Due to the global transition to clean energy, the electric vehicles demand has increased exponentially in recent times. Lithium-ion batteries are an integral part of electric vehicles due to their energy storage capabilities. Cobalt, Lithium, Graphite are some of the most vital raw materials in the lithium-ion batteries. With the rising popularity for electric vehicles, the demand for these battery minerals has also increased a lot.

The global cobalt market continues to evolve rapidly with the rollout of lithium-ion batteries creating a profound change in cobalt demand. In todayâs environment, the demand for batteries is a far cry from humble beginnings in the late 1990s, namely consumer electronics such as laptops and mobile phones. As per Cobalt Blue Holdings Limited (ASX: COB), a single Electric Vehicle (EV) today contains more cobalt than 1,000 laptops.

Cathode stability remains a priority for the battery makers (avoiding battery overheating), and cobalt cost (as a % of the total battery bill of materials) is relatively smaller for phones, laptops and tablet makers. However, for EV manufacturers, cobalt remains an expensive component of the bill, given the size of the batteries involved.

Letâs take a quick look at some of the cobalt related stocks trading on ASX.

European Cobalt Ltd (ASX:EUC)

Explorer and developer of high-grade cobalt assets, European Cobalt Ltd (ASX: EUC) recently announced multiple significant cobalt-nickel intercepts from underground diamond drilling within the Joremeny Adit, Dobsina Project, Slovakia. The drilling was completed using both hand portable diamond drills and ONRAM1000 and Diamec 251 diamond drill rigs at a spacing of approx. 25m along strike between drill holes.

The drilling has confirmed the presence of both massive and disseminated cobalt-nickel sulphide mineralisation within the region. Further, parallel structure to the main zone with high-grade Co-Ni mineralisation was discovered in the central section of the adit, which has defined over 100m strike length. Modelling is being conducted to define the potential offset position of this mineralisation.

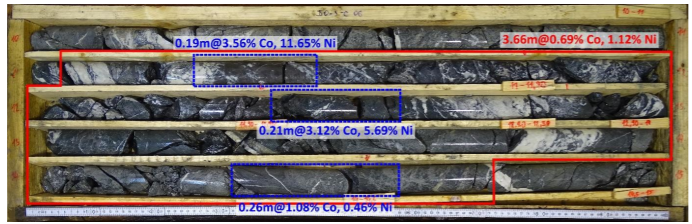

Detail of best intercept within the hole Do-J-C06 Cobalt-Nickel Sulphide Mineralisation (3.66m at 0.69% Co and 1.12% Ni) (Source: Company report)

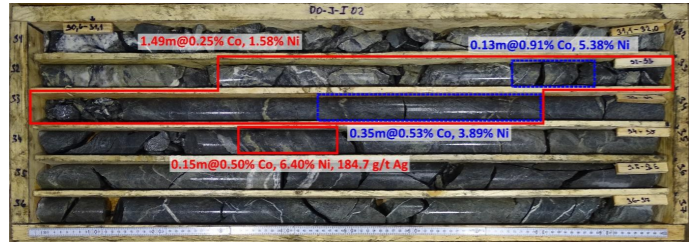

Drill hole Do-J-I02 with two discrete Co-Ni intercepts 1.49m at 0.25% Co and 1.58% Ni, and 0.15m at 0.50% Co, 6.40% Ni and 184.7 g/t Au (Source: Company Reports)

The results obtained from the drilling in conjunction with the geological logging is utilised to refine the exploration targeting model and understanding of the controls of mineralisation.

In terms of further exploration, the company has informed that the geological modelling is being revised based on the results returned to refine the exploration targeting model across the strike length of Joremeny. As per the release, further exploration within the Joremeny Adit will be planned upon completing this targeting review.

The company recently announced that 10,000,000 options exercisable at $0.0624 have expired unexercised.

