Technology sector forms an important part of economy. Around the world, countries make heavy investments to derive benefits from the economic and social opportunities that a digital economy can bring. Australiaâs tech future depends on how well the country can boost the opportunities of technological changes by focusing on areas like people, services, digital assets, maintaining cyber security and reviewing the regulatory systems.

In this article, we would be discussing four tech stocks whose share price has been active on ASX for the past few trading sessions.

Praemium Limited (ASX: PPS)

Praemium Limited (ASX:PPS) is engaged in offering portfolio administration services. The companyâs market-leading technology is designed in a way that it simplifies, boosts and adds value to clientsâ business along with investment experience.

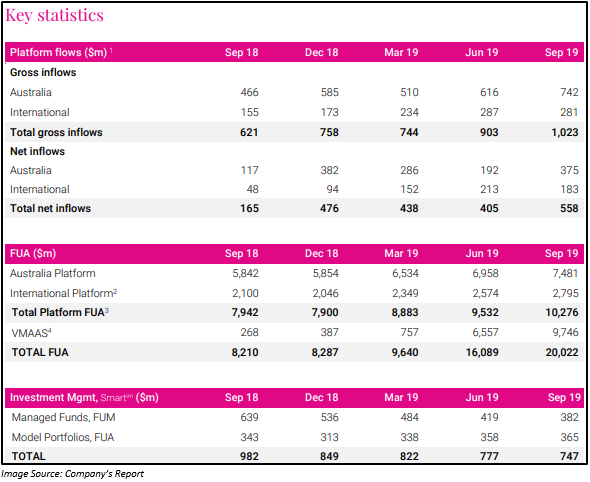

Record Net Inflow of $558 Million in Q1 FY2020

Q1 FY2020 ended 30 September 2019 was a record quarter for the company.

- PPS reported a record quarterly gross inflows of $1.0 billion

- Record quarterly net inflows stood at $558 million

- FUA or funds under administration in Q1 FY2020 surpassed $20 billion for the first time. The FUA amount included $9.7 billion in administration of non-custody assets and $10.3 billion of custodial platform assets.

- Platform FUA grew to $10.3 billion

- Australia platform FUA reported growth of 28% to $7.5 billion as compared to the previous corresponding period (pcp)

- International platform FUA went up by 33% year-on-year to $2.8 billion

- Non-custodial VMA Administration Service (VMAAS) of PPS soared by 49% to $9.7 billion as compared to the last quarter.

- There was growth of 89% in UK SIPPs to 1,247 schemes as compared to the previous year.

- The company also launched a new online Investment Leader video series where leading investment managers discuss topics that could be beneficial to advisers as well as their clients.

Stock Performance:

The stock of PPS on 15 October 2019 (AEST 02:23 PM) was trading at a price of $0.552, up 3.178% from its previous closing price. PPS has a market cap of $218.28 million with approximately 407.99 million outstanding shares. In the last six months and three months, the stock has delivered a return of 27.38% and 20.22%, respectively.

Over the Wire Holdings Limited (ASX: OTW)

Over the Wire Holdings Limited (ASX: OTW) provides telecom and IT solutions. The company specialises in converged voice and data networks, data centres, and hosted infrastructure solutions for business clients.

Achievements:

On 11 October 2019, Over the Wire Holdings Limited joined the list of top companies in Brisbane at the 38th position.

Strong FY2019 Results; Total Revenue Growth of 49%

OTW in FY2019 delivered a strong performance with revenue growth of 49% to $79.6 million.

- EBITDA grew by 64% to $20.1 million on pcp.

- NPATA soared 91% to $13.1 million as compared to FY2018.

- NPAT rose by 83% to $10.1 million on pcp.

- The acquisition of Access Digital Networks and Comlinx was completed during the reported year.

- OTW declared a final dividend of 2 cents per share, bringing the full year dividend to 3.25 cents per share.

- Balance sheet witnessed an increase in net assets from $24.9 million in FY2018 to $65.1 million in FY2019, as a result of a significant increase in total assets.

- Net cash inflow from operating activities increased from $10.3 million in FY2018 to $11.4 million in FY2019.

- Net cash inflow from financing activities went up from $8.3 million in FY2018 to $20.3 million in FY2019

- Net cash outflow due to investing activities increased from $17.1 million to $28.3 million.

- Net available cash at the end of FY2019 stood at $10.3 million.

