Introduction

Its seen that in September 2019, NAOS Small Cap Opportunities Company Ltd performed better than Naos Emerging Opportunities Company Ltd. This also reflects the better performance of small cap compared to micro-cap. In September, most of the companies had come up with their respective FY19 results, which kept the investors active.

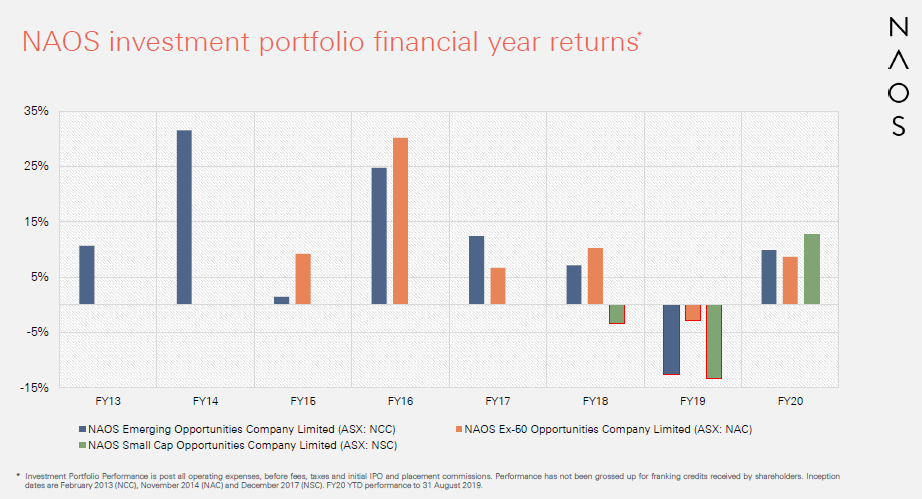

NAOS focuses in offering regular stream of income though dividends along with capital gain. Meanwhile, FY 19 was bad year for the group on the back of downward growth expectations for S&P/ASX 200 Industrials, downward revision of earnings per share (EPS) for FY20, sharp increase in dividend payouts compared to the companyâs relatively flat FY19 earnings and announcement of more than $2 billion of buy backs within the S&P/ASX 100.

Further, in FY 19 there was some weakness initially in some high growth industrial companies and also due to Australiaâs macroeconomic environment.

NAOS Financial Performance (Source: Companyâs Report)

Letâs have a look at the recent updates from NCC and NSC:

Naos Emerging Opportunities Company Limited (ASX: NCC)

Portfolio has given the return of 6.56% in September:

Naos Emerging Opportunities Company Limited (ASX: NCC), a listed investment company that invests in micro-cap industrial companies with market capitalisation of less than $250 million, listed on the ASX and unlisted securities. The companyâs investment is managed by NAOS Asset Management Limited, and its objective is to give return over the benchmark index, being the S&P/ASX Small Ordinaries Accumulation Index (XSOAI). The company invests in the portfolio of companies that are not present in S&P/ASX100 Accumulation Index as the index contains mostly blue-chip companies.

As per NCCâs release on 10 October 2019, for the month of September, the company portfolio has given the return of 6.56%, which means that it has outperformed the benchmark XSOAI by 2.61%. The portfolio from the inception (in 6 years and 8 months) has given the return of 13.27% p.a. This reflects the total return of 127.30% whereas the XSOAI has given the return of 6.44% in a year & the total return of 50.91% over the same period.

The companies during September 2019, that holds major parts of its portfolio are BSA Limited (ASX BSA) (31.71%), Enero Group Limited (ASX:EGG) 15.82%), Calliden Group Limited (ASX:CIX) (15.66%), Capitol Health Limited (ASX:CAJ) (15.22%), Consolidated Operations Group Limited (ASX:COG) (10.72%).

During the month of September 2019, NCC in its investment portfolio had added CML Group Ltd (ASX: CGR) which acquired an unlisted business Classic Funding Group (CFG), for approximately $11 million for strengthening their product offering, and the company during the period has also added Eureka Group Holdings Ltd (ASX:EGH) in its portfolio.

