Those companies which provide communication services with the aid of fixed-line networks, or the ones that provide wireless access, and services form part of the Communication Services Sector. In this article, we would be covering the recent update of three ASX listed companies from the communication services sector.

Superloop Limited

About the company:

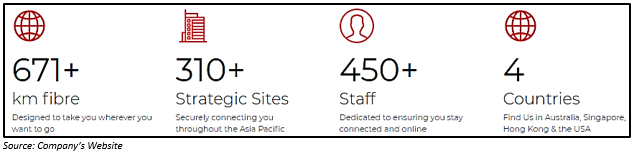

Superloop Limited (ASX: SLC) belongs to the communication services sector on ASX and is an autonomous provider of connectivity services designing, constructing as well as operating networks across the APAC metro region.

Recent Update/s:

On 1 July 2019, the company announced its updated FY2019 EBITDA Guidance. Referring to the 1H FY2019 result presentation which included the FY2019 guidance, the company highlighted that the guidance was based on a number of factors which includes the completion and recognition of certain transactions which were expected in this financial year. However, the company was not able to complete the negotiations by 30 June 2019 in order to secure a substantial commercial agreement which could have helped the company in attaining its FY2019 guidance.

Now, as the company could not complete the negotiation on certain transactions, the companyâs expected EBITDA would be slightly lower than what it was projected in 1H FY2019 presentation. In the 1H FY2019 presentation, the company highlighted that the FY2019 expected EBITDA would be in between $13 million and $18 million. Now, depending on the completion of its audited full-year results, the EBITDA is expected to be in the range of $7 million to $8 million which includes ~ $1 million of the restructuring cost from February 2019.

The company will continue with the negotiation, and if it gets completed successfully, it will be reflected in the future earnings.

For the entire FY2019, the company has continued and will be continuing to monetize its extensive APAC assets in multiple ways which include long-term indefeasible rights of use agreements where the cash would be obtained upfront, however, the revenue is recognized over the life of the contract. As part of its move to strengthen the balance sheet, the company reduced its minority equity stake held in a non-core asset.

Also, the company advised that it has actively engaged with its lender so that its revised guidance is within the terms and conditions of the debt agreement.

Stock Performance:

The stock has provided returns of -38.98 per cent in the past one-year. However, it has provided 0.39 per cent, 4.05 per cent and -12.75 per cent in the past six months, three months and one-month respectively.

By the end of the trading session on 1 July 2019, SLC was down by 11.688 per cent and closed at A$ 1.360. SLC holds a market capitalization of A$ 390.08 million and has approximately 253.3 million outstanding shares.

SportsHero Limited

About the Company:

SportsHero Limited (ASX: SHO) categorized under the communication services sector on ASX and is a gamified social sports prediction platform which is designed to provide a dynamic immersive social experience along with monetary and other prizes.

Recent Update/s:

On 1 July 2019, the company announced that it has signed a binding Agreement with Linius Technologies Limited under which SportsHero would be able to use the Linius technology in the SportsHero app and also in its recently launched âwhite labelâ mobile application, âKita Garuda which was developed by the company for Football Association of Indonesia (âPSSIâ).

Linius Technology helps the user in customizing the video where they can see the video which is relevant to their requirement as well as the viewing preference. The Linius technology is also capable of increasing user engagement significantly as well as viewer numbers for the âKita Garudaâ mobile app. With this, there is a possibility of generation of more substantive advertising revenue for both PSSI and SportsHero.

Stock Performance:

The stock has provided returns of -13.51 per cent in the past one-year. However, it has provided -39.05 per cent, -14.67 per cent and 3.23 per cent in the past six months, three months and one-month respectively.

By the end of the trading session on 1 July 2019, SHO was up by 1.562 per cent and closed at A$ 0.065. SHO holds a market capitalization of A$ 17.3 million and has approximately 270.27 million outstanding shares.

Adveritas Limited

About the Company:

Adveritas Limited (ASX: AV1) segmented under the communication services sector on ASX, and it creates innovative software solutions that utilize big data for driving business performance.

Recent update/s:

On 1 July 2019, the company announced that it had signed a material contract with Indonesian super-app and Google-backed unicorn, GO-JEK for a period of 12 months and an option of extending the contract. The contract fees for 12 months duration is valued at US$210,000.

GO-JEK processes over hundred million transactions on a monthly basis for above 25 million monthly users in 18 service categories. Before entering into the material contact for a period of 12 months, GO-JEK had evaluated TrafficGuard against other anti-fraud offerings. The winning of this contract is seen as a significant endorsement of TrafficGuard product as well as its industry leading technology. At present, TrafficGuard is enabling GO-JEK to protect its advertising campaigns from frauds and thus providing a range of task/time efficiencies along with the clear economic benefits.

Furthermore, for AV1, this contract will improve the annual recurring revenue by 33%. Also, in the past six months, the company has seen a 100% increase in the annual recurring revenue. Apart from that, the company has also earlier announced the signing of LATAM super-app Rappi and TrafficGuardâs PPC product launch. Post which, the company has noticed a sharp increase in the client count joining its trial program. Based on this, the company is optimistic that it would further be winning the additional contracts in the future.

Another update from the company is that Stephen Frank Belben, the Non-Executive Chairman of the company who has an indirect interest in the shares of the company via SF Belben, wherein he is a trustee and beneficiary of the account, has acquired 750,000 unquoted options exercisable at $0.20 with the expiry date of 27/3/2022. Before acquiring 750,000 unquoted options, SF Belben had 500,000 Unlisted options exercisable at $0.45 and expiring on 30 March 2020.

Stock Performance:

AV1 has provided stupendous returns of 252.01 per cent in the past one-year. However, it has provided -7.41 per cent, -16.67 per cent and -7.41 per cent in the past six months, three months and one-month respectively.

By the end of the trading session on 1 July 2019, AV1 was down by 4 per cent and closed at A$ 0.120. AV1 holds a market capitalization of A$ 19.86 million and has approximately 158.9 million outstanding shares.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_09_03_2024_01_03_36_873870.jpg)