Generally, active investors keep a close eye on stocks which they believe could provide them with good returns. We have made a list of 7 stock which investors should watch carefully.

Resolute Mining Limited (ASX:RSG)

With over 30 years of experience in the gold mining sector, Resolute Mining Limited (ASX:RSG) is an Australian company that functions as an explorer, developer, and operator of gold mines in Australia along with Africa.

The company recently published its September Quarter Production Update. According to the company reports, the company produced a total quarterly gold of 103,201 ounces (oz) which is higher than the June 2019 Quarter by 25,069oz.

Recently on 10 October 2019, the company announced that a key component of the sulphide processing circuit at the Companyâs Syama Gold Mine in Mali has been taken offline as a crack in the main external shell has been detected.

At the market close on 11th October 2019, the company's stock was trading at a price of $1.255, down 0.791% intraday, with a daily volume of ~15,175,463 and a market capitalisation of circa $1.14 billion. The stock has a 52 weeks high price of $ 2.120 and a 52 weeks low price of $0.910 with an average volume of ~12,259,928. In the past six months, the companyâs stock has increased by 2.43%.

Washington H Soul Pattinson & Company Limited (ASX:SOL)

Washington H Soul Pattinson & Company Limited (ASX:SOL) is an investment company with investments in a broad and diverse portfolio. The company has major investments in companies like TPG Telecom, New Hope Group, Brickworks Limited, Australian Pharmaceutical Industries, BKI Investment Company Limited, Round Oak, Milton Corporation Limited, Apex Healthcare Berhad, TPI Enterprises Limited, Ampcontrol Pty Limited, Clover Corporation Limited, and Pitt Capital Partners.

The key highlights for FY19 (year ended 31st July 2019) are as follows:

- Group recorded a regular NPAT of $307 million in FY19, down 7.2% on FY18;

- Group Net Profit After Tax of $248 million in Fy19, down 7.1% on FY18;

- Pre?tax value of portfolio $5,469m up 0.6% for year;

- Regular cashflow from operations of 169.6 million, up 18% on previous year.

At the market close on 11th October 2019, the Company's stock was trading at a price of $ 21.490, up 0.421%, with a daily volume of ~ 420,705 and a market capitalisation of circa $5.16 billion. The stock has a 52 weeks high price of $31.870 and a 52 weeks low price of $19.700 with an average volume of ~ 364,791. In the past six months, the companyâs stock has decreased by 12.83%.

Afterpay Touch Group Limited (ASX: APT)

Afterpay Touch Group Limited (ASX: APT) is a retailing technology company formed by the coming together of Afterpay and Touchcorp in June 2007. The company functions in key areas of retail consumer brand and a blend of retail, mobility and health services.

Following the resignation of the company director David Hancock, the company on 8th October 2019, appointed Larry Summers, Uli Becker and Matthew Kaness as the companyâs new Afterpay US Advisory Board.

The company reports reflect, positive underlying EBITDA and free cash flows despite substantial investment in establishing US and UK operations. As per the company reports, the launch of Clearpay in the UK has already shown results as anticipated.

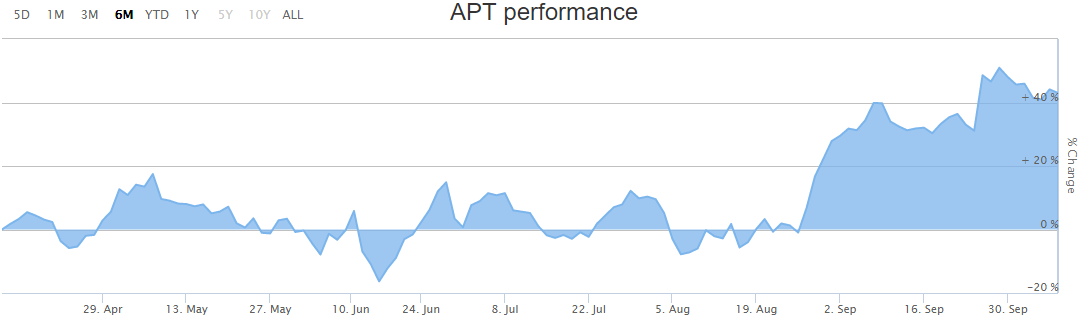

Figure 1 Six months performance of APT (Source: ASX)

At the market close on 11th October 2019, the Company's stock was trading at a price of $ 35.120, up 0.143%, with a daily volume of ~ 1,519,760 and a market capitalization of circa $8.86 billion. The stock has a 52 weeks high price of $ 37.120 and a 52 weeks low price of $10.360 with an average volume of ~ 2,282,821. In the past six months, the companyâs stock has increased by 41.44%.

