Companies engaged in providing death-related goods and services like funeral, burial, cremations, cemeteries, among others, are said to be part of the death care industry. The death care industry is mature, and its revenue depends on the death rate, product mix, incremental price rise and other economic conditions. Investors who are looking for stability and income can opt for stocks operating in this industry. As death is inevitable, companies operating in this industry generate steady cash flow.

The death care industry offers individuals as well as families with important services related to death and sadness.

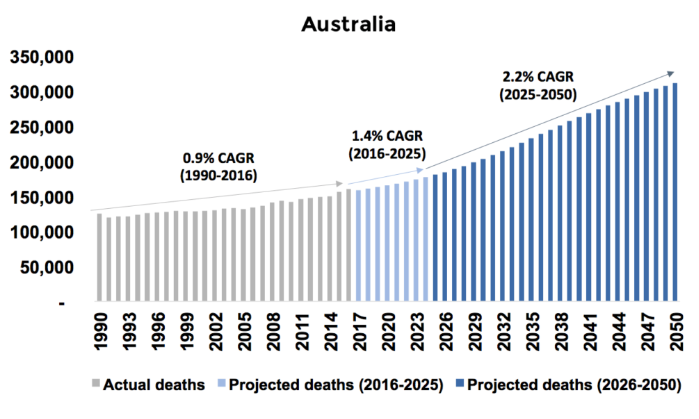

Source: Australian Bureau of Statistics

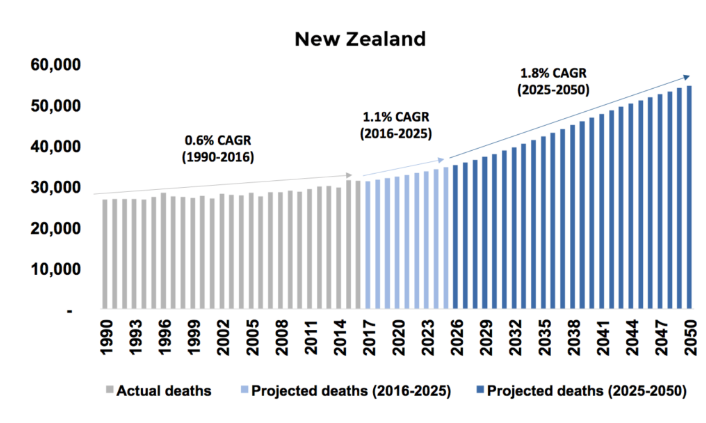

Source: Stats NZ

In this piece of article, we would be discussing two companies - PFP and IVC - listed on the Australia Stock Exchange and operating in the death care industry.

Propel Funeral Partners Limited

Company Overview:

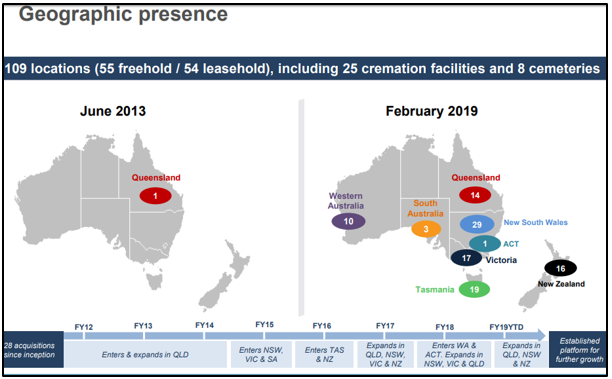

Propel Funeral Partners Limited (ASX:PFP), operating in the consumer discretionary sector, is the 2nd major provider of death care services in Australia and New Zealand. It is the owner of several funeral homes, cemeteries, crematoria along with related assets in multiple locations such as QLD, New South Wales, Victoria, Tasmania, South Australia, Western Australia as well as New Zealand.

PFP Geographic Footprint (Source: Companyâs Report)

Expansion of Debt Facilities:

On 5 August 2019, Propel Funeral Partners Limited announced that it increased its senior debt facilities from $ 50 million to $ 100 million with Westpac Banking Corporation (ASX:WBC). The current senior debt balance of the company is ~ $ 17 million.

The company further requires around $ 20 million of cash, which it needs to pay as part of a binding commitment to acquire Dils Group, with the transaction expected to complete in FY2020. Thus, from the previous senior debt facility limit of $ 50 million of PFP, nearly $ 37 million is drawn and/or committed. With the expansion of senior debt facilities to $ 100 million, the company would have sufficient funds to continue with its investment strategy. The uncommitted debt capacity of the company stands at ~ $ 63 million.

The expanded debt facility consists of the existing $ 50 million tranche, which would mature in August 2021. The next new tranche of $ 40 million would be maturing in the subsequent year in the month of August (August 2022), while the remaining $ 10 million is a revolving working capital facility.

The price remains unchanged and would have an interest rate of ~ 3% on drawn debt. Also, the debt covenants would remain same with Net Leverage Ratio less than 3 times and a Fixed Charge Cover Ratio above 1.75 times.

