Metcash Limited (ASX:MTS) is a wholesaler and distributor in Australia that deals with many supermarkets and retail groups in China. It also operates cross-border eCommerce stores through key platforms including Alibabaâs Tmall Global and JD Worldwide. The company supplies to retailers from the liquor, food and hardware sectors.

Today on 3 June 2019, Metcash revealed to the market that it had reached an agreement with Drakes Supermarkets to supply its Queensland stores for an additional five years, as the previous supply agreement expired on 2 June 2019.

The above update follows another announcement released by Metcash in May 2018 regarding Drakes Supermarketsâ decision to not engage with its supermarkets in South Australia being supplied from Metcashâs new DC, which is currently being built in Adelaide, beyond the previous contract term.

Besides, Metcash has also signed a new supply agreement with Drakes Supermarkets to continue supplying its Foodland supermarkets in South Australia until 30 September 2019, which may be extended up to 30 September 2020, subject to the option of Drakes Supermarkets.

Recently in March 2019, Metcash released its Strategy Update touching upon all aspects of the companyâs business and future strategy.

Also, in February 2019, eCargo Holdings (ASX:ECG) closed the transformational acquisition of 85 per cent of Metcash Export Services Pty Limited from Metcash Trading Limited (a wholly-owned subsidiary of Metcash Limited). A wholly-owned foreign enterprise based in China, Metcash Asia Limited is a subsidiary of Metcash Export Services Pty Limited.

The consideration for the transaction was valued around AU$ 2.5 million along with 85% of the businessâ net asset value of AU$ 5.8 million. In addition, eCargo also paid a deferred compensation of around AU$ 3.5 million, which was financed from its existing cash reserves and facility.

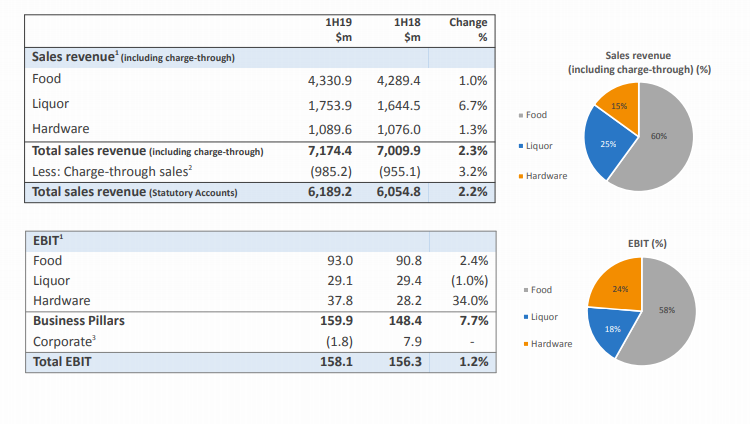

For the first half of financial year 2019 (FY 2019), Metcash reported a 2.2% growth in Group sales to $ 6.2 billion while the Group EBIT increased 1.2% to $ 158.1 million. The underlying profit after tax was up 1.2% to $ 100.3 million and so was the statutory profit after tax that was up 3.0% to $ 95.8 million.

The pillar-wise financial results are as follows:

Results Overview by Pillar, Source: 2019 Half Year Financial Report

Results Overview by Pillar, Source: 2019 Half Year Financial Report

The company also informed that its Working Smarter program is on track to deliver cumulative savings of ~$ 125 million by the end of FY19. The operating cashflows and balance sheet were also strong for the concerned period. The company executed $ 150-million Off-Market Buy-Back in August 2018 and paid out a fully franked interim dividend of 6.5 cents per share.

With a market capitalisation of AU$ 2.68 billion and around 909.26 million outstanding shares, the MTS stock last traded at a price of AU$ 2.960, edging up 0.34% by AU$ 0.010 with ~ 2.09 million shares traded on 3 June 2019.

Recently, Vinva Investment Management and Lazard Asset Management Pacific Co became substantial shareholders in the company upon purchase of ~ 45.52 million (representing 5.01% of voting power) and 49.39 million (representing 5.42% voting power) fully paid ordinary shares respectively. In addition, the Vanguard Group Inc also bought around 45.47 million fully paid ordinary shares reflecting a 5.001% interest in the company.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.