Small Cap Stocks

Small cap stocks are those stocks which have a market capitalisation in the range of $ 300 million to $ 2 billion. Investing in small cap stocks has certain advantages and disadvantages.

Advantages

Growth Potential: As compared to large companies, businesses with small market cap are considered to have higher growth potential. Thus, an investor who selects good small cap stocks can earn a good profit.

Disadvantages

- Risky: Small cap stocks are risky in nature. Any wrong selection of stocks can result in huge losses. Small cap companies do not have a robust business model. Thus, before picking a small cap stock, an investor needs to keep an eye on whether the management would be able to adjust the business model. In case the management experiences challenges in making right decisions, the company would deliver poor results (operational as well as financial).

- Low Liquidity: Small cap stocks have low liquidity when compared with large cap stocks. Owing to low liquidity, there is a non-availability of stocks at a good price. These stocks are also difficult to sell.

- Time Taking process: Selecting the best small cap stock is a time taking process, as it involves a lot of research.

In this article, we would discuss three small cap stocks operating in the IT sector that have delivered decent year-to-date return to investors. Let us have a look at the company, its business and recent updates.

Nearmap Ltd

Company Overview

Nearmap Ltd (ASX: NEA) is an IT sector player, which provides geospatial map technology for its business, enterprise as well as government clients.

Products

-

Nearmap Vertical: It provides commercial businesses as well as municipal governments with quick access to current, high-resolution aerial imagery of urban regions in the United States. The images obtained through Nearmap Vertical are much clearer and more detailed than the images obtained via free satellite.

-

Nearmap Oblique: The product offers access to high-resolution aerial views of urban regions. It precisely measures units or features, all in three dimensions.

-

Nearmap 3D: Through this product, the company offers engineering-ready 3D location content. Clients get rapid delivery, owing to regular capture and automated 3D processing pipeline.

Recent Updates

The company recently made two important announcements. The first was related to the appointment of a non-executive director and second was the release of FY2019 results.

-

Appointment of non-executive director: On 27 August 2019, NEA announced the appointment of Tracey Horton AO as a non-executive director, effective from 01 September 2019. She has been appointed as a member of the companyâs Nomination and Remuneration Committee and Audit and Risk Management Committee.

-

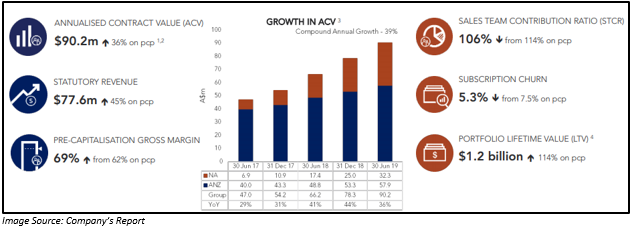

FY2019 Results: The company reported strong performance across all key metrics. The annualised contract value increased by 36% to $ 90.2 million, while statutory revenue grew by 45% to $ 77.6 million as compared to the previous corresponding period. The pre-capitalisation gross margin increased from 62% in FY2018 to 69% in FY2019.

- Net loss in FY2019 was $ 14.93 million.

- Balance sheet of the company remained strong in FY2019 with no debt.

- Cash and cash equivalents at the end of FY2019 stood at $ 75.91 million.

Stock Performance

The shares of Nearmap Ltd have given a decent YTD return of 64.71%. The stock of NEA opened at a price of $ 2.580 and was trading at a price of $ 2.630 on 17 September 2019 (AEST 12:13 PM), up by 2.734% as compared to its previous close. NEA has a market cap of $ 1.15 billion and approximately 449.96 million outstanding shares.

Codan Limited

Company Overview

Codan Limited (ASX: CDA) is another IT sector player that was listed on the ASX in 2003. The company is engaged in the business of designing, manufacturing and marketing a range of high value-added electronics products. CDA caters to clients in the global government, business, aid and humanitarian, as well as sophisticated consumer markets.

The core product of Codan Limited includes metal detectors, radio communications and mining technology. The company is scheduled to hold its annual general meeting on 30 October 2019.

Recent Updates

Quarterly Rebalance of S&P/ASX Indices: On 6 September 2019, S&P Dow Jones Indices updated the market with its September 2019 Quarterly Rebalance. The company, Codan Limited, has been added to S&P/ASX 300 Index, effective at the open on 23 September 2019.

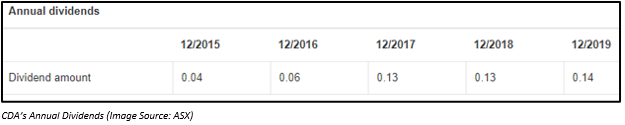

Investor Presentation: On 3 September 2019, CDA released its investor presentation, under which the company highlighted its FY2019 results along with its strategy. The company made record sales of $ 271 million in FY2019. Codan also reported a record statutory NPAT of $ 45.7 million. Additionally, the company unveiled a fully franked annual dividend of 9 cents per share, including an interim dividend of 4 cents per share and a final dividend of 5 cents per share.

The companyâs strategy is to diversify revenues and grow the base business.

FY2020 Outlook

- The company in FY2020 expects sales to be in the range of $ 200 million to $ 220 million and NPAT to be in between $2 8 million and $ 33 million.

- The company believes that it has the potential to surpass base business sales and profit in FY2020.

Stock Performance

The shares of Codan Limited have given a decent YTD return of 74.61%. The stock of CDA opened at a price of $ 4.950 and was trading at $ 4.945 on 17 September 2019, up 0.713% as compared to its previous close. CDA has a market cap of $ 883.77 million with approximately 179.99 million outstanding shares, annual dividend yield of 1.83% and PE ratio of 19.25x.

Infomedia Ltd

Company Overview

Infomedia Ltd (ASX: IFM), established in 1987, ranks amongst the largest providers of SaaS solutions to the parts and service segment of the automotive industry. Its products are being used by more than 170,000 users.

Recent Updates

Dividend Distribution Update

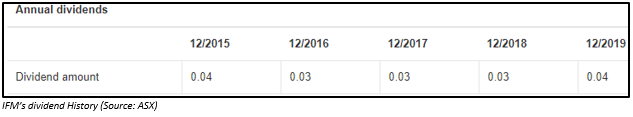

On 11 September 2019, the company gave an update related to a dividend distribution of 2.15 cents per ordinary fully paid share (unfranked). The update was intended towards confirming its dividend reinvestment plan issue price. The dividend related to a period of twelve months ended 30 June 2019 is scheduled for payment on 25 September 2019.

FY2019 Results

The company in FY2019 ended 30 June 2019 reported a 16% increase in group revenue from ordinary activities to $ 84.59 million as compared to its previous corresponding period (pcp). Its EBITDA increased by 31% to $ 38.041 million, while cash EBITDA went up by 82% to $ 19.111 million. Net profit after tax or the period grew by 25% year-on-year to $ 16.122 million. IFM unveiled a full year dividend of 3.90 cents per share.

Stock Performance

The shares of Infomedia Ltd have given a decent YTD return of 81.90%. The stock of IFM opened at a price of $ 1.985 and was trading at $ 2.020 on 17 September 2019 (AEST 12:44 PM), up 0.498% from its previous close. IFM has a market cap of $ 639.13 million with approximately 317.97 million outstanding shares, annual dividend yield of 1.07% and PE ratio of 38.73x.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.