There are generally three types of stocks which investors prefer to invest their money in; growth stocks, value stocks and income stocks. Here we are going to talk about income stocks and share some examples of income stocks.

Income stocks are generally high dividend paying stocks and are defensive in nature. There are certain criteria for picking up high dividend stocks. The easy way is by looking at the dividend yield of the stocks. Below are some examples of high dividend-yield stocks.

Sydney Airport

About the Company: Sydney Airport (ASX: SYD) is Australiaâs most important infrastructure which connects to more than 90 destinations around the world. The market capitalisation of the company stood at $18.41 billion as on 20th September 2019.

Airportâs Traffic Performance: The total number of passengers who passed through the Sydney Airport declined by 1.2 percent year over year in July 2019 and came at 3.846 million passengers. The number of domestic passengers in July 2019 was roughly flat compared to that in July 2018 at 2.388 million passengers.

Highlights of the month-

- Qantas has broadcasted that it will be adding an additional three return flights per week which will operate between Sydney and Santiago;

- LATAM Airlines will start a 3/week, non-stop service starting from Santiago till Sydney from November 2019;

- Malindo Air started their opening Sydney flight on 15th August 2019, opening their daily services to Kuala Lumpur via Denpasar, which added 120,000 seats annually.

1H19 Results Highlights: The total number of passengers who passed through Sydney Airport in first half of 2019 was 21.6 million. International passengers increased by 1.9%, however overall passengers were down by 0.2% due to decrease in domestic passengers by 1.5%.

- EBITDA, excluding other expenses, was up by 4.1% on the prior corresponding period (pcp) to $649.2 million underpinned by international passenger growth of 1.9%;

- Net operating receipts (NOR) was up by 4.8% on the pcp to $431.2 million and PAT came at $17.3 million for the first half-year;

- The company made a capital investment of $116.1 million to increase aviation capacity and to enhance customer experience.

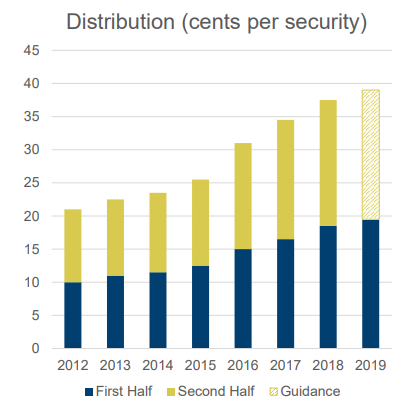

Dividends: The company has declared a total dividend of 19.5 cents per share which will be 100% unfranked. The company has guided dividends of 39 cents per share for full year. The annual dividend yield of the company stood at 4.72%.

Source: Companyâs Presentation

Stock Performance: On 20th September 2019, SYD stock closed at A$8.010, moving down by 1.718 percent from the prior close. In the last six months period, the stock has generated a positive return of 10.58 percent. Currently, the stock is trading at a PE multiple of 46.150X.

Woodside Petroleum Limited

About the company: Woodside Petroleum Limited (ASX: WPL) is the founder of LNG industry in Australia. The company has a worldwide portfolio and is also recognised for its world-class competence as a combined upstream supplier of energy. The market capitalisation of the company stood at $30.12 billion as on 20th September 2019.

Greater Enfield Project Generates First Oil: Woodside stated that first oil from the Ngujima-Yin FPSO was found in the Greater Enfield Project. In 2016, The Greater Enfield Project was sanctioned, and its main purpose was to create Norton over Laverda, Cimatti Oil accumulation and the Laverda Canyon by a subsea tie-back to the Ngujima-Yin FPSO which was located over the Vincent field. The total capital invested for this project was about US$1.9 billion.