Debt Facility with Westpac:

During November 2018 Annual General Meeting, Propel Co-Founder and Managing Director and Head of Investments, Albin Kurti highlighted that the company, through its IPO in November 2017, raised $ 131.2 million. Majority of the $ 50 million of cash that the company started with after the Initial Public Offering was deployed towards acquisitions. In August 2018, the company entered a new $ 50 million debt facility with Westpac, that was made available to the company for general corporate requirements as well as for acquisitions.

The company was founded as well as managed by Propel Investments Pty Limited, an experienced investment manager with operations started in the year 2007. Propel Investments Pty Limited, on behalf of Propel Funeral Partners Limited, identified, negotiated, executed as well as managed all its acquisitions till 20 November 2018. Propel Investments Pty limited is an experienced investment manager who started its operations in the year 2007.

The Companyâs Acquisitions:

During FY2018, Propel Funeral Partners Limited acquired Seasons Funeral. With this acquisition, the company was able to enter into metropolitan Perth. Through the businesses, assets as well as certain freehold properties of the Brindley Group, which was also acquired in the same fiscal year, the company was able to expand its presence in Victoria and NSW. The acquisition of Norwood Park, which is an operator of cemeteries and crematoria, made it possible for the company to boost its presence in NSW as well as QLD.

In FY2019, the company acquired Newhaven Funerals, operating from two locations in QLD. It also acquired three other freehold properties which were earlier tenanted by the company itself.

As per an announcement released by the company in December 2018, it had entered into a conditional sales deals with various vendors. The deals were related to the acquisition of businesses, assets as well as freehold properties related to companies in New Zealand. The targets were Dils Funeral Services, Schnapper Rock Cremations, Rowley Funeral Services and Martin Williams Funeral Directors.

On 18 February 2019, the company announced that it entered into a conditional sale deal for the acquisition of the total issued capital of Morley Funeral Pty Ltd, along with its related businesses as well as certain freehold properties.

On 1 May 2019, the company announced the finalisation of the acquisition of Waikanae Funeral Home, Morley Group as well as the Kaitawa Crematorium. Around 344,828 ordinary shares were issued to numerous vendors. The issued shares that were subject to voluntary escrow arrangement for a maximum period of 3 years from the announcement date.

Stock Information:

In the previous six months, the shares of PFP have provided a return of 10.84%. The opening price of PFPâs share was A$ 3.170. By the end of the trading session on 5 August 2019, the shares of PFP closed at A$ 3.160, down 0.315% as compared to its previous closing price. PFP has a market cap of A$ 312.27 million with approximately 98.51 million outstanding shares and a PE ratio of 11.18x.

InvoCare Limited

Company Overview:

InvoCare Limited (ASX:IVC), headquartered in Sydney, is a major provider of funeral, cemetery and other related products and services in Australia, Singapore as well as New Zealand. The company is a major operator of private graveyards as well as crematoria in Australia.

Australian Brands (Source: Companyâs Website)

Acquisition of Australian Heritage Funerals:

On 17 July 2019, InvoCare Limited announced that it reached an acquisition deal concerning Australian Heritage Funerals, which is situated in Toowoomba Queensland. The company expected to conclude the acquisition as part of a conditional purchase agreement by end-July 2019.

The acquisition of Australian Heritage Funerals would enable the company to boost its presence in the regional market. At present, InvoCare operates under the brand, namely Hiram Philp Funerals, as well as the Toowoomba Garden of Remembrance memorial park in the regional market.

In this region, Australian Heritage Funerals has registered strong growth. The entity being acquired performs around 300 funerals on an annual basis, generating nearly A$ 2 million in annual revenue. The acquisition of Australian Heritage Funerals comprises of a long-term lease over the existing funeral home, mortuary as well as chapel. The facilities would also be used for supporting the current businesses of the company in the Toowoomba region.

Martin Earp, the Chief Executive Officer and Managing Director of InvoCare Limited, stated that the company, via Toowoomba Garden of Remembrance, had enjoyed a productive relationship with the teams of Australian Heritage Funerals in the past. Additionally, Mr Martin mentioned the acquisition as a part of the companyâs strategy to boost its presence within regional markets.

Initial Substantial Holder:

On 24 July 2019, InvoCare Limited released an announcement, unveiling a new initial substantial holder in the company. Pendal Group Limited (ASX:PDL) acquired a total 5,895,632 ordinary shares of the company, translating into a voting power of 5.05%.

Stock Information:

In the previous six months, the shares of IVC have provided a decent return of 27.75%. The opening price of IVCâs share was A$ 15.55. By the end of the trading session on 5 August 2019, the shares of IVC closed at A$ 15.320, down by 1.542% as compared to its previous closing price. IVC has a market cap of A$ 1.82 billion with approximately 116.82 million outstanding shares, a PE ratio of 41.16x and an annual dividend of 2.38%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.