increase in the underlying EBITDA to $6.5m and 46% growth in the underlying NPAT to $3.1m.

Outlook for 2021

Additionally, the company is targeting FUA to reach in the range of $19bn - $23bn by June 2021.

Further, on 6 August 2019, HUBâs stock was at A$11.1, down by 0.359 percent compared to its last closing price. Meanwhile, HUBâs stock has provided a return of -25.98% in the last three months duration.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.