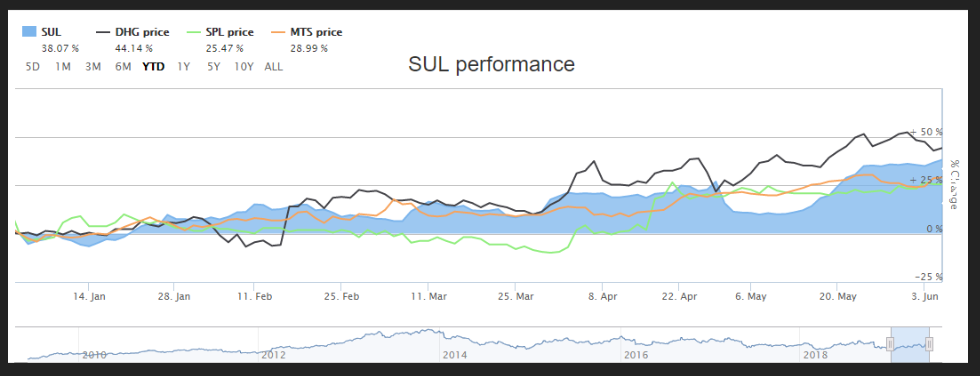

Super Retail Group Limited, Domain Holdings Australia Limited, Metcash Limited and Starpharma Holdings Limited have depicted a similar upward trend in generating a good YTD return. Let us have a view on the recent updates of these players listed on ASX:

Comparative Performance Chart on YTD basis (Source: ASX)

Super Retail Group Limited

Headquartered at Brisbane, Super Retail Group Limited (ASX:SUL) operates in the retail industry, providing auto, sport and outdoor leisure products across Australia and New Zealand. It is amongst Australiaâs largest retailers.

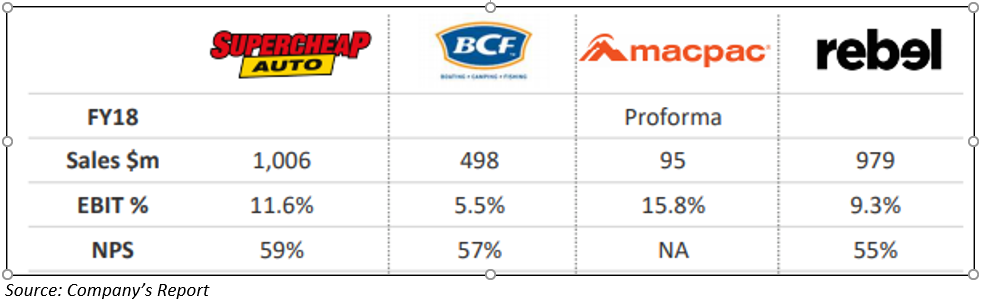

The company has 688 stores operating under its 4 iconic brands, namely, Supercheap Auto, Rebel, BCF and Macpac. At the Macquarie Conference 2019 on 30th April 2019, the company unveiled the financial highlights of these brands as depicted below:

On the operations side, the companyâs proposed Enterprise Agreement (EA) for almost 10,000 retail and clerical team members was approved in November last year. Though the agreement is operational, it is awaiting approval from FWC. The Saturday, Sunday and Late-Night penalty rates were increased and came into effect from 31st March 2019.

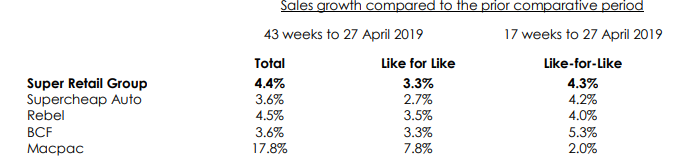

Looking at the trading side, the company provided an update on 30th April 2019. As per the update, its auto and sports businesses are performing as per expectations. Though BCF is undergoing pressure on margins, it has held to its top-line growth.

Trading highlight (Source: Companyâs report)

The market cap of SUL is A$1.88 billion. The 52-week high of its stock is A$10.440 and low is A$6.350. The stock made an intraday low of A$9.050 and closed at A$9.340 (down by 1.89%), as on 7th June 2019. In the last one year, the stock has delivered a return of 12.40%, and the YTD return is 39.39%.

Domain Holdings Australia Limited

Incorporated in 2000, Domain Holdings Australia Limited (ASX:DHG) is a media and technology solutions provider. The company serves the real estate market in Australia.

On 31st May 2019, the company announced that it has signed a binding documentation with TW Australia Holdings 2 Pty Ltd, which is the companyâs JV partner. As per the deal worth $6 million, the company would divest its 50% interest in Compare & Connect, a utilities comparison and connection service. The deal would enable DHG to have a marketing services agreement (guaranteed and referral fees) with Compare & Connect.

