There are different types of battery technologies available in the market. These include-

- Nickel Cadmium Batteries

- Nickel Metal Hydride Batteries

- Lithium Ion Batteries

- Small Sealed Lead Acid Batteries

The advances in battery technology is primarily driven by demands for portable electronics, like laptop computers and mobile phones as well as the global popularisation of electric vehicles (EV). The growth in battery capacity demand and changes in cathode chemistries have important implications on the price for transition metals used in the battery technology - cobalt, nickel and lithium.

Since batteries only form a fraction of the total demand for nickel, the nickel prices are not too susceptible to change in EV-related demand. On the contrary, Cobalt and lithium prices are more prone to the EV battery sector fluctuations.

Australia is incredibly rich in the minerals used to manufacture batteries. Several companies have already started to cash in as the demand for energy storage solutions rises and the preference for electric cars soars amidst global climate change warnings.

Clean TeQ Holdings begins Partnering Process for Sunrise Project

Clean TeQ Holdings Limited (ASX:CLQ), based in Melbourne, is an industrials sector company providing metals recovery and industrial water treatment services through the application of its proprietary Clean-iX? technology.

Clean TeQ wholly-owns the globally significant Sunrise Project, located in New South Wales, Australia, and home to one of the world?s largest cobalt deposits along with the presence of high-grade accumulations of scandium. In addition, Clean TeQ Holdings? subsidiary, Clean TeQ Water (100%- owned) offers advanced wastewater treatment solutions to reduce hardness, nutrient, desalination and zero liquid discharge.

On 4 June 2019, Clean TeQ Holdings confirmed that it had commenced a partnering process for its Sunrise nickel, cobalt and scandium project following numerous inbound enquiries from a range of parties in the electric vehicle supply chain in relation to both project level ownership, long-term offtake and other financing arrangements.

After long preliminary discussions with several potential parties, Clean TeQ has designated Macquarie Capital to manage the partnering procedure for the company to deliberate on divesting around 50 percent of its stake in the Sunrise Battery Materials Complex, in combination with long-term off take.

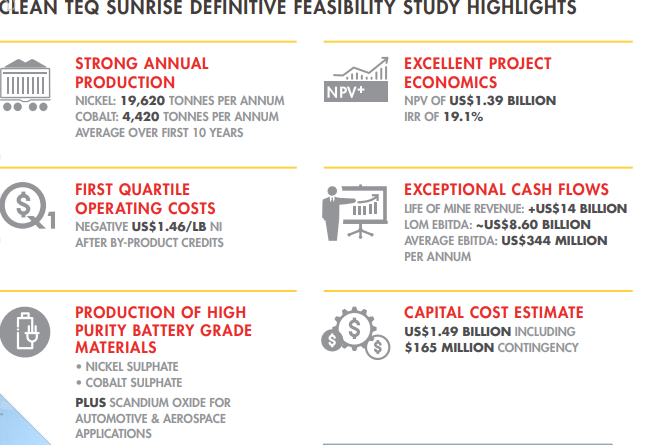

The project?s existing Ore Reserves calculated in accordance with JORC and NI 43-101 support a mine life of over 40 years and a first quartile cost position, with life of mine average C1 cash costs of negative US$ 1.46 / lb Ni (after by-product credits).

Key milestones related to the development-ready Sunrise Battery Materials Complex are as follows:

- Definitive Feasibility Study completed in June 2018 with compelling project economics. An NPV of US$ 1.4 billion and annual average nickel and cobalt production of 19,620 tonnes and 4,420 tonnes over the first 10 years.

Source: Company?s Annual Report 2018

Source: Company?s Annual Report 2018

- Appointment of four leading global banks to progress a project debt facility targeting at least 50% of the total project funding.

- binding 5-year offtake signed with Beijing Easpring for ~ 20% of nickel and cobalt sulphate production.

- An HoA for a fixed price EPC (Engineer-Procure-Construct) contract with Metallurgical Corporation of China.

- Receipt of all key permits and approvals for a 2.5 million tonnes per annum operation.

