Every industry, that has a direct relation with consumer, faces a regular demand and supply impact during the business. The companies often witness an impact on the profitability of the business, in the form of fluctuations in demand and supply, for example if the demand of the product rises in the market, it implies an increase in the sale of the product.

Hence, conclusively, it can be said that the consumer staples industry has a direct impact of demand and supply. On 28th August 2019, the S&P/ASX 200 Consumer Staples (Sector) last traded at 12,084.2 points, with a rise of 0.61% compared to the last close.

The following consumer staples stock listed on ASX have been handpicked by us to provide you with an insight on them.

Bega Cheese Limited

Bega Cheese Limited (ASX: BGA) is primarily involved with the work comprising of processing, collecting, distributing and producing dairy and other items associated with food.

The company, on 28 August 2019 published a presentation, wherein BGA communicated about operational and financial performance for the financial year 2019, closed on 30 June this year.

In the FY19, the company rolled out 41 new products, which included Gluten Free Vegemite, and it also launched brands like Farmerâs Table and Simply Nuts. In the same period, the company had increased licensing, which included the successful introduction of Arnottâs Vegemite Shapes.

Operational Review

When it comes to operational review, the company stated that the total recordable injury frequency rate has been improved by 15% and witnessed a rise in the total production to 280,405 tons. Adding to that, there was significant efficiency gains in processing plants, which included closure of Coburg site and toll processing arrangement. The company has begun construction of lactoferrin plant at Koroit and implementation of ERP system is in the final stages. The company has provided its accelerated growth plan, which includes aligning its manufacturing footprint with milk supply and accelerated investments in growth and innovation. The company has exhibited continuous improvement and rationalisation of manufacturing footprint.

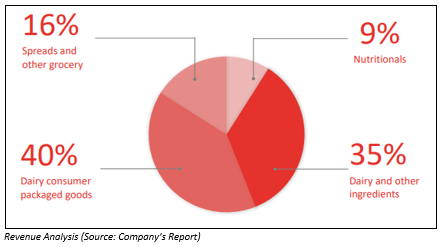

Analysis of Revenue

For FY19 period, the company reported revenue amounting to $1.42 billion, reflecting a rise of 13%. On the revenue analysis front, the export of the company represents 31% of total revenue. On the back of Koroit acquisitions, the company witnessed a rise in dairy and nutritional volumes, and it is also expanding the customer base in infant formula and bionutrients segments.

The company further stated that the export sales have been increased by 4% and stood at $442 million and reported production amounting to 280,405 tonnes with a rise of 8%. There was a rise of 41% in milk intake and was noted at 1.06 billion litres. BGA posted normalised EBITDA of $115.4 million, up 5%. The statutory profit after tax stood at $11.8 million in FY19 as compared to $28.76 million in the pcp.

Dividend

The company has declared a fully franked final dividend amounting to 5.5 cents per share for FY19 period, in accordance with the previous year. This brings the total dividends for FY19 to 11.0 cents per share, which is also in accordance with the year before.

Outlook

The company mentioned that the global dairy commodity prices happen to be strong and it would continue to monitor milk supply expectations throughout Europe, the US and New Zealand which might affect the pricing in the 2H FY20 period. Bega Cheese Limited has focused on the capital program to further rationalise supply chain and manufacturing footprint.

Moving to the stock performance, Bega Cheese Limitedâs stock last traded at A$4.02 per share with a rise of 5.789% on 28th August 2019. In the time frame of three months and six months, it has given a negative return of -24.45% and -22.13%. Further, when it comes to the time period of the last one month, BGA provided a return of -15.37%.

Costa Group Holdings Limited

Costa Group Holdings Limited (ASX: CGC) is primarily engaged with growing mushrooms, berries, citrus, avocados and similar fruits. It is also involved into distribution, packing and marketing of fruit and vegetables.

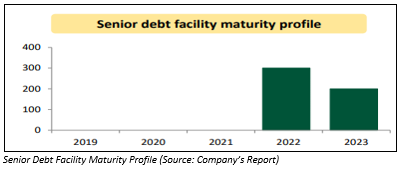

Recently, on 23 August 2019, the company had published the results presentation for the half-year 2019 closed 0n 30 June this year, wherein it mentioned that the business was tracking broadly, in accordance, with the lower end of the revised target range, which was outlined during the AGM. Besides, H2 results would be supported by a robust citrus crop with 75% to be harvested between July-November months. Also, there was a favourable trading environment throughout tomatoes, avocados and berries. The company has successfully wrapped up refinancing of senior debt facilities with an extension of the term to 3- and 4-year tenors and upsizing of facilities amounting to $500 million.