Separately, in its presentation at the Macquarie Australia Conference 2019, the company gave a trading update, according to which its digital revenue for the quarter ended March was in line with the year-ago period. The total revenue, however, was down by almost 6% during the reported period.

For FY19, its underlying costs would most likely be down low to a mid-single digit against FY18. However, this would not include the investment in new Consumer Solutions businesses. Total costs would most likely increase.

The market cap of DHG is A$1.85 billion. The 52-week high and low of the stock is A$3.640 and A$2.060, respectively. The stock made an intraday low of A$3.205 and closed at A$3.240 (up by 2.208%), on 7th June 2019. In the last one year, the stock has delivered a return of 1.93%, and the YTD return stands at 42.79%.

Metcash Limited

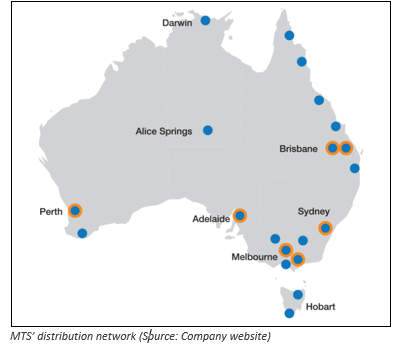

New South Wales-based Metcash Limited (ASX:MTS) is a wholesale distribution and marketing company. With recorded sales of over $14 billion in FY18, the company is a market leader in Australia. The company serves independent retailers, offering marketing, operations and merchandise-based support through its hardware, food and liquor segments.

The company has the widest retail distribution network in Australia.

MTS entered into an agreement with Drakes Supermarkets, according to a company announcement made on 3rd June 2019. As per the deal, the company would supply Drakes Supermarketsâ stores in Queensland for an additional 5 years, after its existing term agreement expired on 2nd June 2019.

In May 2018, the company unveiled that Drakes Supermarkets has decided against its supermarkets being supplied from Metcashâs new DC in South Australia, post the existing contract term expiry on 2 June 2019. Metcashâs new DC is being built in Adelaide.

Moreover, MTS and Drakes Supermarkets have reached a new supply agreement, according to which Metcash will serve Drakes Supermarketsâ Foodland supermarkets located in South Australia till 30th September 2019. The deal could be extended up to 30th September 2020, depending upon Drakes Supermarketsâ options.

According to another update on 30th May 2019, Vinva Investment Management became a substantial holder of the company with 45,522,777 securities and a voting power of 5.01%.

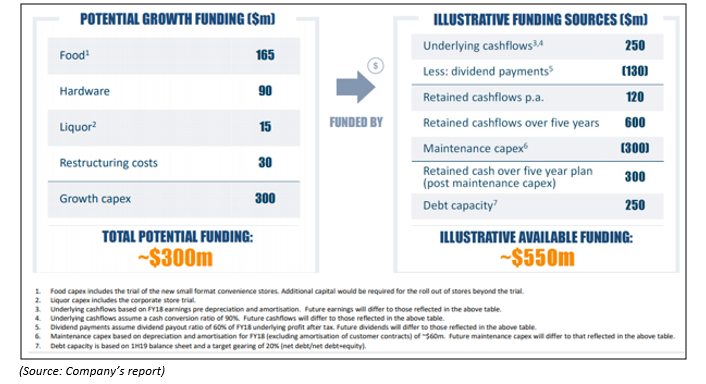

Metcash Limited provided its strategy update on 4th March 2019. As per the release, the company was #2 in the liquor and hardware markets. Moreover, it has positioned itself as an alternative to other major players in the food business and depicted a strong balance sheet. The company plans to focus on a balanced approach to revenue growth and cost out during the next five years.

Below are the segment highlights:

- In the liquor division, MTS capex for growth initiatives is approximately $15 million (inclusive of corporate store trial) over a five-year period. Moreover, share of the IBA retail network in the total ALM business has grown to almost 55%.

- In the hardware segment, the company has received notable synergies with the acquisition of HTH.

- In the food segment, the company expects potential capex of almost $165 million over 5 years. The company is targeting to add nearly 500 stores.

The companyâs sources and application of funds for FY20-FY24 have been provided in the figure given below:

On the trading side, the food sales were slightly higher than the same period a year ago. While liquor sales in 2H19 were strong, aided by increased wholesale customer base. Hardware sales in 2H19 were soft, depicting the slow-down in construction activity in the trade sector.

On 7th June 2019, the stock traded at A$3.070, down by 0.325%. The companyâs market cap is A$2.8 billion. In the last 6 months, it has generated a return of 28.33% while the YTD stands at 29.41%.