Business Outlook:

Business performance is well-positioned as per the companyâs strategy. The company continues to generate positive operational cash flow and at the same time, maintains a strong balance sheet. The company is well placed to deliver organic growth and look for more accretive acquisitions. Based on the FY2019 results, the company is expecting to deliver sustainable profit growth for its shareholders.

Stock Performance:

In the last one month, the OTW stock has given a return of 1.06%. The stock has moved up by 2.5% in the last three trading sessions. On 15 October 2019 (AEST 02:29 PM), the stock was trading at a price of $4.750. OTW has a market cap of $245.11 million with ~ 51.6 million outstanding shares, PE ratio of 22.99x and annual dividend yield of 0.68%.

The Citadel Group Limited (ASX: CGL)

ASX listed software and technology company, The Citadel Group Limited (ASX:CGL) is engaged in offering secure enterprise information management.

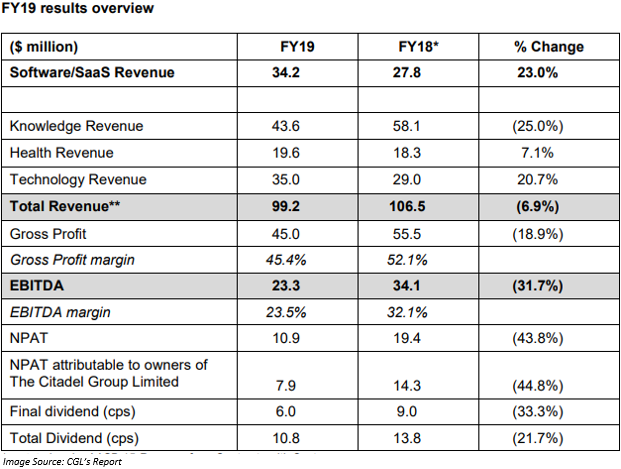

FY2019 Results; Software/SaaS Revenue up 23%:

- In FY2019, the company reported a 23% growth in the Software/SaaS Revenue to $34.2 million, driven by investments made in development as well as the enhancement of software and platform capabilities.

- Revenue from health and technology segments improved by 7.1% to $19.6 million and 20.7% to $35 million, respectively, on the previous corresponding period. However, revenue from knowledge segment declined by 25%. Total revenue registered a drop of 6.9% to $99.2 million.

- Gross profit of the company declined by 18.9% to $45 million.

- EBITDA also went down by 31.7% to $23.3 million and NPAT declined by 43.8% to $10.9 million.

- During the reported year, a decline of 33.33% was also reported in final dividend to 6 cents per share, which impacted the total dividend for FY2019 to 10.8 cents per share, down 21.7% year-on-year.

- The company during the period won contracts across its core verticals of knowledge, health and technology. Thus, positioning the company to achieve long-term growth.

- Cash and cash equivalents available at the end of FY2019 stood at $14.021 million.

Outlook:

The company is dedicated towards keeping people and information safe. CGL continues to make investments targeted towards creating long-term value for its shareholders. The company is expecting that the Citadel 2.0 strategy would enable it to deliver a high percentage of recurring SaaS and software-based services revenue across its diverse client base.

The company believes that investments being made would help The Citadel Group Limited positioning as a leading provider of secure enterprise information management in Australia.

Stock Performance:

The stock of CGL on 15 October 2019 (AEST 03:19 PM) was trading at a price of $3.500, up by $0.010 from its last closing price. The stock has moved up by over 3% in the past two trading sessions. CGL has a market cap of $172.08 million with ~ 49.31 million outstanding shares, PE ratio of 21.81x and annual dividend yield of 3.09%.

Class Limited (ASX: CL1)

Class Limited (ASX:CL1) provides cloud-based self-managed superannuation fund administration software solutions as well as services.

September Quarter Update; Total Account Grew To 181,355.

- In the September quarter ended 30 September 2019 (Q1 FY2020), total accounts stood at 181,355. Almost 1,558 customers are using Class.

- Class Super reported 172,555 accounts, with accounts for Class Portfolio increased to 8,205 accounts and Class Trust to approx. 600 accounts.

- The period also witnessed the launch of Reimagination Strategy, which was supported by the customers, and resulted in 580 registrations at Class Connect conference in September 2019.

Stock Performance:

The stock of CLI on 15 October 2019 (AEST 03:25 PM) was trading flat at a price of $1.480. Yesterday, the stock opened gap up by more than 3.5%. CLI has a market cap of $174.14 million with ~ 117.66 million outstanding shares, PE ratio of 19.32x and annual dividend yield of 3.38%. The one-month return of the stock stands at 2.07%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.