With Australian market recently reaching an all-time high recently, it saw quick correction with dips on two consecutive days over Tuesday and Wednesday, respectively sparked by trade fear revival and profit booking. Subsequently it is recovering; settling at 6730, up 0.3% as on 9 December 2019.

After marking a recent high of 5098.50 in July, the S&P/ASX 200 Resource sector index has shown a downward trend - currently trading at 4,829, up 1.43%.

Given the backdrop, it is quintessential to know the resource stocks which are performing well or may be useful for near-term profit-making decision. For the same, please find below the list of stocks:-

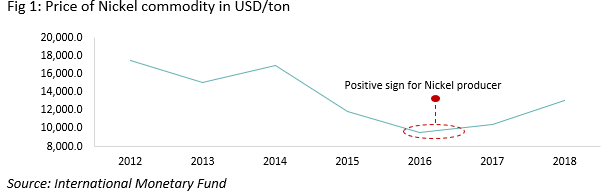

Western Areas Limited (ASX:WSA) is a prominent nickel company in Australia with average high processed grade of ~4.0% and low cash cost of ~2 USD/lb. The Company owns Forrestania and the Cosmos Nickel Operation in Western Australia. The strong correlation between company stock performance and nickel price is a testimony to the fall in share price from maximum AUD 5.007 in July 2014 to lowest AUD 2.022 in December 2018 i.e. tumbling by 59.6%, following the same trend as Nickle price as shown in figure 1.

A plunge is noticed on 4th December 2019 in comparison to the previous day due to the bush fire incident at Forrestania mine. The maximum traded value on 3rd December was AUD 2.87, while plummeting to AUD 2.7 on 4th December 2019. Now, it has revamped and traded at ~AUD 2.855, up 2.33% on 9th December 2019.

The company has annual Dividend Yield of 0.72% with P/E ratio of 53.760 and EPS of AUD 0.052. The EBITDA margin of the company has decreased from 33.83% in FY18 to 30% in FY19. The fall is due to the increase in cash cost in comparison to previous year as show in figure 2.

The company relishes lower cash cost which gives it the margin to withstand the plunge in Nickle prices by 3.46 USD/lb as of FY19. This makes it positive for longer run investment in the stock to benefit out of future demand of Nickel coming from Electric Vehicle (EV) market.

Blue Scope Steel Limited (ASX:BSL) is a steel manufacturing company with global presence in China, India, Indonesia, Thailand, Vietnam, Malaysia and North America- the major consumers of metal coated and painted steel building products.

The share price makes its highest debut in the year with trading value at AUD 15.11 on 6th December. The stock may be further monitored given its operations in the largest construction market China followed by US, and high growth markets in ASEAN and India.

The company has annual Dividend Yield of 0.95 with P/E ratio of 7.730x and EPS of AUD 1.899. EBITDA margin of company has remained almost constant in the range of 14.30 % and 14.05% for the FY18 and FY19 respectively.

Nickel Mines Limited (ASX:NIC) is a low-cost producer of nickel pig iron. It holds Hengjaya Nickel and Ranger Nickel projects with 60% interest; whereas, Hengjaya Mineralindo Nickel Mine, Indonesia with 80% economic interest.

The share of the company has fallen by 10% in the last 5 years from AUD 0.62 on 2nd December to AUD 0.56 on 6th December 2019. The stock may be monitored in near term due to its project reaching its full capacity by FY2020 as shown in below company guidance:-

With no dividend history, it has a P/E ratio of 7.94x and EPS of AUD 0.070. It has EBITDA margin of 30.76% in FY19 and is expected to increase to 46% in FY20; where, ROE is expected to gallop by 48.64% i.e. from 37% in FY19 to 55% in FY20.

Also read: Nickel Mines Limited Signs MOU To Supply Limonite Ore To New HPAL Plant

Bulletin Resources Limited (ASX:BNR) is a mineral exploration company which recently entered into Sale and Purchase Agreement to acquire 80% of the Lake Rebecca gold project of Kalgoorlie via its majority shareholder Matsa Resources Limited.

The stock settled the dayâs trading at AUD 0.028, up 12% on 9 December 2019.

It has 52-week high of AUD 0.033 and 52-week low of AUD 0.03 with negative EPS of AUD -0.011. The dollar devaluation and rise in inflation may aid more gold exploration activity to identify the new deposit or to increase the life of mine.

Also read: Bulletin Resources Limited: Projects And Operations Update

MacArthur minerals ltd (ASX:MIO) is an exploration company in the field of iron ore, lithium and gold. It is now focusing in bringing the production of its Lake Giles Iron Project in Western Australian containing 80 Mt of Ularring hematite resource and the 710 Mt of Moonshine magnetite resource.

Leap from explorer to producer has made the company to set its dual listing by venturing into ASX on 6th December 2019, where previously it was only traded on CVE. With launch it opened at AUD 0.28 and ended the trading 10% higher to AUD 0.31.

The stock ended the dayâs session at AUD 0.320, up 3.2% as on 9 December 2019.

The company holds brighter prospects with the start of Lake Giles operations in FY20 as well as due to increase in Iron Ore prices.

Tap Oil Limited (ASX:TAP) is an exploration and production player with two revenues generation business units including an exploration portfolio in Australia and Manora Oil Field in the Gulf of Thailand.

The share price of the company increased by 33.33% on 6th December 2019 at AUD 0.16. The impulse rise was witnessed after flat trading rate of AUD 0.13 for the last 4 months. This surge was due to the announcement of maiden dividend of AUD 0.025.

The stock traded at AUD 0.165, up 3.125% on 9 December 2019. With first dividend, it has P/E ratio of 2.650 and EPS of AUD 0.06.

The EBITDA margin of the company has remained almost constant in the range of 14.30 % and 14.05% for the FY18 and FY19 respectively. This may improve further since companyâs NPAT first time reached positive in FY18 at USD 13.2 Million from last four year negative figures. This has become possible due to the reduction of debt from USD 64.2 Million in FY14 to zero in FY17 and FY18. Also, the strong cash position of the company will help in building new opportunities in its Australian portfolio.

Allegiance Coal Limited (ASX:AHQ) is engaged in the exploration and development of metallurgical coal in countries with low level of political risk and a good investment record. It currently owns Telkwa metallurgical coal project (Canada), Kilmain project (Bowen Basin of Central Queensland) and Back Creek project (Surat Basin of Central Queensland).

The share price of the company surged by 21.7% on 6 December 2019, following the announcement that Allegiance has entered into a non-binding MoU to acquire additional coal resources from the land adjacent to the New Elk hard coking coal mine.

There is no dividend distribution history in Current FY19 or even in any previous yearâs financial years, with negative EPS of AUD 0.003. The stock settled the dayâs trade at AUD 0.135, down 3.57% on 9 December 2019.

Amani Gold Limited (ASX:ANL) is an exploration and gold development company. It has completed its maiden resource estimate of Douze Match of 45.62Mt @ 1.46g/t Au on 10 December 2018. Apart from above, it has two more deposits i.e. Giro Gold â Kebigada Deposit and Giro Project.

The company recently completed its first shipment from Tanzania to a Hong Kong refinery via Amago Trading Limited. It holds 60% share in Amago Trading Limited through which Amani attained Gold Dealer Licence in Tanzania for Geita district mineral hub.

Till now, no dividend has been paid to the shareholders and the company has negative EPS of AUD 0.008. The stock settled the dayâs trade at AUD 0.002 on 9 December 2019.

The stock may be monitored with other projects of the company start producing and rise in the shipment of Tanzania.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_09_03_2024_01_03_36_873870.jpg)