Domain Holdings Australia Limited (ASX: DHG) is a leading property technology and services company which helps agents and consumers at every step in the property lifecycle. The company has today disclosed its FY19 results and has also released its 2019 Annual report.

While announcing the results, the companyâs chairman stated that in a very challenging year for property listings, Domain has delivered an impressive yield performance, a testament to the value it delivers to consumers and agents at all points of the property lifecycle. The companyâs CEO in its report has also highlighted that in FY19, the companyâs business was impacted by tighter lending conditions and declining house prices, creating historically low listings volumes.

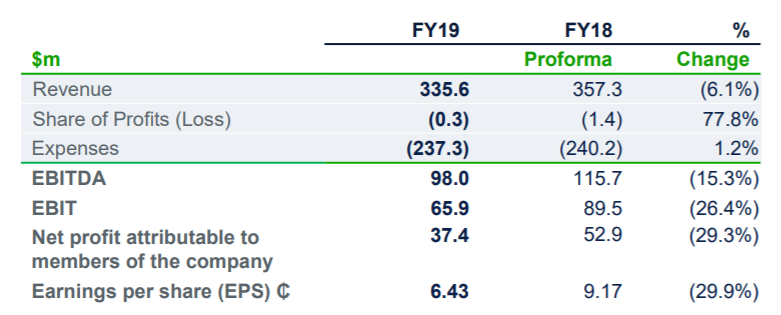

The companyâs revenue decreased by 6% to $335.6 million in FY19, mainly due to the challenging market environment. The companyâs EBITDA declined by 5% to $98.0 million, and EBIT declined by 26% to $65.9 million, mainly due to higher depreciation and amortisation expense.

Trading Performance in FY19 (Source: Company reports)

For FY19, the company reported 12% increase in residential yield despite having significantly lower listings volumes. In Media, Developers & Commercial business, the company reported a negative growth of 13% in revenues, reflecting a challenging market environment for Media and Developers, the adoption of a new operating model for Media, and a strong performance from the companyâs commercial business.

During the year, Agent Services revenue increased by 15%, underpinned by yield growth and the consolidation of Homepass following the increase in Domainâs ownership.

In Print business, the companyâs revenues and EBITDA reduced by around 30% in FY19, reflecting the continued shift to digital, exacerbated by cyclical market conditions.

The company has declared a dividend of 4 cents per share which will be paid on 10 September 2019.

At the end of FY19, the company had a strong balance sheet with net debt of $113.2 million, representing a leverage ratio of 1.2 times EBITDA.

During the year, the company strongly progressed towards its vision to build a customer-centric Australian property marketplace. The company is boosting its existing listings business as well as it is growing and extending its ability to deliver a different types of solutions directly to consumers.

During FY19, the company introduced a new organisational structure, in line with the three objectives of the companyâs strategy:

- Grow the core listings business;

- Grow new revenue in consumer solutions;

- Simplify and optimise its business.

Progressing on its strategy of simplifying and optimising the business, the company divested Compare & Connect and Star Weekly to drive improved margins across the business.

On the stock performance front, in the past six months, the companyâs stock has provided a return of 13.44% as on 15 August 2019. At market close on 16 August 2019, DHGâs stock was trading at a price of $2.930, up by 2.091% intraday with a market capitalisation of circa $1.67 billion.

Peer Analyses

On ASX, DHG comes under the communication services sector. Letâs take a look at financial and operational performance of two more stock belonging to this sector.

Event Hospitality and Entertainment Ltd (ASX:EVT)

Event Hospitality and Entertainment Ltd (ASX: EVT) has cinema exhibition operations in Australia, New Zealand and Germany and along with that it owns, operates and manages hotels and resorts in Australia and overseas.

Recently, Investors Mutual Limited became increased its holding in the company from 9714,201 ordinary shares to 11,420,540 in 2019, increasing the voting power to 7.09%.