Magellan Financial Group Limited (ASX: MFG)

Magellan Financial Group Limited (ASX: MFG) invests in global equities and global listed infrastructure in order to generate attractive returns for its clients and simultaneously protecting their capital. Headquartered in Sydney, Australia, the company lately devised various sustainable strategies and initiated a paperless way to invest in global stocks. The company has a presence in multiple countries and offers its services to the high net worth, retail, and institutional investors.

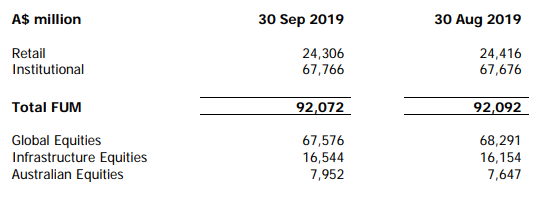

Figure 2 Funds Under Management (Source: Company Reports)

According to the company reports, the net inflows for the company were $462 million in the September month, which comprised of net retail inflows of $175 million and net institutional inflows of $287 million.

The IPO of the Magellan High Conviction Trust raised approximately $862 million by incurring an estimated cost of the offer around $55 million, including the Loyalty Units and IPO Foundation Units.

At market close on 11th October 2019, the Company's stock was trading at a price of $ 48.350, up by 2.069%, with a daily volume of ~ 871,372 and a market capitalisation of circa $8.63 billion. The stock has a 52 weeks high price of $ 62.600 and a 52 weeks low price of $ 22.550 with an average volume of ~1,080,231.

Mayne Pharma Group Limited (ASX: MYX)

Mayne Pharma Group Limited (ASX: MYX) is a specialty pharmaceutical company which commercializes branded and common pharmaceuticals by focusing on utilising its expertise in drug delivery. The company also servs its globally present clients through contract development and manufacturing services. The company operates globally with its partners present in North America, Europe and Asia. Over the years, the company has developed a noteworthy product portfolio.

The Company has recently signed exclusive supply and license agreement with Mithra Pharmaceuticals lasting 20 years. Following the agreement, Mithra Pharmaceuticals shall commercialise the companyâs novel oral contraceptive in the US. With a peak net sales potential to surpass USD 200 million per annum, the company expects to be EBITDA positive in the financial year after the approval.

At market close on 11th October 2019, the company's stock was trading at a price of $ 0.585, down 0.847% intraday, with a market capitalisation of circa $940.09 million. The stock has a 52 weeks high price of $1.285 and a 52 weeks low price of $0.430 with an average volume of ~ 6,019,159.

Speedcast International Limited (ASX: SDA)

Speedcast International Limited (ASX: SDA) possess greater satellite capacity as compared to any other service provider in the communication and IT sector in Australia.

According to the company reports, there has been a change in the companyâs rating by S&P and Moodyâs. Following are the changes:

- S&P Global has lowered its issuer credit rating to B from B+, and placed its rating on CreditWatch negative;

- Moodyâs has lowered its issuer credit rating to B2 from B1 and retained its negative ratings outlook.

The fall in the ratings was announced following the companyâs declaration of financial results for the H1 2019 (ended 30 June 2019) and the changes in the companyâs board and management.

At the market close on 11th October 2019, the Company's stock was trading at a price of $ 1.020, up by 1.493% intraday, with a daily volume of ~ 2,554,745 and a market capitalisation of circa $240.94 million. The stock has a 52 weeks high price of $ 4.150 and a 52 weeks low price of $ 0.682 with an average volume of ~ 6,125,763.

To know more about SDA click here

WiseTech Global Limited (ASX: WTC)

WiseTech Global Limited (ASX: WTC) advances and delivers cloud-based software solutions to its clients in the international and domestic logistics industries spread across 150 countries. Across the globe, there are over 12,000 logistics organizations that have employed the companyâs software for solving logistics related issues.

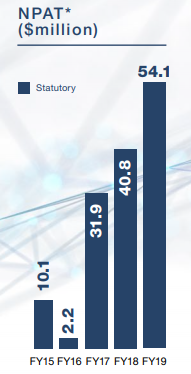

Figure 3Profits for past five years (Source: Company Reports)

As per the company reports, the net profit after tax of the company for FY19 was $54.1 million which is significantly higher than the net profit after tax of $40.8 million earned in FY18. In addition to this, the companyâs revenues increased by 57% to $348.3 million and EBITDA increased by 39% to $108.1 million in FY19.

FY19 Operational Highlights:

- The companyâs global business witnessed major organic growth in revenues;

- The company developed several product augmentations and features for its CargoWise One technology platform; and

- The company acquired many strategic assets in new locations and adjacent technologies.

At market close on 11th October 2019, the company's stock was trading at a price of $ 34.220, down by 0.029% intraday, with a daily volume of ~ 625,677 and a market capitalisation of circa $10.89 billion. The stock has a 52 weeks high price of $38.800 and a 52 weeks low price of $ 14.885 with an average volume of ~1,030,660. In the past six months, the companyâs stock has increased by 50.79%, as on 10 October 2019.

To know more about WTC click here.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.