2019 turned out to be a better year for the Australian property market with soaring prices and high clearance rates, driven by factors including lower interest rates and improved lending conditions. In 2020, prices in the property market are expected to keep growing with Sydney and Melbourne anticipated to continue to lead the recovery.

Let’s discuss six companies that are catering to the property market directly or indirectly, along with their recent updates and stock performance on ASX.

Lendlease Group (ASX: LLC)

ASX-listed property and infrastructure group, Lendlease Group (ASX: LLC) is engaged in creating places to work, live, connect and enjoy. Headquartered in Sydney, the company has operating presence in four regions, namely Americas, Asia, Australia and Europe. LLC was founded in 1973 by Dick Dusseldorp.

BlackRock Group Increases LLC Holding: According to a company announcement dated 13 January 2020, BlackRock Group boosted its voting power in LLC from 5.01% to 6.03%, effective 8 January 2020.

LLC to Divest Engineering Business: On 19 December 2019, Lendlease announced to have reached an agreement to sell its engineering business to Acciona Infrastructure Asia Pacific (Acciona) for $180 million. The deal is a key milestone for the company, which is focusing on achieving its target of delivering more than $100 billion global development pipeline.

It is worth mentioning that two projects, namely, Kingsford Smith Drive and NorthConnex would be excluded from the sale agreement. Also, another project, Melbourne Metro Project, which is being undertaken by a JV, has also been excluded from the agreement.

The expected closure of the transaction is in the first half of 2020, as regulatory approvals and third party and client consents are pending.

Stock Performance: The stock of LLC last traded at $18.900 on 16 January 2020, moving upward by 1.232% compared to its previous closing price. The company has a market capitalisation of nearly $10.54 billion, and its stock has delivered a positive return of 31.48% and 56.63% in the last six months and one year, respectively.

Domain Holdings Australia Limited (ASX: DHG)

A property technology and services business, Domain Holdings Australia Limited (ASX: DHG) offers marketing services via its listing portals for the real estate market of Australia. The company also provides media and lead-generation solutions and data and technology services.

Domain Holdings is scheduled to release its half-year results for the year 2020 on 20 February 2020.

Completion of Bidtracker Holdings’ Acquisition: On 27 November 2019, the company updated the market with the completion of acquisition of the entire issued share capital of Bidtracker Holdings Pty Ltd (operating the point of sale platform - Real Time Agent) in a deal worth $24.8 million.

Of the total consideration, $19.4 million in cash was scheduled for payment on the deal completion, while the payment of remaining cash amount in the range of $0 to $15.6 million is dependent upon attainment of set targets over FY20 and FY21. On achievement of 200% of the business plan, the consideration would maximise to $35 million.

Stock Performance: On 16 January 2020, the stock of DHG last traded at $3.860, down 2.771%. The company has a market capitalisation of nearly $2.31 billion, and its stock has delivered a positive return of 29.74% and 79.64% in the last six months and one year, respectively.

REA Group Ltd (ASX: REA)

ASX-listed digital media business focused on the property market, REA Group Ltd (ASX: REA) serves clients backed by a staff of 1,400 people in 3 continents namely, Asia, Australia and North America.

The company operates large number of websites in all the three continents, including eight in Australia, ten in Asia and two in North America. To name a few: iproperty.com.sg, realcommercial.com.au, spacely, realestate.com.au, and iproperty.com.my.

REA Director Acquires Performance Rights: On 3 December 2019, REA notified the market that one of its directors, Mr Owen Wilson changed his interests in the company. Mr Wilson acquired 8,342 performance rights (with 30 June 2022 as a performance period).

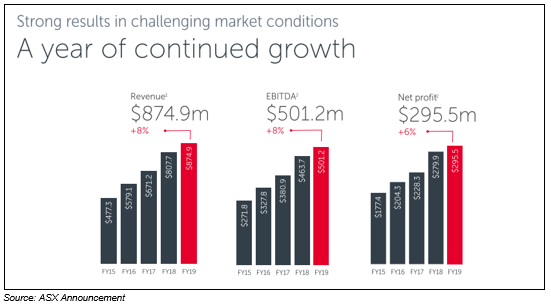

2019 AGM Presentation Highlights: In November 2019, the company released AGM presentation, with key highlights covering the performance of REA during FY19, another year of strong performance. During FY19, revenue grew by 8% to revenue, while net profit went up by 6% to $295.5 million.