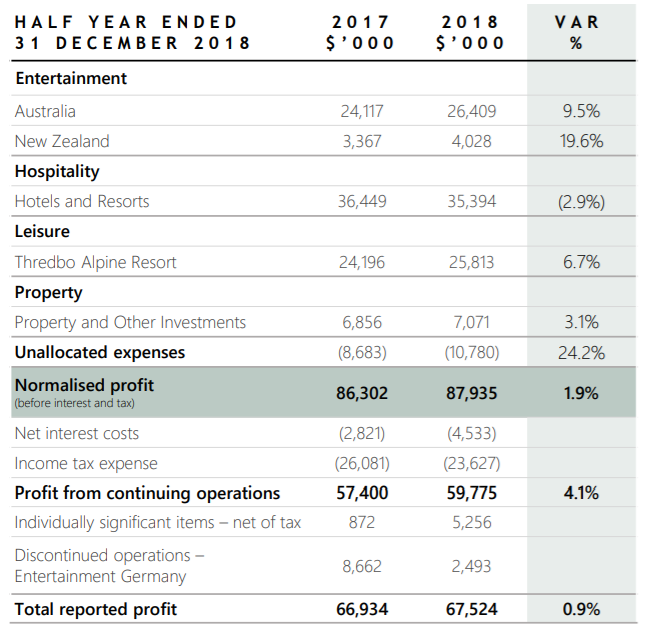

In the first half of FY19, the company reported revenue of $525 million, up 6% on the previous corresponding period (pcp). For the half year period, the company reported 2% growth in EBITDA and Normalised PBIT.

In Entertainment business, the company reported 9.5% growth in its PBIT from Australia and 19.6% growth in New Zealand, driven by strong box office collection.

H1 FY19 Snapshot (Source: Company Reports)

During the period the company opened 2 new cinemas In Australia. To improve its asset portfolio, the company closed three cinemas totalling 13 screens during the period. These included Event Cinemas in Cairns City, BCC Cinemas in Darwin and the Tower Cinema in Newcastle. These sites had been underperforming for a number of years.

In Hotels and resort business, the company reported Normalized PBIT of $35.39 million, down by 2.9% on pcp. During the period, four new managed hotels joined the company.

As at 31 December 2018, the company had current assets of $346.93 million and current liabilities of $255 million. Net cash provided by operating activities during the half year period was around $92.72 million while net cash used by investing activities and financing activities were around $59.92 million and $7.88 million, respectively. At the end of the half year period, the company had cash and cash equivalent of $122.23 million.

On the stock performance front, in the past six months, the companyâs stock has provided a negative return of 6.91% as on 14 August 2019. At market close on 16 August 2019, EVTâs stock was trading at a price of $12.050, down by 0.823% intraday with a market capitalisation of circa $1.96 billion. The stock has a PE multiple of 17.330x and an annual dividend yield of 4.28%.

Vocus Group Limited (ASX:VOC)

Australiaâs specialist fibre and network solutions provider, Vocus Group Limited (ASX: VOC) recently outlined its three-year turnaround strategy.

3 Year Turnaround strategy (Source: Company Reports)

The company has also announced its intention of simplifying into three independent business units:

Vocus Network Services: Leading fibre and network solutions provider;

Vocus Retail: Reseller of broadband, mobile, voice, energy;

Vocus NZ: Full service offering of fibre connectivity, broadband, voice energy and mobile

The company is of the view that Vocus Network Services is having an untapped growth potential and an outstanding market opportunity.

The company is implementing a comprehensive network and systems modernisation program, which will allow the business to grow and contribute significant annual operating cost and capital expenditure reductions within the next 3 years and along with this, the program will also allow the company to disrupt the market with new commercial models, easier product innovation and enable Vocus to deliver an improved customer experience.

During FY19, the company has taken significant steps including:

- Brand refreshes across Dodo and Commander including Commander Centre channel reinvigoration and opening of new centres;

- MVNO agreement renegotiated with Optus, driving better mobile offers and having a pathway to 5G and fixed wireless broadband;

- Product simplification and Implementation of a digital operating model.

Recently, the company was in discussion with AGL Energy Limited for a proposed acquisition of Vocus, however AGL dropped its plans as it is of the view that the acquisition of Vocus will not create value for AGL shareholders.

In the first half of FY19, the company reported revenue of around $974.2 million and EBITDA margin of 18.1%. At the end of half year period, the company had net leverage ratio of 3.08x. During the period, the companyâs net debt increased by $88 million, principally due to funding ASC project. Underlying EBITDA of the company declined by 7% to $176.4 million, driven by declining performance in business and increased technology costs.

Recently, the company reaffirmed its FY19 guidance, as per which, underlying EBITDA in FY19 is expected to be between $350 million - $370 million. In FY20, underlying EBITDA is expected to be in between $350 million â $370 million.

On the stock performance front, in the past six months, the companyâs stock has provided a negative return of 16.02% as on 15 August 2019. At market close on 16 August 2019, VOCâs stock was trading at a price of $2.880, down by 5.263% intraday with a market capitalisation of circa $1.89 billion. VOCâs stock was trading at a PE multiple of 47.060x.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.