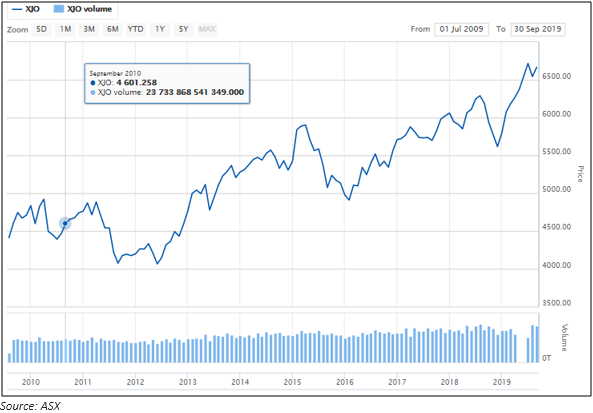

S&P/ASX 200 Index

The Australian benchmark index S&P/ASX200 was trading at 6525.6, up by 32.6 basis points and 0.5 per cent (as on 4 October2019, AEST 3:11 PM). In this article, we would discuss the five diversified stocks wherein, Nufarm limited is from the materials sector, OOH! Media Limited from the communication services sector, CIMIC Group Limited is from industrials sector, Pro Medicus limited is from the Health Care sector and Domain Holdings Australia limited from the communication services.

Pro Medicus Limited (ASX:PME)

Pro Medicus Limited is a health imaging Information technology provider. PME specialises in offering radiology information systems (RIS) along with other solutions throughout the world.

Selling of Shares

On 6 September 2019, the company notified that the board has urged the founders to consider selling three million shares each to improve the liquidity in the PMEâs securities.

Financial Performance for the FY ended 30 June 2019

- The companyâs revenue rose up by 47.9% to $50.1 million from the pcp or previous corresponding period.

- The profit after tax increased by 91.9 per cent to $19.1 million compared to pcp.

- The companyâs cash reserves surged up by 28.0% to $32.3 million.

- Revenue increased in all the 3 areas, by 42.2% in North American region, 102.3 % in Europe and 30.2 per cent in Australian region.

- PME declared a (fully franked) final dividend/distribution of $0.045.

- Underlying profit after tax moved up by 83.1%, standing at $22.7 million.

Stock Performance

The stock of PME quoted $29.740 on 4 October 2019 (AEST 3.03 PM), moving up by 3.228 per cent. The company has approx. $103.98 million outstanding shares and a market cap of $3 billion. The stockâs 52-week low and high was noted at $8.716 and $38.390, respectively. The stock has generated a positive return of 75.99 per cent in the last six months and a positive return of 153.35 per cent in year-to-date.

CIMIC Group Limited

CIMIC Group Limited (ASX:CIM) offer services related to construction, mining, engineering, and such.

Refinanced Syndicated bank Facility

On 30 September 2019, CIM notified that it had effectively refinanced its core working capital cash facility. The new facility (syndicated bank) is of 1.9 billion of 2 different tranches of four and five years.

$761 million Monash Freeway Upgrade

The company on 30 September 2019, notified the market that its CPB contractors has been selected for Monash freeway upgrade. The contract would generate approximately $761 million revenue to CPB.

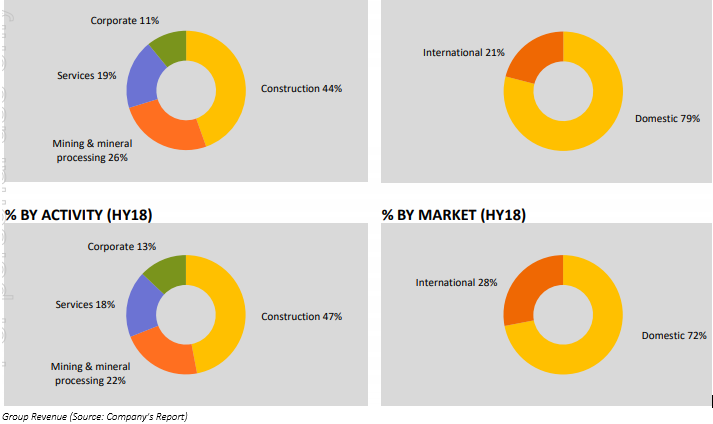

Financial Performance of CIM for the HY 2019

On 17 July 2019, provided HY report ended 30 June 2019, and a few points are mentioned below:

- NPAT for the period was recorded at $367 million compared to $363 million in the pcp.

- Revenue was stable at $7.0 billion.

- Applied AASB 16 leases, followed by a surge in finance costs, EBITDA & EBIT Margins.

- EBIT & PBT rose by 8.2 percent and 7.2 percent, respectively.

- CIM secured $8.3 billion of fresh work in half-year 2019 timeframe.

Stock Performance

The stock of CIM quoted $30.465 on 4 October 2019 (AEST 03.01 PM), surging up by 1.045 per cent. The company has approx. $323.73 million outstanding shares and a market cap of $9.76 billion. The 52-week low and high value of the stock is at $28.880 and $51.670, respectively. The stock has generated return of -39.89 per cent in the last six months and return of -29.51 per cent in year-to-date.

