Consumer Discretionary Sector

The consumer discretionary sector includes non-essential goods and services. The products and services categorised under this sector comprises of cars, furniture, restaurants, hotels, handbags, shoes, movies and household items. The segment is divided into five categories - automobiles & components, media, retailing, consumer durables & apparel and consumer services. The performance of the stocks related to this sector largely depends on a consumerâs buying behaviour.

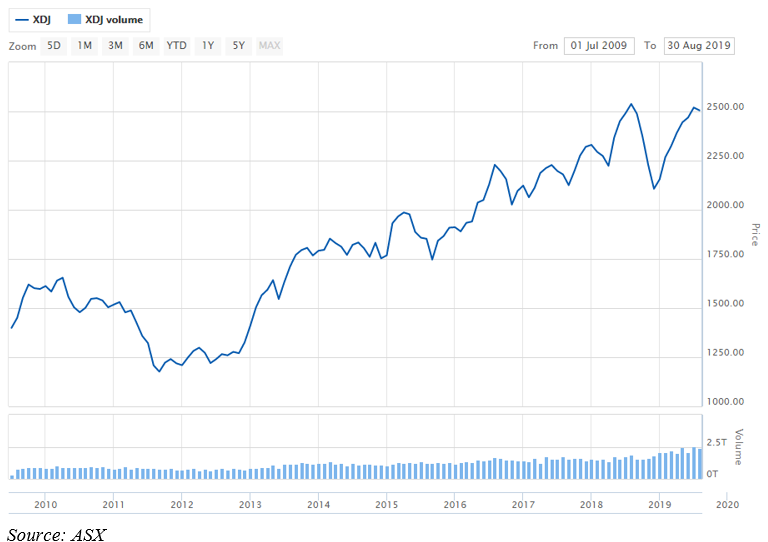

The S&P/ASX 200 Consumer Discretionary (Sector) was trading on 3 September 2019, at 2,502.7 points down by 0.47% or 11.8 points and the Australian Benchmark S&P/ASX 200 was trading at 6579.5 or 0.1 points (at AEST 12:37 PM).

In this article, the two-consumer discretionary and consumer staples stocks, are as follows:

Tassal Group limited

Tassal Group limited (ASX: TGR) is prawn and salmon grower. The company engages itself with the selling and marketing of seafood. It operates in both local and global markets. Also, TGR employs ~1400 employees.

Recent Updates: On 30 August 2019, Recently, TGR announced that one of the directors, Mr. Trevor Gerber has made a change in his interests in the company by acquiring 13,000 ordinary shares, at a consideration of $4.35 per share on 29 August 2019.

Also, the company notified that the eligible shareholders of the company may take part in SPP or Share Purchase Plan through sending application for up to $15,000 ordinary shares (fully paid) in TGR devoid of sustaining brokerage and any other costs like transaction cost. Under the plan, the company will raise a maximum of $25 million.

The new shares under discussion, issued under SPP is anticipated to be issued on 23 September this year and would rank at an equal level with already existing ordinary shares (fully paid) in TGR. It would also have the similar voting rights and powers, apart from the fact that the new shares, that are scheduled to be issued under the SPP would not be eligible to obtain dividend for the interim period closed 30 June this year.

On 29 August 2019, TGR made an announcement for a change in one of the directorâs interest. The release by the company mentioned that on 29 August this year, Mr John Watson has acquired 9,000 ordinary shares at a consideration of $4.37/share. The director now holds 144, 274 ordinary shares.

On 21 Aug 2019, the company notified that it had concluded ~108 million fund raising to fast-track the progress of its strategy and aid alluring sustainable development for longer duration.

