Success of the renewable energy sector in Australia has accelerated, considering the rapid installation of solar and wind energy power stations in 2018. During the year, the sector saw massive attraction from international investors by bringing in advancements through innovation and new technology.

Let us now have a detailed look at three stocks in the renewable energy space.

Infigen Energy

Infigen Energy (ASX: IFN) generates and sources renewable energy through its wind and solar projects.

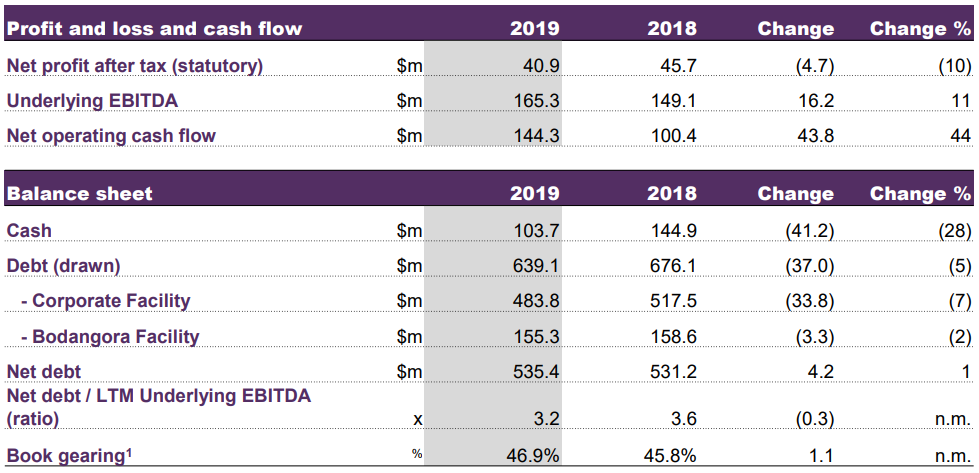

Financial Performance: During the year ended 30 June 2019, the company reported underlying EBITDA amounting to $165.3 million, up 11% on prior corresponding year. Net revenue for the period stood at $229.3 million, up 9% on prior corresponding year. Net profit after tax was reported at $40.9 million, decreasing 10% in comparison to FY18. Net operating cash flow for the year was reported at $144.3 million, up 44% in comparison to prior corresponding year.

Financial Metrics (Source: Company Presentation)

Strategic Achievements: During the year, the company added 113MW of new owned capacity in New South Wales with the completion of the Bodangora Wind Farm. Moreover, 31MW of contracted renewable capacity was added in Victoria for a five-year period, as the company sourced first renewable energy volumes from Kiata Wind Farm under its Capital Lite strategy. The period saw continued deleveraging by the company with Net Debt to EBITDA multiple of 3.2x, as compared to 3.6x in the previous year. During the year, the company sold 67% of the renewable energy generation under contracts.

During the year, the company sold 1,775GWh of its renewable energy generation, representing an increase of 20% when compared with the same period a year ago, driven by Bodangora WF, Kiata WF and Smithfiled OCGT. Commercial and industrial (C&I) customer electricity volumes witnessed an increase of 19% at 768GWh, reflecting continued success of contracting strategy. During the year, the company also made significant investments in C&I customer service systems and capabilities. PPA volumes for the year were 20% higher than the previous year, owing to the Bodangara WF PPA that came into effect from March 2019. Higher Renewable Energy Generation increased the merchant volumes sold during the year by 6%.

Dividend: The company declared dividend amounting to 1 cent per security for the half year ended 30 June 2019.

Outlook: In FY20, the company expects renewable energy generation to be higher in comparison to FY19, reflecting full year contributions from Kiata Wind Farm and Bodangora Wind Farm. The company expects to sell 1.9TWh of renewable energy generation in FY20, out of which 45% is expected to be sold to C&I customers and 30% via PPA. Merchant revenue for the year is expected to be slightly higher than FY19. Asset operating costs and business operating costs for FY20 are expected to be higher than FY19.

Stock Performance: The stock of the company has generated returns of 8.16% and 23.26% over a period of 1 month and 3 months, respectively. The stock closed the dayâs trading at a market price of $0.570 on 23 August 2019, up 7.547% from its previous closing price, with a market cap of $506.98 million and approximately 956.56 million outstanding shares.

Origin Energy Limited

Origin Energy Limited (ASX: ORG) is an operator of energy businesses including exploration and production of natural gas, in addition to electricity generation. By 2020, the company intends to source one fourth of energy from renewables for its clients.

Dividend Distribution: The company recently updated that it would be paying a dividend amounting to AUD 0.150 per fully paid ordinary share. The shareholders would receive the dividend on 27 September 2019.

