Adveritas Limited (ASX:AV1) is into the business of developing innovative software solutions powered by Big Data, targeted towards driving performance and success for businesses, globally. The company is run by a team comprising of highly skilled executives from Perth and Singapore. TrafficGuard, a fraud mitigation software, is the companyâs first available software as a service solution, which identifies, mitigates and reports on digital ad fraud, thereby protecting advertisers from fraudulent digital advertising engagements.

The company got listed on ASX on 18 December 2012 and is headquartered in Australia.

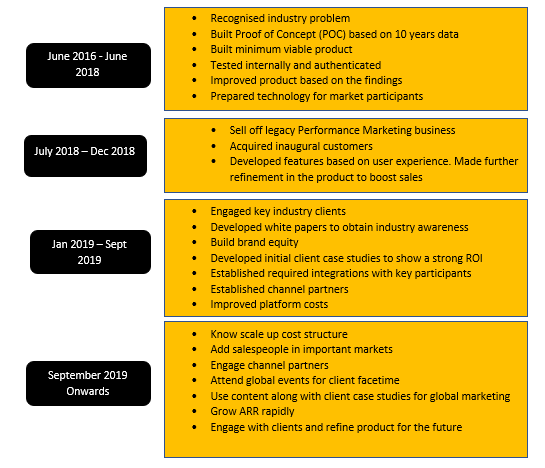

AV1 History:

TrafficGuardâs Solutions:

Ad Fraud Protection:

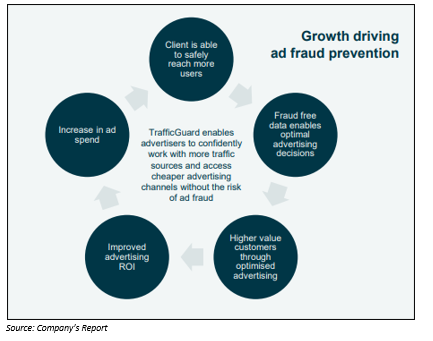

As highlighted above, TrafficGuard identifies, mitigates as well as reports on digital advertisement fraud before it hits advertising budgets. Its 3 levels of ad fraud prevention block general invalid traffic (GIVT) as well as sophisticated invalid traffic to make sure that digital advertising culminates in actual engagements. TrafficGuard helps in removing fraud and protecting valid traffic. It also receives clear as well as consistent reporting. It examines traffic at several phases in the advertising journey and eliminates fraud at the earliest reliable identification, targeted towards keeping performance data clean, boosting optimisation and lowering the user expenses associated with measurement as well as analytics.

PPC Protection:

With PPC Protection, users get genuine advertising engagement, can convert more customers and grow their business at a faster rate.

AV1 Growth Strategy:

- Sector Education: The company leads the education of the digital marketing sector on the global advertisement fraud problem, providing solutions via white paper, industry events and journal articles.

- Campaign Management Platforms/Integrated partners: Major brands use Campaign Management Platforms for managing their digital advertising campaigns. Keeping this in mind, TrafficGuard is now linked directly with various CMPs and other platforms, enabling clients with easy access.

- North American Expansion: North America, which is the leader in global digital ad spend, is a target region for TrafficGuardâs international expansion.

- Emerging Markets Expansion: TrafficGuard boasts presence in Sydney, Perth, Singapore, Croatia, New York, São Paolo, San Francisco and Los Angeles. The company plans to boost marketing in these regions and expand these accounts along with driving new clients.

- Agency Channel Strategy: Agencies often handle a portion of each of their brand clientsâ advertisement expenses. Onboarding of one agency would provide exposure to TrafficGuard to multiple brand advertiser prospects.

- Account Growth

Q1 FY2020 Results (Period Ended 30 September 2019)

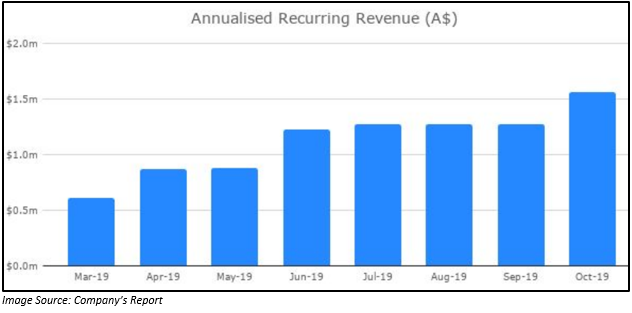

On 31 October 2019, Adveritas Limited released its Q1 FY2020 results for the quarter ended 30 September 2019. Rapid growth was reported in annualised recurring revenue during the quarter, with value reaching ~ $1.6 million at the date of the company release, highlighting significant achievement for AV1, as the company started active commercial sales of its proprietary TrafficGuard SaaS in January 2019.

- ARR grew by 19% in October 2019, 78% in the 6 months to October 2019 and 157% from Jan 2019 to October 2019.

- New client GO-JEK, one of the most highly valued and well-funded super apps in the world, was added as a global enterprise client during the September 2019 quarter. A 12 months contract was signed between the two parties.

- Further improvements were made to TrafficGuardâs portal user interface, reporting and functionality, enabling clients to identify growth opportunities with accuracy and at a rapid rate and at the same time protecting them from advertising fraud.

- AV1 continued towards geographic diversification. Its clients are now in the regions of the US, Latin America and Southeast Asia.

- AV1 received strong support from investors, which was observed during the August 2019 placement of $2.8 million to institutions and sophisticated investors at 10 cents per share.

- Multiple sales strategies supported in driving the revenue.

- TrafficGuard sales team expanded during the period with the appointment of industry experienced personnel in the US and Brazil.

- Globally, the US is the largest digital advertising market, comprising of US$129 billion in 2019, thereby representing a big opportunity for TrafficGuard.

- Net cash outflow from operating and investing activities was $2.354 million and $0.023 million, respectively.

- Net cash inflow from financing activities was $1.727 million. The primary source of cash inflow was from the issue of shares.

- Cash and cash equivalents at the end of September 2019 quarter were $1.447 million.

- Expected cash outflow in the December 2019 quarter is $2.355 million.

Post completion of the September quarter, the company executed two deals.

- A new agreement was signed between AV1 and Rappi, increasing the minimum monthly TrafficGuard subscription fee by 50% (from US$15,000 to US$22,500 per month).

- MUV, a subsidiary company of WPP PLC, also extended its contract from 12 months to 15 months. Its minimum monthly subscription, which was US$2,000, increased to US$10,000.

Outlook

For the second quarter of FY2020, the company expects client trials and new client wins from North America, new clients from emerging markets, and joint events with partners in Jakarta and Brazil with client facing time.

Meanwhile, during the third quarter of the financial year, the company is expecting to add new clients from the European region.

AV1 Stock Performance:

The shares of AV1 have given a decent YTD return of 17.86%. In the last three months, the shares gave an impressive return of 83.33%. On 5 November 2019, the shares of AV1 opened flat on ASX at $0.165. By market closure, the price of the shares stood at $0.165. AV1 has a market cap of $30.96 million and has approximately 187.61 million outstanding shares.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.