The benchmark index S&P/ASX200 closed at 6,593.4 on 8 October 2019, reflecting a rise of 0.45% from its previous close. Below discussed are five stocks with their recent updates.

Silver Lake Resources Limited

Silver Lake Resources Limited (ASX:SLR) is engaged into exploration activities in addition to mine development and operations. The company is also into the sale of gold and gold/copper concentrate in Australia.

A Brief on Substantial Holdings

The company recently made a series of announcements, wherein it discussed about changes in substantial holdings:

- SLR unveiled that Mitsubishi UFJ Financial Group, Inc. ceased to become a substantial holder in the company from 24th September 2019.

- According to another market release of the company, Van Eck Associates Corporation and its associates ceased to be a substantial holder in SLR on 20th September 2019.

High-Grade Mineralisation at Deflector Mine

The company through a release dated 16th September 2019 updated the market regarding the intersection of further high-grade gold and copper mineralisation, outside of the mineral resources and ore reserves at the Deflector mine. The company reported following significant results from the multiple lode intersections with Deflector style mineralisation:

- 1m @ 84.7 g/t gold & 3.0% copper

- 8m @ 53.1 g/t gold & 0.7% copper

- 7m @ 126 g/t gold & 3.0% copper

- 9m @ 75.5 g/t gold & 3.0% copper

- 3m @ 95.7 g/t gold & 7.4% copper

- 3m @ 177 g/t gold & 3.1% copper

- 8m @ 53.1 g/t gold & 0.7% copper

- 3m @ 35.6 g/t gold & 0.6% copper

- 5m @ 51.3 g/t gold & 0.1% copper

- 7m @ 35.3 g/t gold & 0.6% copper

- 9m @ 17.8 g/t gold & 4.6% copper

- 6m @ 15.3 g/t gold & 0.1% copper

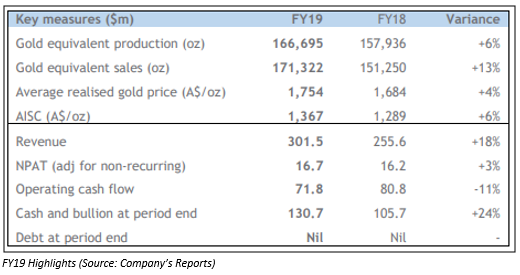

Gold Sales Up 13% in FY19

- In the financial year 2019 ended 30 June 2019, the company acquired Deflector Operation, which was introduced as a second operating asset in a tier 1 jurisdiction to the portfolio.

- SLR reported normalised profit after tax (PAT) of $16.7 million in comparison to $16.2 million in FY18.

- Gold sales went up by 13% to 171,322 ounces gold equivalent

- Cash flow from operations stood at $71.8 million against $80.8 million of FY18.

Stock Performance

The stock of Silver Lake Resources Limited closed the dayâs trading at a price of $0.905 per share, representing a fall of 3.723%, on 8th October 2019. The stock rose by 18.24% in the time frame of six months, while on a year to date basis, the stock produced return of 69.37%.

Jumbo Interactive Limited

Jumbo Interactive Limited (ASX: JIN) is into the business of retailing lottery tickets. The company has its client base in Australia and eligible overseas jurisdictions.

Notice and Agenda of Annual General Meeting

The company through a release announced that it will be conducting its 2019 Annual General Meeting on 24th October 2019 and following resolutions would be considered during the meeting:

- Resolution 1- To consider the remuneration report.

- Resolution 2- Re-election of Mr Bill Lyne as a director.

- Resolution 3- Election of Mr Giovanni Rizzo as a director.

- Resolution 4- Election of Professor Sharon Christensen as a director.

- Resolution 5- Issue of management rights under a new remuneration framework.

- Resolution 6- Issue of rights to a director.

- Resolution 7- Approval to increase directorsâ fees.

- Resolution 8- Proportional takeover approval provisions.

Addition to S&P/ASX 200 Index

As per a release by S&P Dow Jones Indices, wherein some changes to S&P/ASX indices were mentioned, Jumbo Interactive Limited got added to S&P/ASX 200 Index, which came into effect on 23rd September 2019

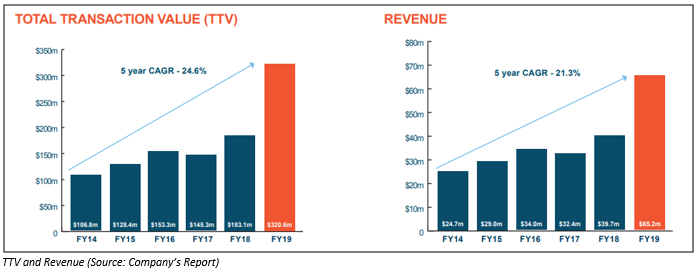

Growth in total transaction value and revenue for the company till FY19:

Stock Performance

The stock of Jumbo Interactive Limited settled at a price of $26.070 per share with a fall of 3.193% on 8th October 2019. The stock rose by 72.36% in the time frame of six months, while on a year to date basis, the stock produced return of 269.69%.