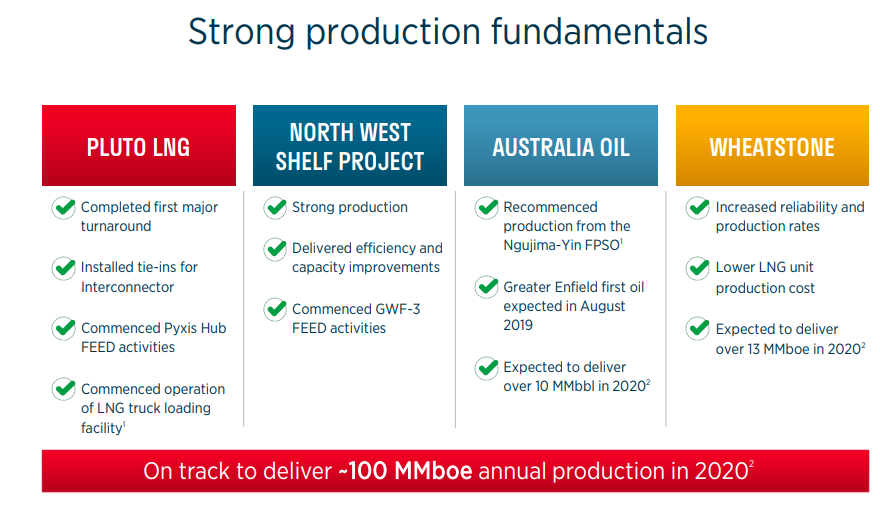

The production from this project makes an important contribution to Woodsideâs estimated annual production which is of approximately 100 MMboe in 2020.

Performance in 1H19: In 1H19 company reported a strong production performance from the NWS Project and Wheatstone. Woodsideâs base business generated strong cash flows and kept the margins sustainable. The company reported the net profit after tax of $419 million, which was lower compared to the corresponding prior-year period, due to the impact of the planned maintenance at Pluto LNG, Tropical Cyclone Veronica and the Ngujima-Yin FPSO facility being offline.

Key business activities:

- Delivered production of 39 MMboe and operating revenue of $2,260 million;

- Achieved strong production performance from NWS and Wheatstone;

- Completed first major Pluto LNG turnaround.

Fundamental Performance Source: Companyâs Presentation

Dividends: The company has declared an interim dividend of 36 US cents per share and have also reactivated the dividend reinvestment plan. The price for each share issued through the DRP for the interim dividend to be paid is AU$31.3447.

Stock Performance: On 20th September 2019, WPL stock closed at A$32.290, moving up by 0.373 percent from the prior close. In the last six months period, the stock has generated a negative return of 9.25 percent. Currently, the stock is trading at a PE multiple of 16.660X and a dividend yield of 5.6%.

New Hope Corporation Limited

About the Company: New Hope Corporation Limited (ASX: NHC) is a diversified energy company which has interests in port operation, exploration, coal mining, agriculture, conventional oil, investment and innovative technology. The market capitalisation of the company stood at $2.01 billion as on 20th September 2019.