According to NCC, CGR seemed to be undervalued stock as it was trading at the P/E of less than 9x, based on FY20 earnings estimates. EGH may expand geographically through the acquisition of bolt-on properties. NCC considers EGH to have an attractive risk-adjusted investment.

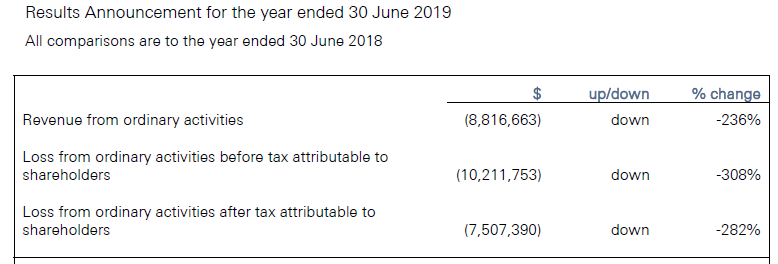

On the other hand, in FY 2019 report for the period closed 30 June this year, released on 22 August 2019, the company mentioned 282% decline in the profit to loss after tax of $7.5 million and its portfolio gave the negative return of 12.51%, however the benchmark index S&P/ASX Small Ordinaries Accumulation Index (âXSOAIâ) rose by +1.92%.

FY 19 Financial Performance (Source: Companyâs Report)

On 5 November 2019, NCC stock last traded at a price of $1.075, up by 1.415 percent from its last close.

NAOS Small Cap Opportunities Company Limited (ASX: NSC)

Portfolio has given the return of 8.10%:

NAOS Small Cap Opportunities Company Limited (ASX: NSC) is a listed investment company that invests in undervalued small cap companies that have the market capitalisation that range between $100 million and $1 billion, listed on the ASX and unlisted securities.

The companyâs investment is managed by NAOS Asset Management Limited, and its objective is to give return over the benchmark index, being the S&P/ASX Small Ordinaries Accumulation Index (XSOAI). The company invests in the portfolio of companies that are not present in S&P/ASX100 Accumulation Index as the index contains mostly blue- chip companies. This fund had commenced in December 2017.

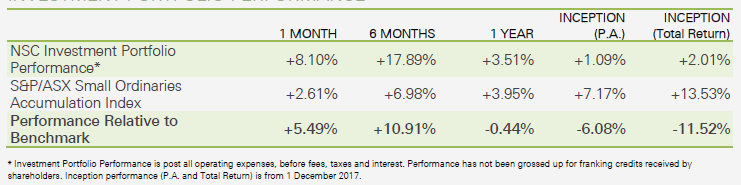

For the month of September, the company portfolio has given the return of 8.10%, which means that it has outperformed the benchmark XSOAI by 2.61%. The companies during September 2019, that holds major parts of its portfolio are MNF Group (ASX:MNF), BSA Group (ASX:BSA), and Enero Group (ASX:EGG) had contributed 7.81% to the portfolioâs return. The major detractor in the portfolioâs return was Consolidated Operations Group (ASX:COG), which had given the proposal to acquire Thorn group (ASX:TGA) equipment finance business for $80 million.

During the month of September, the portfolio was affected on the back of stocks like - COG, BSA (contributed 5.76% to the portfolioâs return), 360 Total Return Fund (TOT had contributed 1.52% to the portfolioâs return) and MNF. TOT in the month of September had announced the acquisition of 23 new strata apartments within inner Sydney for the total value of $16.5 million. This was at 20% discount to the price prevailing in September and expected to grow TOTâs NTA by approximately 5%.

BSA had extended its Operate and Maintain Master Agreement (OMMA) with the National Broadband Network (NBN) until 31 December 2020 and MNF had reaffirmed its FY 20 forecast in its presentation for US institutional investor roadshow. On the other hand, the company delivered strong performance in the second half of FY 19 compared to the first half of FY 19.

The company had already repurchased ~2 million shares to 30 June 2019 under its on-market share buy-back programme, which started in March 2019.

Portfolioâs Performance (Source: Companyâs Report)

On 5 November 2019, NSC stock last traded at a price of $0.735, down by 1.342 percent from its last close.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.