Technology stocks are stocks of those companies which are into the business of electronics, computers, software as well as scientific research. In this article, we discuss seven technology stocks and cover their recent updates.

Bigtincan Holdings Limited (ASX:BTH)

Bigtincan Holdings Limited (ASX:BTH), a company which facilitates the sales and service teams in improving their win rates and customer satisfaction, recently announced the completion of the acquisition of Xinnovation, Inc (âXINNâ) as per the stock purchase agreement signed between Bigtincan, XINN and the shareholders of XINN on 30 September 2019.

BTH made a payment of circa US$4.437 million at the closure along with the issue of 6,940,211 fully paid ordinary shares in the capital of Bigtincan to the sellers. The shares were issued at a price of A$0.537 per share. Out of the total shares issued by the company, 4,337,632 shares were issued to two key executives of XINN. These shares are subject to voluntary escrow restrictions for 12 months and are subject to penalty in case the executive voluntarily leaves the employment of Bigtincan without giving a proper reason, or terminated by BTH for some reason within six months or against the warranty claims as per the stock purchase agreement during the escrow period.

The remaining US$500,000 would be paid by the company by the first anniversary of Closing, which depends on the set-off of any amounts payable by the sellers to BTH.

Stock Performance

The shares of BTH have generated a YTD return of 98.97%. By the end of the trading session on 04 October 2019, the closing price of the shares of BTH was $0.535, down 0.926% from its previous closing price. BTH has a market capitalisation of $145.19 million and approximately 268.87 million outstanding shares.

Audinate Group Limited (ASX: AD8)

Audinate Group Limited (ASX: AD8), a provider of the professional audio networking technologies globally, released its Annual Report for the FY2019 ended 30 June 2019 on 20 September 2019.

- The companyâs revenue in FY2019 increased by 44% to $28.3 million.

- The operating cash flow increased from $1.0 million in FY2018 to $3.6 million in FY2019.

- EBITDA increased from $0.6 million to $2.8 million.

- The company raised $24 million through placement and SPP.

- There was a 29% growth in the annual shipping of Dante units and 22% growth in the OEMs shipping Dante product.

- Three videos and software products were launched during this period.

- Around 2,134 Dante-enabled products are available in the market.

Stock Performance

The shares of AD8 have generated a YTD return of 114.89%. By the end of the trading session on 04 October 2019, the closing price of the shares of AD8 was $7.570, down 1.046% from its previous closing price. AD8 has a market capitalisation of $511.95 million and approximately 66.92 million outstanding shares.

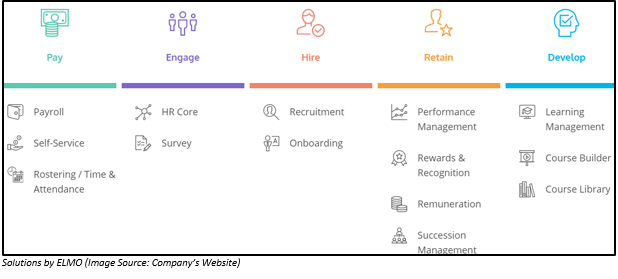

ELMO Software Limited (ASX:ELO)

ELMO Software Limited (ASX:ELO), a cloud-based HR & Payroll software provider, in last one week made two announcements.

On 26 September 2019, ELO announced the dispatch of SPP Offer Booklet along with the customised application form to shareholders who were entitled to take part in the SPP.

On 27 September 2010, the company released an announcement related to the date of the Annual General Meeting. The AGM of ELO is scheduled to take place on Tuesday, 26 November 2019 at 2.00 pm Sydney time.

Stock Performance

The shares of ELO have generated a YTD return of 22.49%. By the end of the trading session on 04 October 2019, the closing price of the shares of ELO was $6.610, down 1.343% from its previous closing price. ELO has a market capitalisation of $485.18 million and approximately 72.42 million outstanding shares.

Serko Limited (ASX:SKO)

Serko Limited (ASX: SKO), a provider of an integrated, cloud-based corporate travel booking and expense management solution, recently confirmed due to inbound investor enquiries that it neither has any commercial relationship with Thomas Cook nor it has any financial exposure due to liquidation of Thomas Cook.

Stock Performance

The shares of SKO have generated a YTD return of 42.69%. By the end of the trading session on 04 October 2019, the closing price of the shares of SKO was $3.710, flat against its previous closing price. SKO has a market capitalisation of $300.22 million and approximately 80.92 million outstanding shares.