Many other headways have been achieved for the project. Once in production, Sunrise will be one of leading integrated suppliers of high-purity battery-grade nickel and cobalt, the primary raw materials in the production of cathodes for lithium-ion batteries.

In its Quarterly Activities Report for the three months to March 2019, released on 30 April 2019, Clean TeQ Holdings reported that the construction and commissioning of three commercial-scale ion-exchange metal recovery and water purification plants were approaching completion in Democratic Republic of the Congo, Australia and Oman.

The company also focussed on the fact that the market conditions remain favourable for EV battery materials while nickel was the best performing base metal in the London Metal Exchange during Q1 2019.

With a market cap of AU$ 261.26 million, the CLQ stock price was trading on (5 June 2019, AEST 12:23 PM) at AU$ 0.325, down by 7.143% by AU$ 0.025.

Battery Minerals releases Resource Rising Stars Presentation

West Perth, Australia-based Battery Minerals Limited (ASX:BAT), formerly known as Metals of Africa Limited, is engaged in varied mining development and mineral exploration activities in East Africa. Its primary interest lies in exploring for zinc, graphite, lead and copper deposits.

On 5 June 2019, the company announced the change of interests of the substantial holder, Farjoy Pty Ltd, effective 30 May 2019. Farjoy Pty Ltd now holds 199,133,245 person?s votes with the voting power of 15.1%.

On 4 June 2019, Battery Minerals released its Resource Rising Stars Presentation touching upon various crucial aspects of the business. The company is led by a capable Board and Executive Management team with a track record of project execution.

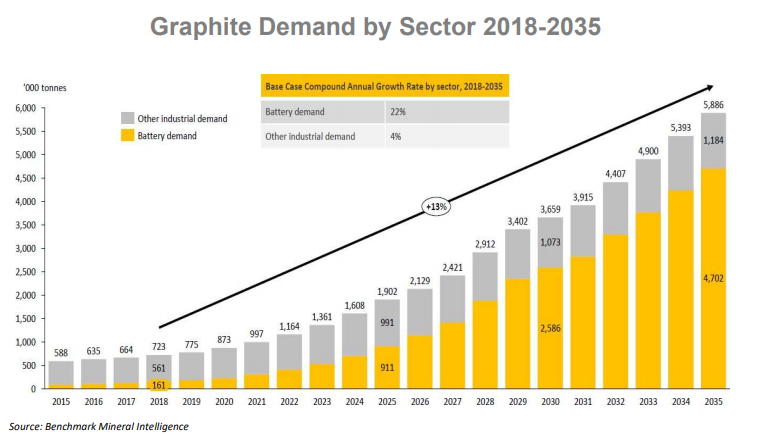

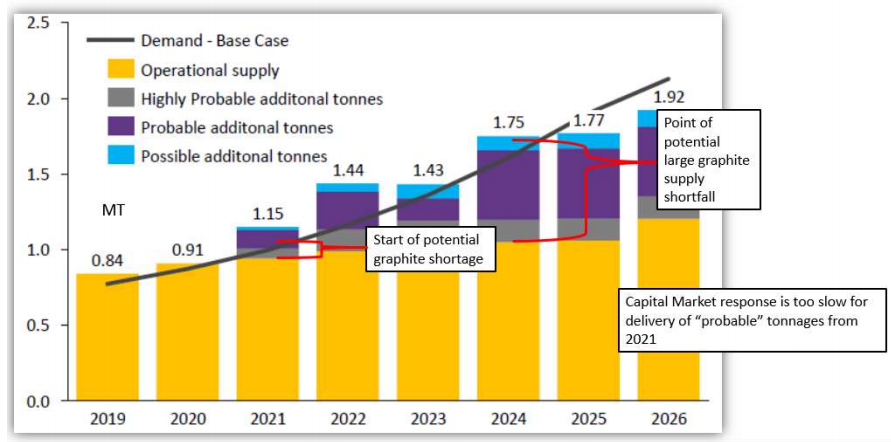

As per the company, it is well positioned to rapidly respond to the clean energy growth with its current exposure to the growing traditional graphite markets, and unprecedented forecast demand from the global transition to clean energy.

