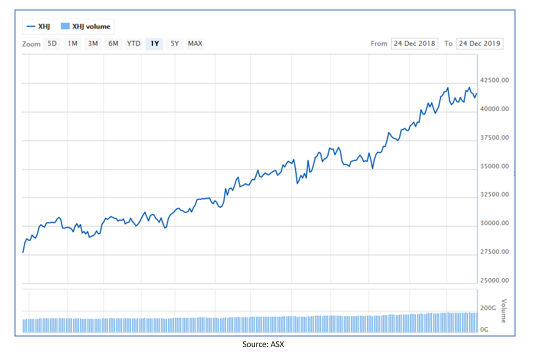

On 30 December 2019, the benchmark index S&P/ASX200 Health Care (Sector) was trading in green, as the index witnessed a rise of 50.9 points or 0.12% at 41,459. Also, the S&P/ASX 200 index was trading in red witnessing a fall of 0.5 points or 31.2% at 6790.5. While ALL ORDINARIES was noted at 6936.3, with a fall of 28.9 points 0r 0.42% (as at AEDT 2:00 PM).

Despite the wavering market, Australia’s health care industry is flourishing with excellent growth prospects, catching investor’s attention as reflected in the below figure that represents excellent exponential growth of Australian health care sector on ASX in the last one year from 24 December 2018 to 24 December 2019.

In this article we would be discussing two ASX listed health care stocks while looking at their recent updates.

Telix Pharmaceuticals Limited (ASX:TLX)

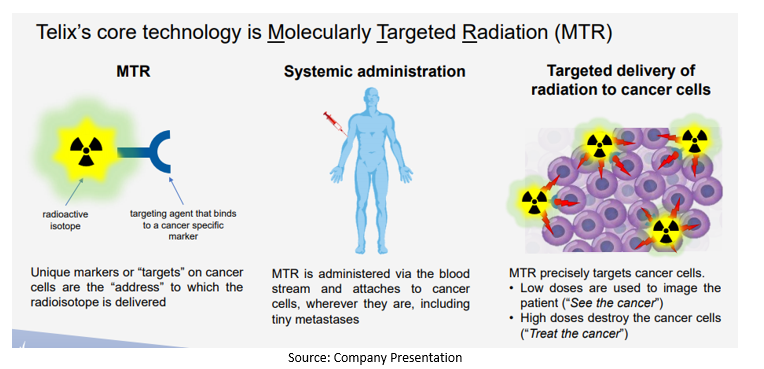

Australian Securities Exchange listed Telix Pharmaceuticals Limited (ASX:TLX) is based in Melbourne having international operations in United States, Japan and Belgium. Telix is a clinical-stage biopharmaceutical company with its focus on the development of diagnostic and therapeutic, clinical stage oncology products portfolio by using Molecularly Targeted Radiation (MTR) to address the unmet medical needs relating to renal, prostate & brain cancer.

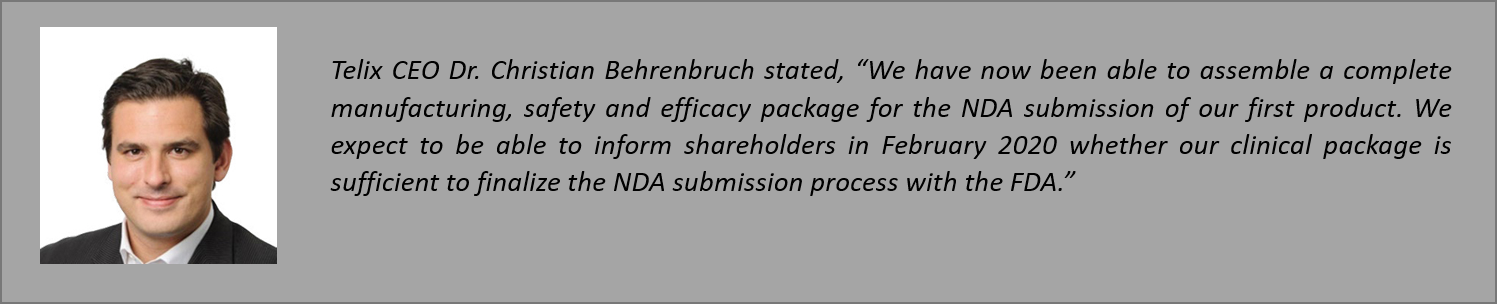

Telix Submitted NDA Clinical Briefing Package the US FDA

· In a recent announcement dated 27 December 2019, Telix informed that a complete clinical briefing package has been submitted to the United States Food and Drug Administration (US FDA) for its 1st product TLX591-CDx, post receiving the procedural guidance from its pre-NDA meeting that was reported on 28th August 2019.