During the March quarter, the company reported net cash used in operating activities of $1,542k, which includes $1,525k of exploration and evaluation expenses and $110k of administrative and corporate costs. At the end of the March quarter, the company had cash and cash equivalents of $12,653K.

In the past six months, the share price of the company decreased by 52.50% as on 27th June 2019. At the time of writing on 28th June 2019 (AEST 02:00 PM), the companyâs stock was trading at a price of $0.019, with a market capitalisation of circa $14.47 million.

Cobalt Blue Holdings Limited (ASX:COB)

A cobalt exploration/development company, Cobalt Blue Holdings Limited (ASX: COB) has developed a detailed understanding of the battery market and the specifications required to service the same. Ever since the company completed its Pre-Feasibility Study (PFS), it has been advancing the metallurgical program for the Broken Hill (Thackaringa) Cobalt Project. The company has been treating 45t (wet basis) of RC drill chips through a pilot-scale concentrate circuit, recently completed in the month of June 2019.

The company achieved 90% recovery of cobalt to concentrate, confirming Pre-Feasibility Study results at a 50x larger scale. The overall recovery of cobalt was 90% and cobalt grades in the gravity and flotation concentrates were remarkably similar, ranging from 4,444 ppm to 5,075 ppm, confirming that the cobalt content in the host pyrite mineral was consistent across the range of ore grade samples.

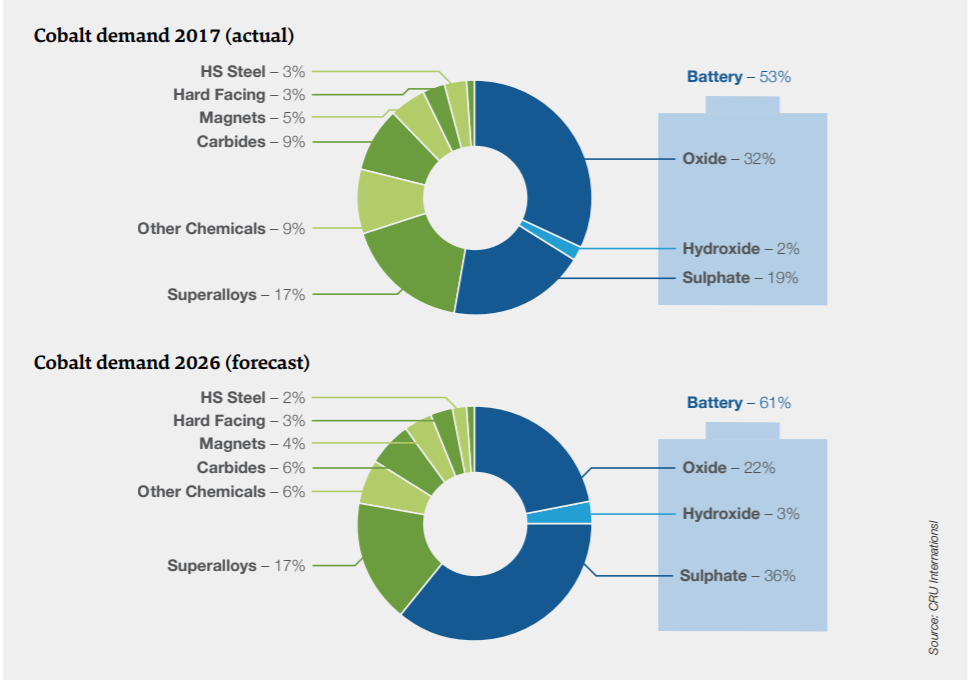

The company believes that cobalt demand growth will average over 9% in the coming decade. A breakdown of the forecasted cobalt demand over the period of 2017 (Actual) and 2026 (Forecast) is depicted in the image below.

Cobalt Demand Data (Source: Company Reports)

In the past six months, the companyâs stock has provided a negative return of 27.66% as on 27th June 2019. At the time of writing on 28th June 2019 (AEST 4 PM), the companyâs stock was trading at a price of $0.130, down 7.143%, with a market capitalisation of circa $20.99 million.