Northern Star Resources Ltd

Northern Star Resources Ltd (ASX:NST) is primarily involved in the exploration, development, mining and processing of gold deposits.

Independent Directors Accept Takeover Offer

- Echo Resources Limited gave an update on 8th October 2019 concerning the unconditional off-market takeover bid by NST for all shares in Echo Resources Limited.

- Echo Resources Limited advised the market that independent directors who held or controlled shares in Echo have accepted the Northern Star offer in line with the takeover bid implementation agreement. It added that those shares in total demonstrates around 1.8% of the total issued shares in Echo Resources.

Change in Interest

- Northern Star Resources Limited and each of its subsidiaries made a change to their substantial holdings in Echo Resources Limited, as a result current voting power stood at 35.87% as compared to the previous voting power of 34.20%.

- The change in substantial holdings became effective on 7th October 2019.

Group EBITDA up 8% in FY19

The company through a release dated 27th August 2019 updated the market with its performance for the year ended 30th June 2019:

- In FY19, the company made a substantial investment in its growth strategy, such as the acquisition of the Pogo gold mine in Alaska for $350 million

- NST witnessed a rise of 8% in group EBITDA and the figure stood at $479.7 million, backed by the outperformance of Australian operations.

Stock Performance

The stock of Northern Star Resources Ltd closed the dayâs trading at a price of $11.580 per share with a fall of 2.03% on 8th October 2019. The stock rose by 32.66% in the time frame of six months, while on a year to date basis, the stock produced return of 27.92%.

Gold Road Resources Limited

Gold Road Resources Limited (ASX: GOR) is involved in the exploration and development of the Gruyere Project in Western Australia (WA).

Updates on Substantial Holdings

- The company recently announced that BlackRock Inc. and subsidiaries made a change to their substantial holding, owing to which the current voting power stands at 8.89% in comparison to the previous voting power of 9.95%.

- In another release by the company, GOR reported that Van Eck Associates Corporation and its associates have become an initial substantial holder with a voting power of 8.65%, as on 20th September 2019.

Half-Year Results

During the interim period ended 30 June 2019, the companyâs exploration team wrapped up its annual exploration targeting process at Yamarna. This formed the basis of its exploration programme worth $20 million for the calendar year 2019.

Cash and cash equivalents at the end of the six months to June 2019 stood at $63.27 million.

Stock Performance

The stock of Gold Road Resources Limited settled at a price of $1.165 per share with a fall of 3.32% on 8th October 2019. The stock rose by 30.98% in the time frame of six months, while on a year to date basis, the stock produced return of 81.20%.

Bravura Solutions Limited

Bravura Solutions Limited (ASX:BVS) is primarily in the development, licensing as well as maintenance of highly specialised administration and management software applications.

Issue of Shares

- On 27th September 2019, the company issued 439,440 fully paid ordinary shares at a consideration of $4.39 per share.

- The shares have been issued in pursuant to its Dividend Reinvestment Plan in respect to the final dividend payable on 27 September 2019.

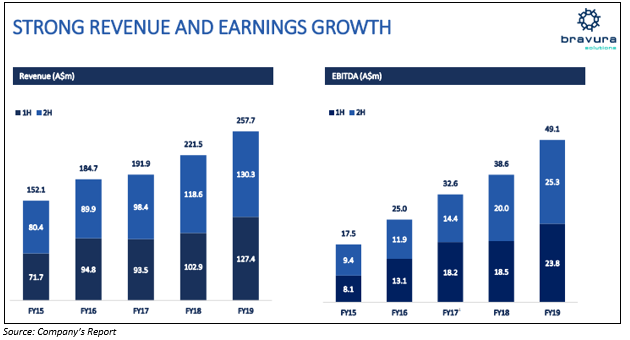

Group Revenue Up 16% in FY19

For the year ended 30th June 2019, the company reported strong FY19 financial results across all key financial metrics:

- The company reported a rise of 16%, 27% and 21% in group revenue, EBITDA and NPAT and the figure stood at $257.7 million, $49.1 million and $32.8 million, respectively.

- BVS added that FY19 results were fuelled by strong growth throughout the Bravura product suite.

Stock Performance

The stock of Bravura Solutions Limited settled at a price of $3.850 per share with a fall of 1.282% on 8th October 2019. The stock witnessed a decline of 25.71% in the time frame of six months, while on a year to date basis, the stock produced return of 2.63%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.