Stocks trading at a low price of less than a dollar with a low market cap are termed as penny stocks. Penny stocks are considered as speculative in nature and are highly risky. Moreover, these stocks have small number of shareholders and have large bid-ask spreads.

In this article, we would be discussing three penny stocks and cover the recent updates from these companies.

Clean Seas Seafood Limited

Clean Seas Seafood Limited (ASX:CSS), a global leader in full cycle breeding, manufacturing and sale of Yellowtail Kingfish, on 9 September 2019, provided its investors with a business update and a strategic review of its âVision 2025â.

Business Update

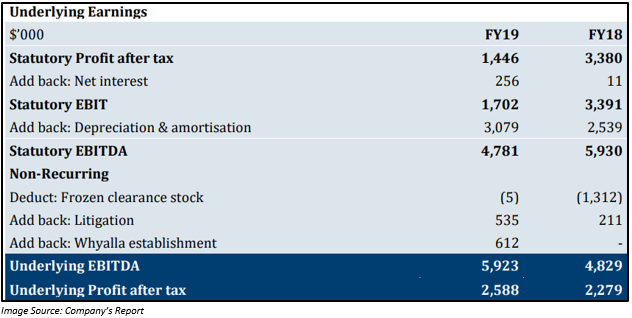

Underlying EBITDA of the company increased by 23% to $5.9 million and underlying cash flow grew by 73% to $3.2 million during FY2019. The statutory net profit declined from $3.38 million in FY2018 to $1.45 million in FY2019, highlighting the companyâs ongoing investment in biomass growth in order to support future sales growth, investment in sales and infrastructure, as well as in litigation costs.

Strategic Review - Vision 2025

The company confirmed that there is a significant untapped market opportunity in North America and Asia for for SensoryFresh premium frozen product, as more than 75% of the Kingfish market is frozen product in these two regions.

CSS also unveiled to have identified per capita consumption growth opportunities for Yellow Tail Kingfish, globally, especially in Asia and Europe.

Farmed Kingfish is one of the seafood species and is considered as one of the premium Kingfish species, with Spencer Gulf Hiramasa the only cold water farmed product outside Japan. The vision sets out the companyâs competitive advantage with the quality of its ocean nurtured Spencer Gulf Hiramasa Kingfish. This product has market in 4 continents and has 20 years of breeding management programs along with the related intellectual property.

Competitive advantage of the companyâs SensoryFresh premium frozen product was achieved via the sue of liquid nitrogen freezing technology. The technology provides strong product advantage over traditional frozen processing.

The company aims to expand its annual sales of ocean farmed Kingfish by ~ 50% by 2022, majorly through the market share growth in North America and Asia.

In August 2019, the company raised $6.6 million via equity placement and announced to raise further $15.3 million via a proposed convertible note entitlement offer. The company expects that after the completion of the proposed convertible note issue, it would be able to implement its âVision 2025â Strategic Plan.

Stock Performance

The stock of CSS was trading at a price of $0.830 on 10 September 2019 (AEST 03:06 PM). CSS has a market cap of $69.3 million and approximately 83.5 million outstanding shares. The bid and ask rate was $0.830 and $0.840, respectively. In the last three months and six months, the stock has delivered negative returns of 11.23% and 10.27%, respectively.

Oro Verde Limited

Mineral exploration company, Oro Verde Limited (ASX:OVL) is engaged in the identification and advancement of emerging resource opportunities in Australia and Central America. The company is majorly focused on Nicaragua, since 2014. The company has a wholly owned project, San Isidro Gold Project, which is located 70km north of the capital city of Nicaragua, Managua. In order to boost its portfolio, OVL seeks quality gold-silver-copper projects.

New Contract

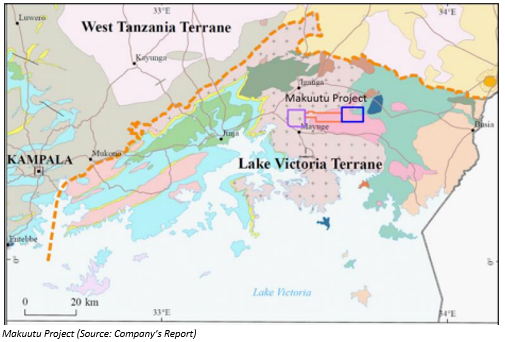

Mineral exploration company, Oro Verde Limited (ASX:OVL), on 9 September 2019, announced that it has entered into a contract, under which it would acquire up to 60% interest in the Makuutu Rare Earths project (Makuutu). The company has now acquired an initial interest of 20% in Rwenzori Rare Metals Limited, which is a Ugandan company with a wholly owned share in Makuutu.