· It was further reported that FDA recommended further (manufacturing & product release analytics) which is now completed by Telix.

· As a result, and a part of the company’s ongoing NDA submission process, Telix will file the revised Drug Master File (DMF) with the FDA during January 2020.

About TLX591-CDx1

A small molecule-based imaging agent that issued with Positron Emission Tomography (PET), TLX591-CDx1 (68Ga-PSMA-11) Prostate-Specific Membrane Antigen (PSMA) which is a cell surface antigen that is over-expressed on most prostate cancer cells.

Telix’s Prostate Cancer Program

Telix’s diagnostic imaging agent for prostate cancer is illumet™ (TLX591 CDx), which has a superior sensitivity/specificity as compared with standard care, being sold as an investigational product in United States, Europe, and Australia with a huge market opportunity of US$500 million for prostate imaging (multiple indications).

The company anticipates launching this product in mid-2020 into US commercial market. Early adoption of illumet™ (TLX591 CDx) is increasing rapidly. TLX591 is under development for advanced prostate cancer.

Stock Information

With a market capitalisation of 400.18 million and 253.28 million outstanding shares, TLX’s stock was trading at $1.530, witnessing a decline of 3.165% on 30 December 2019 (at AEDT 1:35 PM). The 52 weeks high and low of the stock was noted at $1.95 and $0.620, respectively with an average (year) volume of 739,850. The stock generated a significant return of 143.08% on a year-to-date basis.

Regis Healthcare Limited (ASX: REG)

One of the biggest aged care providers in Australia, Regis Healthcare Limited (ASX: REG) offers services like aged care facilities, home care services as well as day therapy and day respite services and retirement villages across Australia from the last twenty-five years with the highest standard of care. Regis Healthcare has 6,753 operational places across Queensland, New South Wales, Victoria, Western and South Australia. The company provides services including ageing-in-place and transitional care, respite care, palliative care and dementia care.

Regis Provides Trading Updates and Revised Financial Year 2020 Guidance

As per the latest ASX announcement dated 20 December 2019, Regis healthcare informed the market on its trading update and reviewed FY2020 Guideline.

· Regis informed that the FY2020 guidance has been reduced on account of continued industry pressure on occupancy.

· The company further informed that the occupancy has seen a downfall on a continuous basis.

· As at December 2019, the financial year to date occupancy was noted 92% and as at 17 December 2019, the spot occupancy was reduced to 91.5% compared to 92.4% as at June 2019 because of the ongoing challenges in industry conditions and is stable with the sector experience.

· Recent Australian Institute of Health and Welfare report regarding the Operation of the Aged Care Act (ROACA) Summary for financial year 2019 and the Aged Care Financing Authority 2019 report shows industry occupancy at 89.4% for FY2019, which is noted at its lowest in 3 years.

· Moreover, non-wage expenditure is in accordance with the expectations. With the facilities bolstering, Regis continue to deliver solid performance against other key metrics including RADs. Regardless of increasing wage costs as a fraction of revenue, Regis is maintaining superior quality and service levels.

Regis’s Revised Financial Year 2020 Guidance

· Regis’ revised guidance for fiscal year 2020 is circa $92 million normalised EBITDA and circa $28 million normalised NPAT assuming no further significant fall in occupancy during FY2020.

· However, the previous FY2020 guidance was normalised EBITDA of circa $105 million and normalised NPAT of circa $38 million.

· It was also informed that the normalised adjustments would continue to incorporate direct expenses linked with responding to the ongoing Aged Care Royal Commission.

· Further detailed information on financial performance and outlook would be provided by the company, when it will release its half-year results on Wednesday 26 February 2020.

Stock Information

With a market capitalisation of 739.84 million and 300.75 million outstanding shares, REG’s stock was trading at $2.51, witnessing a rise of 2.033%, as on 30 December 2019 (at AEDT 1:45 PM). The 52 weeks high and low of the stock was noted at $3.515 and $2.450, respectively with an average (year) volume of 360,623. The stock generated a negative return of 10.22% on a year-to-date basis.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.