Northern Cobalt Limited (ASX:N27)

A resource company, Northern Cobalt Limited (ASX: N27) recently announced that its â1 for 3 Rights Issueâ at 5 cents per share, with one free attaching option for every 2 shares subscribed closed on 17th June 2019. The maximum number of shares offered under the issue was 20,937,802, resulting in a shortfall of 18,361,402 shares.

The company recently completed an assessment of the potential for iron ore to contribute to the Snettisham Project, which is located on the coast, in close proximity to a deep-water channel, which is capable of hosting Cape class and Panamax vessels. The Snettisham Project is uniquely situated to take advantage of Snettisham Hydroelectric Power Plant.

The company earlier communicated that before the end of June 2019, it will commence a three-hole diamond drilling program, testing the validity of the magnetic model and geophysical exploration target. As per the historic metallurgical test, the Snettisham material has a potential to produce a high grade and quality magnetite concentrate of 66.1% Fe, 2.85% TiO2, 0.66% V2O5 and < 0.01% P.

During the March quarter, net cash used in operating activities amounted to $594k, which includes $441k of exploration and evaluation expenses, $89k of staff costs and $71k of administrative and corporate costs. At the end of the March quarter, the company had cash and cash equivalents of $527k.

On the stock performance front, the companyâs stock has provided a negative return of 55.43% for the six-month period as on 27th June 2019. At the time of writing on 28th June 2019 (AEST 4 PM), the companyâs stock was trading at a price of $0.033, down 5.714%, with a market capitalisation of circa $2.31 million.

New World Cobalt Limited (ASX:NWC)

The Australian exploration and development company, New World Cobalt Limited (ASX: NWC) recently announced the commencement of its maiden field exploration programs at the newly?acquired Tererro Copper?Gold?Zinc VMS Project, located in New Mexico, USA.

This announcement was released to the market after the successful completion of due diligence by the company. Meanwhile, the company agreed to proceed with a 5?year option to acquire the advanced gold?rich Jones Hill VMS deposit. This acquisition is providing new exploration and growth opportunities for the company.

The historical Mineral Resource estimate for the Jones Hill Deposit comprises 5.7Mt @ 1.96 g/t Au, 1.02% Cu, 1.46% Zn, 0.24% Pb and 22.0 g/t Ag.

In order to put things into perspective, the company has already applied for drilling permits, the approvals of which are expected to land in the fourth quarter of 2019. With only one diamond core hole drilled at the Jones Hill Deposit since 1984, and multiple under?explored VMS prospects located along strike from the Jones Hill Deposit, the company has excellent potential to discover the additional mineralisation.

The company intends to take a two?pronged approach to advance the Tererro VMS Project, targeting:

(i) Rapid completion of work programs at the Jones Hill Deposit so that mine development can be advanced as quickly as practicable; and

(ii) Aggressively exploring for the extensions of the Jones Hill Deposit and additional mineralisation at adjacent prospects, as the discovery of any additional mineralisation is likely to enhance the economics of developing a mine operation at the Jones Hill Deposit.

During the March quarter, net cash used in operating activities stood at $778k, which includes $613k of exploration and evaluation expenses and $165k of administrative and corporate costs. At the end of March quarter, the company had cash and cash equivalents of $307k.

On 30th April 2019, the company announced a capital raise of approximately $2.2 million (before costs) via underwritten non?renounceable entitlements issue of 2 fully paid ordinary share for every 5 existing shares to eligible shareholders held at 6th May 2019. This placement was later completed, as announced on 27th May 2019.

On the stock performance front, the companyâs stock has exhibited a negative return of 10.00% for the six months as on 27th June 2019. At the time of writing on 28th June 2019 (AEST 4 PM), the companyâs stock was trading at a price of 0.012, with a market capitalisation of circa $9.27 million.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.