Growth Program

When it comes to the growth program, the expansion plan into China is underway to obtain a 5-year roll-out plan by FY20, with on track planning for further expansion in 2021. The company has wrapped up the expansion of Morocco 45ha in Agadir for earlier season production, and it is progressing to plan the expansion of tomato 10ha glasshouse and nursery. In terms of berries, the company is focused on expansion of Arana blueberry production and long cane raspberry and blackberry plantings.

Financial result

On the financial performance front, the company delivered revenue amounting to A$ 573.3 million in 1H FY19 as compared to A$512.7 million, reflecting a rise of 11.8% on pcp primarily resulted by new Colignan farm sales and increased table grape marketing volume. It reported EBITDA-SL with a rise of 8.4% because of lower Produce segment earnings. The company reported NPAT-SL amounting to A$40.9 million versus A$48.1 million recorded in June last year, reflecting a fall of 7.2%.

Dividend

The company has declared interim dividend amounting to 3.5 cents per share, fully franked, which recognises major growth initiatives in train. The record date and payment date for the dividend is mentioned as 12th September 2019 and 3rd October 2019, respectively.

Outlook

The company stated that the business fundamental remains strong for FY19, despite the current trading challenges. With respect to international berry expansion in Morocco, it has planned a further 2.67% share acquisition in late 2019 and 2020, which is taking the ownership of the company to 90%. Adding to that, the plant health and productivity on oldest plants now 12 years old remains excellent. Future replanting would leverage new early season varieties.

Moving to the stock performance, Costa Group Holdings Limitedâs stock last traded at A$3.100 per share with a rise of 5.085% on 28th August 2019. In the time frame of the last three months and six months, it gave a return of -42.61% and -45.67%, individually. When it comes to the time period of one month, CGC provided return of -27.87%.

Tassal Group Limited

Tassal Group Limited (ASX: TGR) is engaged with growing salmon as well as processing, marketing and selling of both salmon and seafood.

Recently, TGR announced that one of the directors, Jackie McArthur has made a change in his interests in the company by acquiring 25,000 ordinary shares, at a consideration of $4.41 per share on 27th August 2019.

Additionally, it also announced that another director, Mr Mark Ryan has also made a change in his interests in TGR by purchasing 26,675 ordinary shares on 26th August 2019. The total number of securities held by Mr Mark Ryan, after the change, were 187,053 ordinary shares.

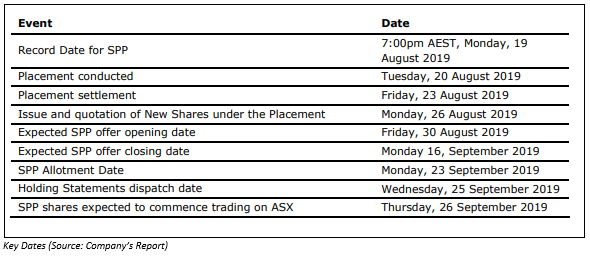

As per the release dated 21st August 2019, the company updated the market that it has successfully wrapped up the fund-raising amounting to around $108 million by a fully underwritten placement of ordinary shares to global and domestic sophisticated, professional and other institutional investors. It further stated that the placement under discussion was well oversubscribed and has introduced numerous new high quality global and domestic institutional investors to the companyâs share register.

It was also mentioned in the release, that the company would also be initiating an offer of non-underwritten Share Purchase Plan in order to raise up to an additional $25 million to eligible TGRâs shareholders with registered addresses in ANZ region.

Financial Results

On 20 August 2019, TGR declared annual report, and in the financial performance of the company during FY19 period closed on 30 June this year, it had mentioned that Operating NPAT was at $56.6 million, reflecting a rise of 12.5% and operating cashflow stood at $89.9 million with a substantial rise of 104.9%, which outlines the strength of the companyâs platform in order to generate continued, sustainable growth in shareholder returns.

The company further added that it is committed to safety and posted Lost Time Injury Frequency Rate of 0 for FY19 period as compared to 0.41 in FY18. It is focused towards achieving the core value of âZero Harmâ, and its goal from Total Recordable Injury Frequency Rate perspective is less than zero.

Dividend

The board of directors of the company have declared a total year dividend amounting to 18.0 cents per share for FY19, which was franked at 25% in comparison to 16.0 cps of FY18 100% franked. TGR added that the total dividend includes a final dividend of 9.0 cps, 25% franked, reflecting a rise of 12.5% on the final FY18 dividend. The record and payment dates stood at11 and 30 September 2019, respectively for the FY19 final dividend.

Moving to the stock performance, the Tassal Group Limitedâs stock last traded at A$4.390 per share on the trading session of 28th August 2019. In the time frame of the past three months and six months, it gave a negative return of -10.04% and -10.41%. When it comes to the time period of one month, TGR provided a return of -13.92%.

Disclaimer This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.