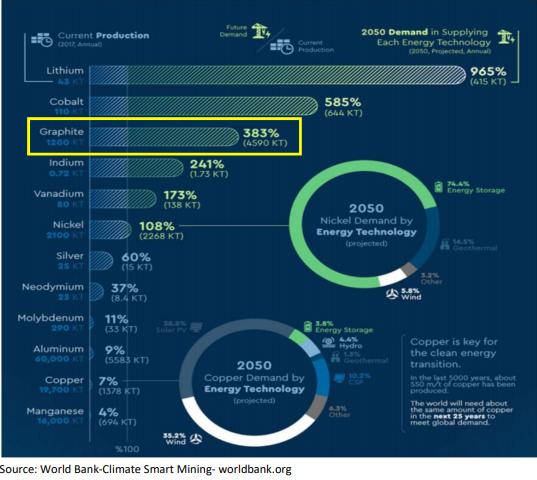

In the presentation, the company has emphasised on the importance of Graphite which is a vital raw material at the backdrop of the world witnessing a climate change and thus, a shift to Clean Energy alternatives.

Energy storage is a key element in the drive to providing Clean Energy and without natural graphite, the cost of Clean Energy storage systems is high. The mineral is used as an anode in the lithium-ion batteries and the largest contributor by weight.

Source: Company?s Presentation

The applications for graphite are not limited to the electric vehicles. It is estimated that in the short-term to 2023, a significant increase in graphite demand is forecast in traditional sectors including refractories, fire retardant materials, friction and lubricants.

Source: Company?s Presentation

Source: Company?s Presentation

The data released by Benchmark Minerals on Graphite Supply & Demand is illustrated as below:

Source: Company?s Presentation

Source: Company?s Presentation

Battery Minerals is currently advancing works at two of its world-class graphite projects:

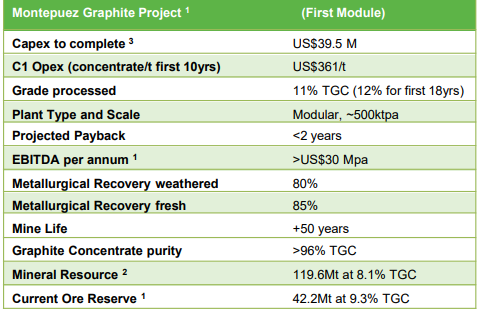

- Montepuez Graphite Project - Phase 1 (Total JORC Resource of 152.5 at 8.5% TGC)

Source: Company?s Presentation

The preliminary works at the site have been completed and a 100 Man Camp has also been arranged. Besides, the company has received approval for 100,000tpa of graphite concentrate allocation at the Pemba Port.

Construction is expected to take around 15 months after the financing is finalised, followed by around six months of commissioning and ramp up. The discussions for technical due diligence have been completed while engagement with potential financiers is underway. With Mining Licence granted, port allocation & offtake agreements in place, no further regulatory impediments are expected in the future.

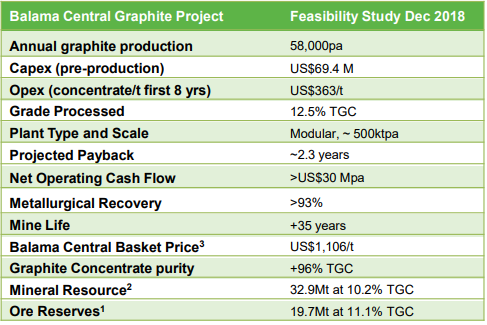

- Balama Central Graphite Project (Total JORC Reserve of 61.9Mt at 10.1% TGC2)

Source: Company?s Presentation

The mining license application for Balama is expected to be submitted in 2019.

Going forth, the company is aiming to explore the Vanadium opportunity at the Montepuez Project.

With a market capitalisation of AU$ 26.36 million and ~ 1.32 billion outstanding shares, the BAT stock was trading at an unchanged price of AU$ 0.020 (as on 5 June 2019, AEST 12: 31 PM).

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.