Starpharma Holdings Limited

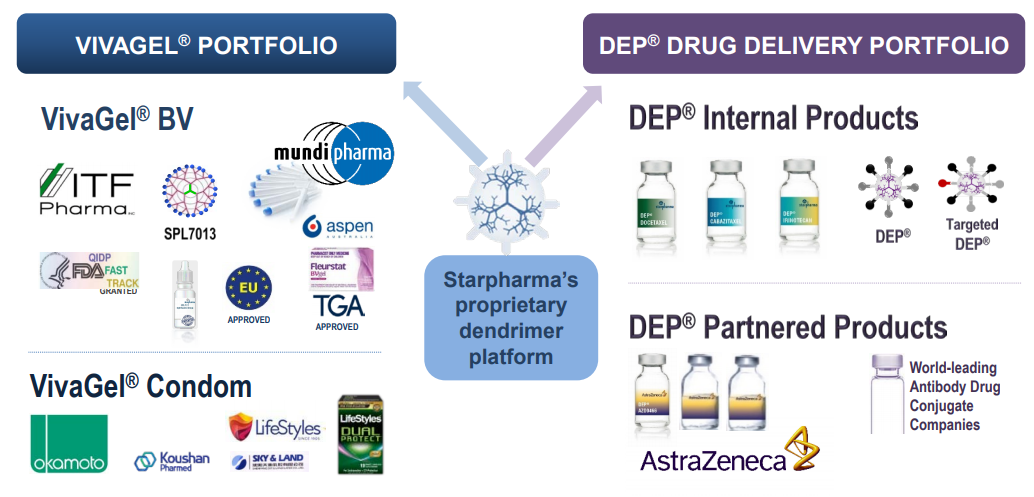

As a global leader, Starpharma Holdings Limited (ASX:SPL) develops dendrimer products for applications including pharma and life sciences. VivaGel® portfolio and DEP® drug delivery are its key development programs.

SPLâs products (Source: Company website)

On 4th June 2019, the company unveiled that the VivaGel® condom has been launched in Japan under the Zero Zero Three brand of Okamoto. In the country, this would be the first condom with antiviral coating.

Okamoto enjoys a dominating position in Japanâs condoms marketing business, accounting for a majority share in the countryâs condom market. Japan is amongst the worldâs largest condom markets, with an estimated value of $500 million per year. The company also has good market positioning in other Asian countries like Taiwan, Korea, China and Singapore.

In another announcement made with ASX on 3rd June 2019, SPL revealed a Development and Option Agreement with AstraZeneca. The deal is aimed at progressing with a DEP® version of an AstraZeneca marketed oncology medication, not disclosed yet. With AstraZeneca, this is the SPLâs 2nd commercial deal.

As per the agreement sealed during Chicagoâs 2019 ASCO meeting, SPL is responsible for performing a preclinical testing of the DEP® variety of the AstraZeneca oncology product, while AstraZeneca has the right to exercise its option and licence the DEP® drug candidate for clinical and commercial development at any point in time. Moreover, USD 5m would be payable to the company as an option exercise fee, in such a case.

However, if AstraZeneca doesnât choose to exercise the option, the company holds the option to license the drug development and commercialisation rights on its own or via a sub-licensee.

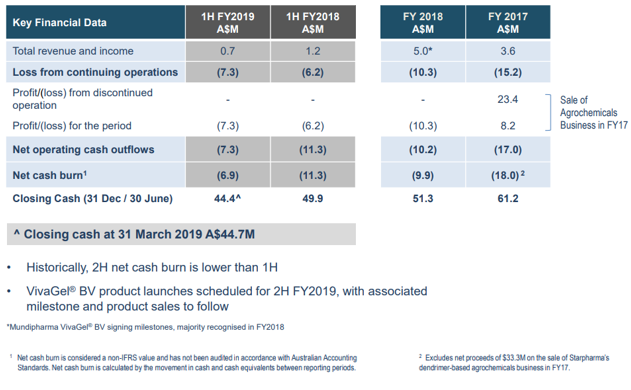

On 29th May 2019, the company made a presentation at the UBS Healthcare Conference. The company revealed that in 1H FY19, its revenue and income was A$0.7 million. The closing cash at the end of the period amounted to A$44.7 million.

Financial position (Source: Company website)

Understanding its product portfolio, the VivaGel® BV is licensed in more than 160 countries and on-market in Australia. The product is scheduled for launch in Europe in May/June 2019. DEP® is a proprietary nanoparticle drug delivery platform.

The company announced on 24th May that DEP® irinotecan has shown significant efficacy and safety benefits than the Erbitux® and Camptosar® in the irinotecan-refractory HT-29 human colon cancer model.

In a meeting held with the US FDA, the company received feedback regarding obtaining approval for the BV treatment and prevention of recurrent BV in the US. Since the companyâs application/NDA entailed two related bacterial vaginosis indications, there were many options to get approval, as per the feedback shared by the agency. The FDA knows the key unmet needs of BV and SPLâs VivaGel® BV capability would aid towards the cause.

The stock traded at A$1.370 on 7th June 2019, down by 0.364% from its previous trade. The companyâs 6-month return has been a negative 10.14%, though the YTD stands better at 25.47%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.