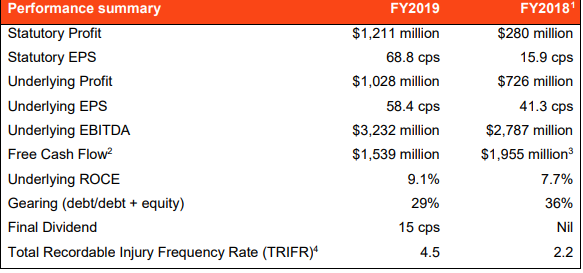

FY19 Results: During the year ended 30 June 2019, the company reported statutory profit amounting to $1,211 million, as compared to a FY18 profit of $280 million. Underlying profit for the period was reported at $1,028 million, as compared to $726 million in prior corresponding year. Underlying EBITDA for FY19 was reported at $3,232 million, in comparison to $2,787 million in prior corresponding period.

Source: Companyâs Report

The period was marked by strong earnings, as a result of stable production at Australia Pacific LNG, higher effective oil prices and cost efficiencies. Net cash flow to the company from Australia Pacific LNG was reported at $943 million. The period saw reduced earnings in electricity due to relief measures provided to the customers, lower average customer numbers and heightened retail competition.

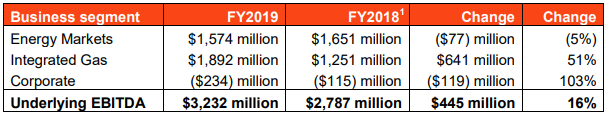

Operational Performance: Underlying EBITDA for Energy Markets was reported at $1,574 million, down 5% in comparison to $1,651 million in prior corresponding year. Despite reduced earnings, the business witnessed improvements in working capital that led to an increase in operating cash flow. Integrated Gas revenue went up by 51%, from $1,251 million in FY18 to $1,892 million in FY19.

Segment EBITDA (Source: Company Reports)

Outlook: ORG expects FY20 underlying EBITDA for energy markets to be in the range of $1,350 million and $1,450 million. Due to the impact of government default market offers worth $100 million, lower customer usage and lower green scheme prices flowing through to business customer tariffs, gross profit for electricity is expected to witness a reduction. Gross profit of the companyâs natural gas portfolio is likely to remain relatively stable. Meanwhile, during the financial year 2020, cost to serve retail as well as business customers would be in the range of $40 million and $50 million. Production of Australia Pacific LNG is expected to be between 680 petajoules and 700 petajoules, that will also help reduce the debt balance during the year. Corporate costs during the year are expected to be in the range of $70 million - $80 million. Excluding Australia Pacific LNG, the companyâs capital expenditure and investments for FY20 are expected to be in the range of $530 million - $580 million.

Stock Performance: ORG stock has generated negative returns of 2.77% and 6.23% over a period of 1 month and 3 months, respectively. The stock of the company closed trading at a market price of $7.330 on 23 August 2019, down 0.543% from its previous closing price with a market cap of $12.98 billion and approximately 1.76 billion outstanding shares.

Genex Power Limited

Genex Power Limited (ASX: GNX) is primarily engaged in the development of the Kidston Renewable Energy Hub in Far North Queensland, Australia.

Shareholding Update: The company recently updated that the voting power of Asia Ecoenergy Development Limited was reduced to 8.878%, from 11.011% earlier. As per another announcement, the voting power of Danawa (Inv) Pty Ltd, another shareholder of the company, reduced from 9.906% to 7.092%. Voting power of KFT Capital Pty Limited was also reduced to 5.212% from 7.258% earlier.

Share Purchase Plan: The company notified that the Share Purchase Plan closed after receiving applications worth $5.3 million.

Funding Update: The company recently updated that its Kidston Stage 2 Pumped Storage Hydro Project has been offered a financing opportunity for up to $610 million from the Northern Australia Infrastructure Facility Board.

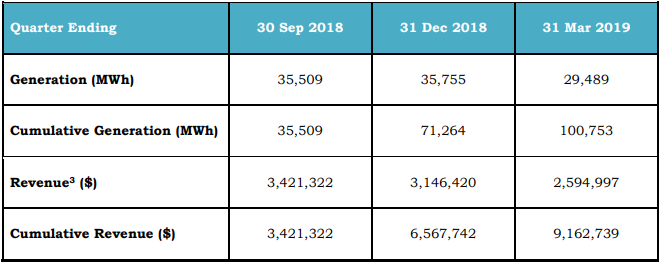

March Quarter Revenue Update: During the 3 months ended 31 March 2019, the company generated 29,489 MWh of energy from the 50MW Kidston Solar Project, as compared to 35,755 MWh in the December quarter. Cumulative energy generation as at 31 March 2019 was reported at 100,753 MWh. Revenue during the quarter was reported at $2.59 million, as compared to $3.15 million in the December quarter. Cumulative revenue for the period ended 31 March 2019 stood at $9.16 million.

KS1 Revenues (Source: Company Reports)

Stock Performance: The stock of the company has generated negative returns of 17.65% and 16.00% over a period of 1 month and 3 months, respectively. The stock closed the dayâs trading at a market price of $0.200 on 23 August 2019, down 4.762% from its previous closing price with a market cap of $84.39 million and approximately 401.84 million outstanding shares.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.