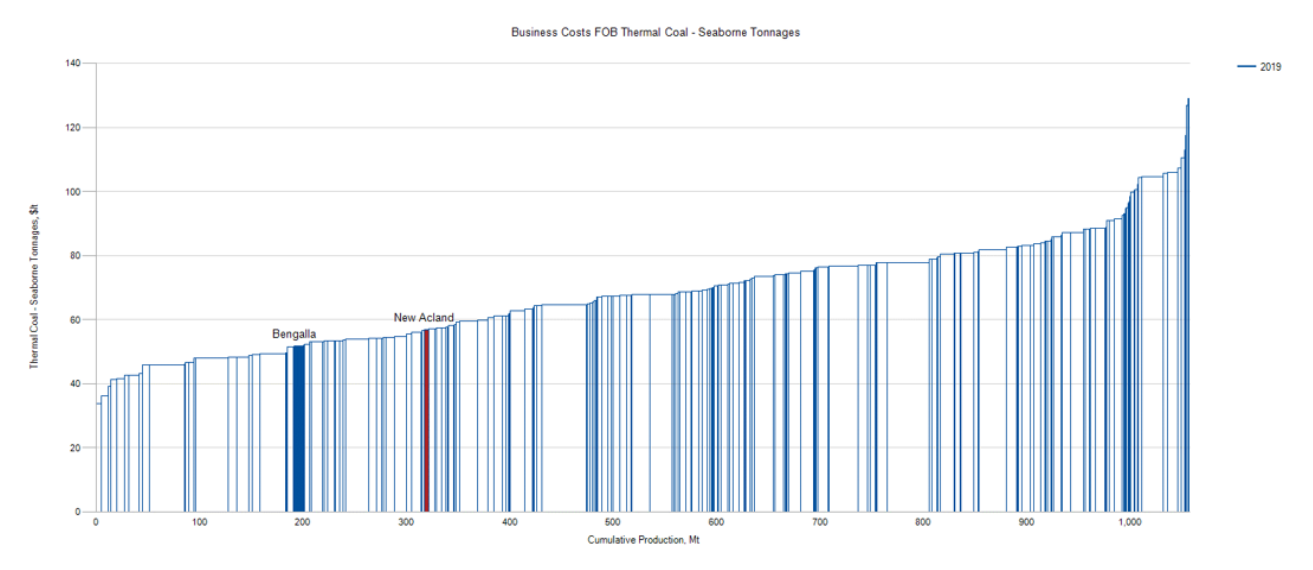

FY19 Financial Highlights: The company reported a revenue of $1,306 million which was up by 21% as compared to previous year. This strong revenue growth was seen due to strong export thermal coal prices during the period. It reported a profit before tax and non-regular items of $384.3 million up by 3% due to increase in sales tonnage along with a combination of strong coal prices.

Source: Companyâs Presentation

After the non-regular items, company reported net profit after tax of $210.7 million which was up by 41% from the previous year. During FY19, the company generated a strong cash operating surplus of $509.8 million, an increase of 18% on the 2018 result of $433.9 million.

Key Highlights of the Year:

- The company produced 10.9 million tonnes of saleable coal in 2019, an increase of 21% as compared to previous year;

- New Hopeâs two operating mines in South East Queensland combined to produce 4.8 million tonnes of saleable coal in FY19;

- Share from Bengalla mines increased from 40% to 80% and it produced 6.0 million tonnes of coal.

Companyâs update on its Coal Resources and Coal Reserves-

- New Acland- coal resources reduced by in-situ depletion of 9.29 Mt, entirely within the Measured Resource area;

- Burton- a new coal resource has been declared for the Ellensfield South and Plumtree North areas;

- Bengalla- coal resources reduced by in-situ depletion of 11.27 Mt entirely within the Measured Resource area.

Dividends: The company has declared a final dividend of 9 cents per share. This is fully franked and is payable on November 5, 2019 to shareholders which are registered as on October 22, 2019. The annual dividend yield of the company is 7.02%.

Stock Performance: On 20th September 2019, NHC stock closed at A$2.350, moving down by 2.893 percent from the prior close. In the last six months period, the stock has generated a negative return of 37.79 percent. Currently, the stock is trading at a PE multiple of 9.550X.

Aventus Group

About the Company: Aventus group (ASX: AVN) is Australiaâs top, fully integrated manager and developer of large format retail centres. The market capitalisation of the company stood at $1.49 billion as on 20th September 2019.

FY19 Financial Highlights:

- The company reported a profit of $110 million;

- Like-for-like Net Operating Income (NOI) growth of 3.5%;

- Boosted everyday-needs category to 38% of portfolio by gross income;

- Revaluation gains of $85 million;

- Weighted average debt maturity of 4.1 years;

- Achieved 98%+ high occupancy rate

Outlook for FY20:

- Investing in the expansion and development of the portfolio to enhance the shopper experience and capitalise on attractive development returns;

- Maintaining disciplined capital management to allow for the execution of groupâs strategy;

- Diversifying its tenant base with a priority on increasing everyday-needs to continue to drive weekday traffic and energise its centres;

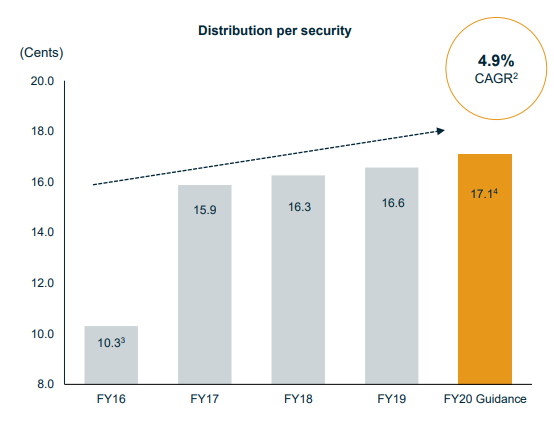

Dividends: The company reported distribution per security of 16.6 cents for FY19. In the last four years, the distribution per security has increased by a CAGR of 5.3%. For FY20 the company has given a guidance of 17.1 cents per share.

Source: Companyâs Presentation

Stock Performance: On 20th September 2019, AVN stock closed at A$2.710, moving down by 0.368 percent from the prior close. In the last six months period, the stock has generated a positive return of 21.97 percent. Currently, the stock is trading at a PE multiple of 12.890X and has a dividend yield of 6.09%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.