A significant exploration target was announced by the company for Makuutu recently, with drilling expected to start in September 2019 to progress the project. The company has also completed a placement of $0.75 million to professional and sophisticated investors.

Stock Performance

The stock of OVL was trading at a price of $0.007 on 10 September 2019 (AEST 03:10 PM). CSS has a market cap of $13.19 million and approximately 1.88 billion outstanding shares. The bid and ask rate was $0.007 and $0.008, respectively. In the last three months and six months, the stock has delivered returns of 250.00% and 133.33%, respectively.

ClearVue Technologies Limited

Smart building materials company, ClearVue Technologies Limited (ASX:CPV), on 9 September 2019, released its investor presentation to the market, under which it highlighted about the company, its board and management, investments, technology, product, in addition to commercial and residential applications.

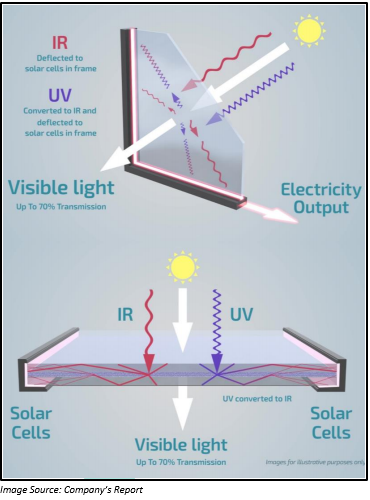

ClearVue Technologies operates in the BIPV sector. The BIPV or Building Integrated Photovoltaic sector involves the integration of solar technology for building materials such as glass as well as building surfaces to produce localised renewable energy.

Investment Highlights

The company has invested more than $9 million in the technology development programme till date. Recently, CPV has signed a Consultancy Agreement with ARUP for the further development of Smart Façade panel concepts of the company. Moreover, ClearVue has 85 granted patents along with 40 patent applications across the globe. The company has also received a $1.6 million grant from the Australian federal government for building a grid-independent greenhouse in 2019.

The companyâs technology sits within an activated interlayer that is between two glass panes.

ClearVue has extensive IP protection on its technology and products. The product of CPV is scalable in terms of production and manufacturing. CPVâs glass/window product is clear as well as functional.

Government Support

In another announcement to the market on 6 September 2019, the company unveiled to have received an R&D tax credit worth $602,000. The payment was made pursuant to the Commonwealth Government Research & Development Tax Incentive Program.

Capital Raising

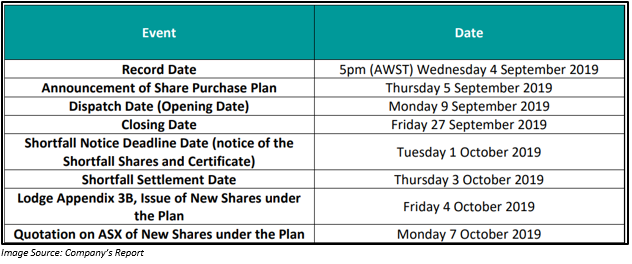

The company has also announced an underwritten Share Purchase Plan, through which it plans to raise up to $2 million before costs and a proposed target of another $2 million. The funds raised through the SPP would be used to service and advance the global sales and marketing efforts of the company, its R&D program and intellectual property portfolio protection. Moreover, the funds would be directed towards meeting operating expenses and working capital.

Stock Performance

The stock of CPV last traded at a price of $0.185 on 9 September 2019. CSS has a market cap of $18.08 million and approximately 97.73 million outstanding shares. The bid and ask rate was $0.175 and $0.185, respectively. In the last three months and six months, the stock has delivered negative returns of 21.28% and 38.33%, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.