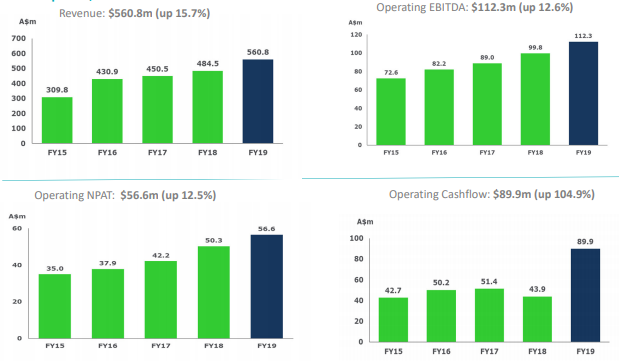

Financial & Operating Performance: On 20 August 2019, the company announced financial year 2019 results for the period closed 30 June this year.

Key highlights of the results are mentioned below:

- The operating net profit after tax, increased by 12.5 percent to $56.6 million.

- Also, the operating cash flow increased by 104.9% to $89.9 million, which shows the companyâs strength to generate the sustainable growth in shareholder returns.

- Salmon size optimised at 4.4kg hog and live salmon value rose up by 9.4% to $399.9 million.

- The operating EBITDA increased by 12.6% to $112.3 million in FY 2019 period.

- Total sales volume increased by 10.3 percent, standing at 33,856 Hog tonnes.

- Gearing Ratio and Funding Ratio both increased by ~10% to 28.2% and 38.8 % respectively.

- The company is committed to provide safety and posted lost time Lost Time Injury Frequency Rate of 0 for FY19 compared to 0.41 in Financial year 2018.

Source: Companyâs Report

Dividend Distribution: The board of directors of the company declared the final dividend of 9.0 cps, 25% franked up 12.5% on the final FY 2018 dividend. The payment date for final dividend is 30 September 2019, the ex date if of 10 September this year, with a record date of 11 September 2019.

Outlook: The company is expected to have favourable market dynamics for 2020. Tassal will continue to make investment in the state-of-the-art technology. The company would concentrate towards optimising existing leases, reduce costs and improve product margins. Also, the newly acquired prawn farms have performed well and TGR is implementing the strategy to substantially enhance the production. The prawn farms are expected to perform well in FY 2020 period.

Stock Performance: On 3 September 2019, TGRâs stock was trading at AUD 4.31, with a rise of 0.466 per cent (at AEST 1:23 PM). The company has ~203.19 million shares outstanding, and a market cap of AUD 871.67 million. The 52-week high and low value of the stock was noted at AUD 5.250 and AUD 3.980, respectively.

Harvey Norman Holdings Limited

Harvey Norman Holdings Limited (ASX:HVN) is involved with integrated retail, franchise, property and so forth. The company functions within a franchise system in Australian region that constantly grants an unmatched retail offering to Australian buyers with a vast array of goods.

Recent Updates: On 30 August 2019, the company notified a renounceable pro-rata entitlement offer of new fully paid ordinary shares in HVN to raise ~$173.49 million (before costs), with an offer price of $2.50 per new share. The offer consists of one new share for every 17 existing ordinary shares held in the company to be subscribed by the eligible shareholders.

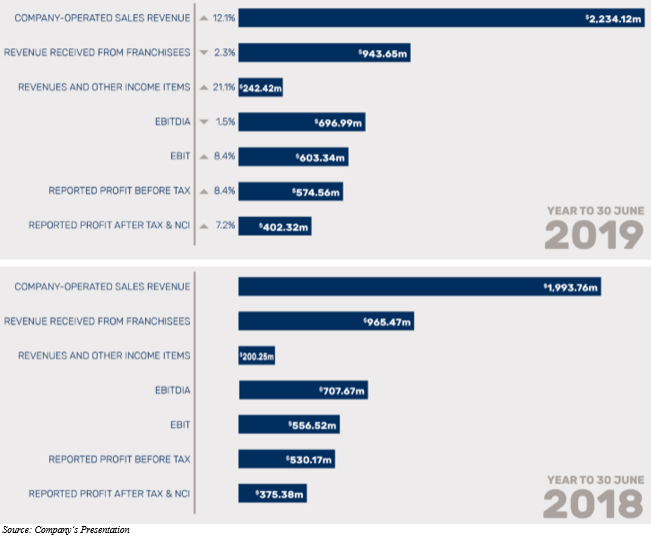

Financial & Operating Performance for the company for FY 2019: On 30 August, the company announced financial year 2019 results closed 30 June this year.