The company also updated on its performance for the first quarter ended 30 September 2019, registering a decline of 9% in revenue to $202.3 million and a drop of 14% in EBITDA to $114.9 million. For in-depth quarterly results, click here.

Stock Performance: The stock of REA closed the day’s trading at $114.060 on 16 January 2020, up 1.054%, with a market cap of nearly $14.87 billion. The stock has delivered a positive return of 15.17% and 53.98% in the last six months and one year, respectively.

Brickworks Limited (ASX: BKW)

Founded in 1934, ASX-listed materials company, Brickworks Limited (ASX: BKW) caters to commercial and residential markets. Apart from specialising in property and investments, BKW covers the distribution, manufacturing and sale of building materials.

6 BKW segments are

- Clay Bricks and Pavers;

- Masonry and Stone;

- Cement;

- Precast;

- Roofing;

- Specialised Building systems.

BKW Becomes Initial Substantial Holder of TOT: Recently, BKW and its subsidiaries became an initial substantial holder in 360 Capital Total Return Fund (ASX:TOT) with a voting power of 6.26%.

First Quarter Update & Outlook: At the end of November 2019, the company held its AGM, which covered MD address on Investments, Property, Building Products Australia and Building Products North America.

Also, the company covered the first quarter update and outlook.

- Under the Investments segment, earnings, dividends and market value of WHSP are expected to increase over the long term.

- The Property Trust is anticipated to register another strong result in FY2020.

- For Building Products Australia, the company is expecting high energy costs, low building activity and particularly difficult conditions in WA to impact earnings during the first half of 2020.

- For Building Products North America, market conditions seem supportive for steady growth.

Stock Performance: With a market cap of $2.89 billion, the BKW stock closed the day’s trading at $19.790 on 20 January 2020, moving upward by 2.592%. The stock has delivered a positive return of 14.96% and 19.07% in the last six months and one year, respectively.

James Hardie Industries Plc (ASX: JHX)

ASX-listed materials company, James Hardie Industries Plc (ASX: JHX) pioneers in the manufacturing of backerboard and fibre cement siding worldwide and fibre gypsum products in Europe. Its products are used in a wide range of industrial and commercial applications, in addition to remodelling and construction. The company operates in several regions, namely Australia, Canada, Europe, New Zealand, Philippines and the United States.

Dividend Distribution Update: On 19 November 2019, JHX announced a dividend distribution update for the security - JHX - CHESS DEPOSITARY INTERESTS 1:1. The dividend for six months period closed on 30 September 2019 was scheduled for payment on 20 December 2019, with an ex-date of 15 November 2019 and record date of 18 November 2019.

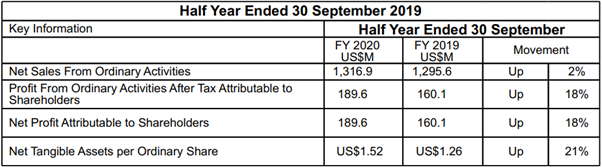

Below figure depicts the company’s performance during the half year period ended 30 September 2019.

Source: ASX Announcement

Also Read: Spark in ASX industrial and material stocks: James Hardie, Amcor and BlueScope

Stock Performance: The JHX stock has delivered a positive return of 58.28% and 100.13% in the last six months and one year, respectively. On 20 January 2020, the stock of JHX last traded at $30.250, up by 1.171% compared to its previous closing price. JHX has a market capitalisation of nearly $13.35 billion.

Boral Limited (ASX: BLD)

ASX-listed materials company, Boral Limited (ASX: BLD) provides materials for construction and building products. The company’s product categories include Decking (Hardwood Timber), quarry products (Rail Ballast), ceramic roof tiles (Artline) and packaged products (Builders cement).

Financial Misreporting in Windows segment: Boral updated the investors in early December 2019 about certain irregularities found in financial reporting for the Windows division in North America. This misreporting of information is regarding labour and raw material costs and levels of inventory at the company’s Windows plants, for the period between September 2018 and October last year.

This matter, being dealt by the company’s appointed lawyers and forensic accountants, would have an impact on EBITDA with order amount of US$ 20 million to US$ 30 million. The probable ongoing impact on EBITDA from the Windows business in the time frame beyond October 2019 is still being determined.

Interesting Read: After banks, are industrials and materials stocks under fire? A look at Boral

Stock Performance: On 16 January 2020, the stock of BLD last traded at $4.920, up by 0.613% from its previous close, with a market capitalisation of nearly $5.73 billion. The stock has delivered a return of -9.28% and -1.81% in the last six months and one year, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.