Nufarm Limited

Nufarm Limited (ASX: NUF) is one amid the leading developers worldwide, and manufactures seeds & crop safety resolutions. NUF operates in regions like New Zealand, Australia, Europe etc.

Nufarm to sell South American Operations

On 30 September 2019, the company notified the market on selling the South American operations for $11,88 million cash. The transaction includes seed treatment and crop protection operations situated in the Brazilian, Argentina and such regions. For the same, the company inked a deal with Sumitomo.

NUF has also lengthened the commercial agreements and signed fresh agreements with Sumitomo Chemical Company Limited.

Few Highlights of the transaction are as follows:

- The company confirmed preferred commercialisation partner for Sumitomoâs Proprietary fungicides Pavecto and Indiflin in Germany, UK etc.

- Numfarm and Sumitomo will enter into a two-year supply agreement along with transitional services.

- The company was supposed to buy $97.5 million preference shares issued to Sumitomo in August this year, after the finalisation of deal.

- The transaction is expected to be completed in 1HFY20, subject to the companyâs shareholder approval, as well as competition approval by the South American regulatory bodies.

- The existing agreements between NUF and Sumitomo extended to 2025 with a process to extend the period ahead.

- 10x EBTIDA (underlying) for FY 2019 and c.12.3x FY Underlying EBITDA after adjusting the net costs related to working capital management.

- The transaction is recommended by the Board of NUF.

- The proceeds from the transaction will be used to pay down debt, reducing leverage from c.3.0x to c.0.7x.

- The company would also undertake a review of corporate costs after completion of the Transaction to produce future savings.

Financial Highlights for the year ending 31 July 2019

On 30 September 2019, the company announced the financial result for the period ending 31 July 2019, below are a few pointers of the result;

- The companyâs revenue increased by 13.6 per cent to $3,758 million compared to the previous corresponding year.

- On the Group results front, the underlying gross profit of the company increased by 7 per cent to $1,035 million.

- Underlying net profit after tax decreased by 9.5 per cent to $89 million.

Stock Performance

The stock of NUF was trading high at $6.58 on 4 October 2019 (AEST 02.57 PM), rising by 1.858 per cent. The company has approx. $379.64 million outstanding shares and a market cap of $2.45 billion. The 52-week low and high value of the stock is at $3.605 and $6.940, respectively. The stock has generated a positive return of 30.77 per cent in the last six months and return of +10.62 per cent in year-to-date.

oOh!media Limited

oOh!media Limited (ASX: OML) leads as Out Of Home media entity. It provides advertisers with the skill to build interaction with people and brands, throughout one of the biggest and most varied Out Of Home location-based portfolios in regions like Australia and New Zealand.

Change of interests of Substantial Holder

On 24 September 2019, HMI Capital LLC & Its associates, HML Capital Partners, LP., Merckx Capital Partners LP and HMI Capital Offshore Partners, LP have increased their voting power in CIM to 15.12 percent on 17 September 2019, from 13.98 percent.

Appointment of Non-Executive Director

On 18 September 2019, OML notified the hiring of Philippa Kelly as an independent non-executive director of the company. Ms Kelly will stand for election at the OMLâs next AGM or Annual General Meeting in May 2020.

Stock Performance

The stock of OML quoted $2.825 on 4 October 2019 (AEST 02.55 PM), declining by 0.528. The company has approx. $242.39 million outstanding shares and a market cap of $688.38 million. The 52-week low and high value of the stock is at $2.290 and $5.280, respectively. The stock has generated given return of -26.61 per cent in the last six months and a negative return of 16.47 per cent on year-to-date.

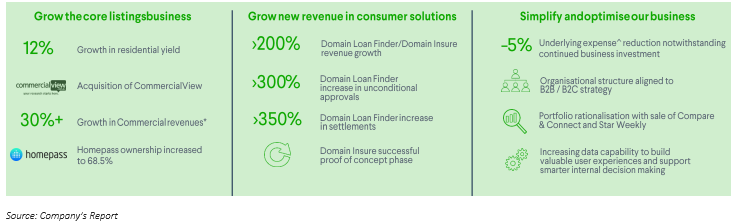

Domain Holdings Australia Limited

Domiciled in Australia, Domain Holdings Australia Limited (ASX:DHG) is a real estate technology and services business, which concentrates on the property market in the Australian region.

The Financial highlights for the year ending 30 June 2019 is as follows;

- The companyâs revenue has been decreased by 6.1 per cent to $335.6 million compared to pcp.

- EBITDA of the company declined by 15.3 per cent to $98.0 million.

- The companyâs EBIT dipped by 26.4 per cent to $65.9 million.

- Net profit attributable to members of the company lessened by 29.3 per cent to $37.4 million.

Stock Performance

The DHG stock was trading at $3.315 on 4 October 2019 (AEST 02.52 PM), slipping by 0.151 per cent. The company has approx. $583.03 million outstanding shares and a market cap of $1.94 billion. The 52-week low and high value of the stock is at $2.060 and $3.600, respectively. The stock has generated a positive return of 14.09 per cent in the last six months and a positive return of 49.55 per cent in year-to-date.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.