Key highlights of the result are given below:

Key highlights of the result are given below:

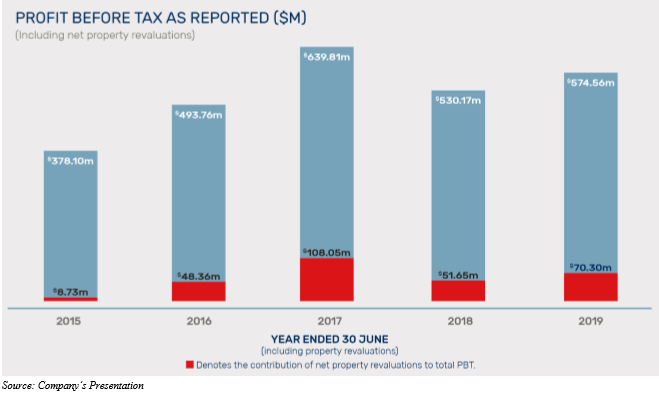

- Reported profit before tax increased by $8.4 to $574.56 million.

- The value of net assets exceeded by 8.8 percent to $3.20 billion (as on 30 June 2019).

- Offshore HVN retail revenue surpassed $2 billion milestone.

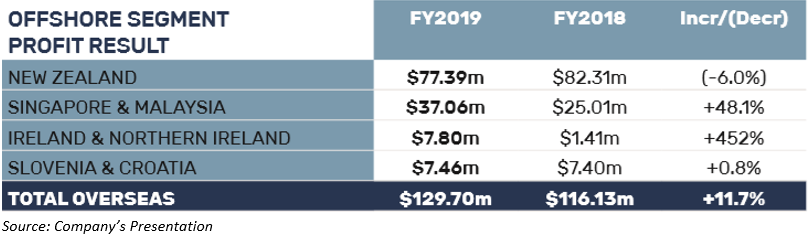

- The overseas retail operations produced a handsome profit of $129.70 million, up by 11.7% from the prior year.

- Total expenses decreased by 2.7% to $1,344,68 million.

- Total assets increased by 4.8 percent to $4.80 billion from $4.58 billion.

Reported Profit before Tax, key contributors:

- $16.11 million increase in the overall property segment to $204.68 million.

- 1% decrease in franchising operations segment to $248.40 million.

- $12.51 million increase in the equity investments segment to $18.40 million.

- The major part of the profit was driven by New Zealand region with $77.39 million and Singapore & Malaysia region with $37.06 million out of the total overseas revenue standing at $129.70 million, which rose up by 11.7 percent in the pcp.

Reasons for Significant increase in offshore Revenue

- Increase in Singapore & Malaysia sales revenue was due to full year trade of expanded stores at Parkway Parade & North Point City in the financial year 2018 and 2 new stores opened in Malaysia.

- New Zealand sales revenue was up by $25.57 because of full yearâs trade of Wairau Park Flagship.

- Due to the conclusion and launch of Zagreb Flagship during October last year, Croatia region sales revenue increased by $1.88 million.

Dividend Distribution: The company announced the dividend of $AUD 0.21 to be paid on 1 November 2019. The dividend has an ex date of 10 October 2019 and record date of 11 October 2019.

Outlook: HVN has an intention to keep growing its international retail footprint and anticipates opening 21 new stores internationally, in the upcoming 2 years period. By the end of 2021, the company is expected to have 111 Harvey Norman, company operated stores across 7 offshore nations. Strong sales growth has been forecasted for New Zealand, Slovenia, Ireland, Croatia and Northern island. The consolidated entity would keep on investing in brands, people, enhancement and development of the tools to provide quality service to the customers.

Stock Performance: On 3 September 2019, TGRâs stock was trading at AUD 4.405, with a slip of 0.564 per cent (at AEST 02:29 PM). The company has ~1.18 billion shares outstanding, and a market cap of AUD 5.23 billion. The 52-week high and low value of the stock was at AUD 4.770 and AUD 2.990, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.