Whispir Limited (ASX: WSP)

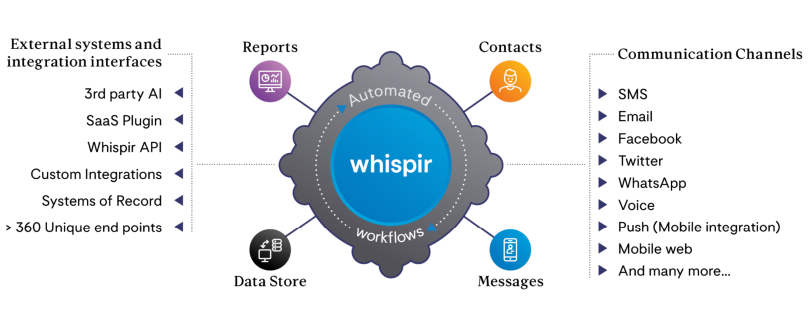

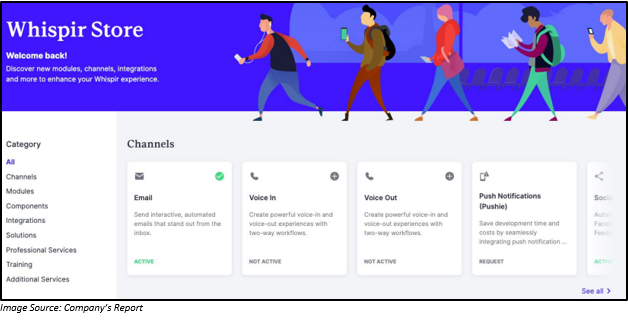

Whispir Limited (ASX: WSP), an international software-as-a-service (SaaS) company, which provides a communications workflow platform that facilitates interaction between businesses and the individuals, announced the launch of Whispir Store. The launch of Whispir Store has helped the company in increasing its digital sales potential. More than 500 blue-chip companies would now be able to explore the growing product offering of the company and also initiate additional features as well as services via its platform.

The enterprise customers of the company would be able to access the Whispir Store library for selecting >45 products across modules, channels, components, templates, integrations, training as well as professional services.

WSP at a Glance (Source: Companyâs Website)

Stock Performance

The shares of WSP have generated a 3-month return of 7.33%. By the end of the trading session on 04 October 2019, the closing price of the shares of WSP was $1.590, down 1.242% from its previous closing price. WSP has a market capitalisation of $166.53 million and approximately 103.43 million outstanding shares.

LiveTiles Limited (ASX: LVT)

LiveTiles Limited (ASX: LVT), a software company into the business of developing and selling business software in Australia and beyond, on 27 September 2019 announced renewal of its Board. The company appointed an accomplished People executive based in San Francisco, Dana Rasmussen as the non-executive Director followed by the resignation of Cassandra Kelly from the Board. Dana Rasmussen is also the SVP Head of People at Honor, a US technology healthcare business. She has proven record of establishing high performing teams within high-growth companies as well as helping these companies to grow and scale up.

The company is looking forward to obtaining benefits from her knowledge.

Stock Performance

The shares of LVT have generated a YTD return of 2.94%. By the end of the trading session on 04 October 2019, the closing price of the shares of LVT was $0.360, up 2.857% from its previous closing price. LVT has a market capitalisation of $281.23 million and approximately 803.52 million outstanding shares.

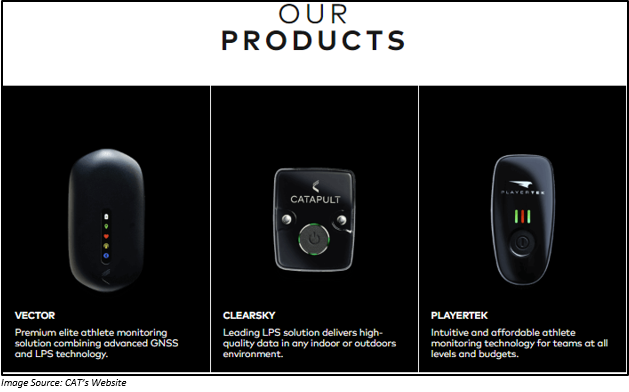

Catapult Group International Ltd (ASX:CAT)

Catapult Group International Ltd (ASX: CAT), a company which develops technology that helps players as well as teams to perform to their true potential, recently on 18 September 2019 released its investor presentation. The investor presentation of the company highlighted on its FY2019 performance, achievements in FY2019 and its outlook for FY2020.

Stock Performance

The shares of CAT have generated a YTD return of 81.33%. By the end of the trading session on 04 October 2019, the closing price of the shares of CAT was $1.380, up 1.471% from its previous closing price. CAT has a market capitalisation of $259.62 million and approximately 190.9 million outstanding shares.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.