Its that time of the year again when companies are actively releasing their updates for the last quarter of the financial year 2019. Letâs look at how the following five resources sector players faired as the fiscal year came to close.

Helios Energy Ltd

West Perth, Australia-based Helios Energy Ltd (ASX: HE8) provides oil and gas exploration services in the United States and Australia. The company has a market capitalisation of around AUD 254.43 million with ~ AUD 1.5 billion shares outstanding. On 1 August 2019, HE8 stock was trading flat at AUD 0.170 (as at AEST: 11:29 AM).

In addition, HE8 has generated positive return yields of 21.43% YTD and 36.00% in the last six months.

Recently, Helios Energy disclosed its activities for the quarter ended 30 June 2019 (Q4 FY2019).

Q4 FY19 Update- The company completed the 1,400ft horizontal section of the Presidio 141#2 well situated in Presidio County, Texas, United States of America. During the quarter, Helios also undertook the design of a multi-stage hydraulic fracture stimulation plan for the 1,400 feet horizontal portion of the Presidio 141#2 well, for which fracking is scheduled to commence in early August 2019.

There were cash outflows of ~ AUD 5.02 million from operating activities, AUD 465K from investing activities and the cash and cash equivalents as at quarter -end stood at AUD 8.39 million.

Hipo Resources Limited

Hipo Resources Limited (ASX: HIP), based in West Perth, Australia offers mineral exploration services such as mining and exporting operation of metals to customers in Australia. The company has a market capitalisation of around AUD 3.48 million with approximately 386.51 million shares outstanding. On 1 August 2019, HIP stock was trading at AUD 0.010, zooming up 11.11% by AUD 0.001 with ~ 40k shares traded (as at AEST: 11:29 AM).

On 31 July 2019, the company released its Quarterly Activities Report for Period Ended 30 June 2019 providing updates on three key areas discussed below.

Kamola Lithium Project â The detailed mapping and sampling program at Kamola was completed by Minex Consulting SARL. Positive assays received from grab samples at PE 13081, including 1.42% Li2O at Kirkoff and 0.919% Li2O at Kabimbi. The assays strong demonstrate lithium mineralisation for principle targets.

Next-Battery â During the quarter, the Company provided an update of its 25% interest in Next-Battery, a lithium-ion battery technology company, currently testing a novel Li-ion cathode, a polyaniline infused graphene-based nanocomposite, by making a prototype cell, with proposed testing at Warwick Manufacturing Group in the UK. This cathode would use no cobalt or nickel, thus reducing production cost.

Besides, Next Battery is also undertaking a strategic funding round to continue development of its commercial prototypes and to significantly advance existing relationships and further discussions development potential with more automotive, recreational and commercial power boats and energy storage companies currently engaged with Next Battery.

A site visit was also completed by AMVâs technical team to further assess Busumbu Phosphate Projectâs compelling geology and project development options.

Energy Resources Of Australia Limited

Energy Resources Of Australia Limited (ASX: ERA) is engaged in mining, processing and sale of uranium oxide from the Ranger mine in the Northern Territory. The company has a market capitalisation of around AUD 119.08 million with approximately 517.73 million shares outstanding. On 1 August 2019, ERA stock was trading at AUD 0.227, down by 1.304%, with around 1,032 shares traded (as at AEST: 11:34 AM). In addition, ERA has generated a positive return of 15% in the last one month.

Half year Result 2019 - The company released its Half Year Results for the period ended 30 June 2019, positing the revenue from sales of uranium oxide at $ 170.15 million, up 6% on $ 160.19 million in the prior corresponding period (pcp) and the revenue from ordinary activities was around $ 190.48 million, climbing up 12% on pcp. The Net Profit for the period attributable to members improved by a stellar 163% to $ 49.27 million as compared to the loss of $ 78,322 in the pcp.

Besides, Energy Resources Of Australia generated positive cash flow from operating activities of $36 million for the period as a result of higher sales receipts and lower payments to suppliers in aggregate, offset by increased expenditure on rehabilitation activities.

Energy Resources Of Australia had a total cash at bank of $ 349 million at 30 June 2019 relative to $ 313 million on 31 December 2018. In addition, the company had ~$ 76 million of cash held by the Commonwealth Government under the Ranger Rehabilitation Trust Fund, resulting in total cash resources of $ 425 million.

Infigen Energy Limited

Infigen Energy (ASX:IFN) generates renewable energy and also sources from third party under its âCapital Liteâ strategy , increases the value of intermittent renewables and offers competitively priced energy solutions to clients, thus leading the clean energy transition. . It owns wind farms in New South Wales, South Australia and Western Australia.

The companyâs market cap to date stands at around AUD 454.37 million with approximately 956.56 million shares outstanding. On 1 August 2019, IFN stock was trading at AUD 0.475, up 1.053% with ~ 183,782 shares traded (as at AEST: 11:34 AM). In addition, IFN has delivered positive return yields of 7.95% YTD and 5.56% in the last six months.

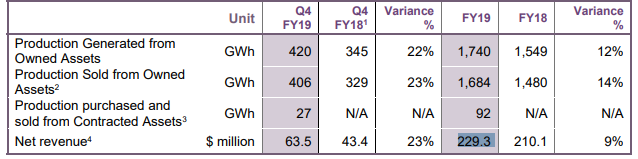

Q4 FY19 Production & Revenue â For the fourth quarter ended 30 June 2019, Infigen Energy reported its unaudited figures with a net revenue of $ 63.5 million, up 23% on $ 43.4 million in Q4 FY18. As a result, the total revenue for FY19 amounted to $ 229.3 million, improving by 9% on pcp.

Also, Infigen recognised a compensated revenue of $ 10.1 million, primarily relating to liquidated damages for construction delays at Bodangora Wind Farm. The audited full year FY19 results are scheduled to be released on Thursday 22 August 2019.

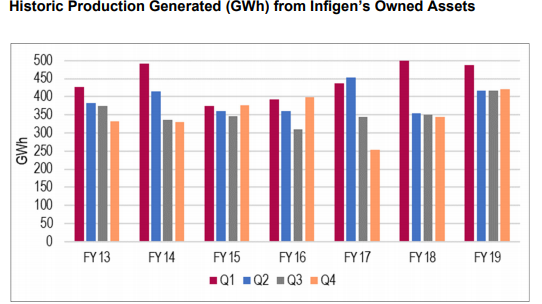

The historic production generated from the companyâs owned assets is illustrated in the bar graph below for the last seven years.

June 2019 Monthly Production - During June 2019, Production Sold from the Smithfield OCGT, was 3GWh. Smithfield is a gas peaking facility where capacity utilisation is expected to be in the range of 2-8%. Also, as previously stated by the company in May 2019 in the âSmithfield OCGT Acquisition and Capital Management Updateâ, Smithfield complements Infigenâs renewable energy portfolio and its economic contribution to Infigen is not directly related to production.

Galilee Energy Limited

Galilee Energy Limited (ASX: GLL) is striving to be a mid-tier exploration and production company as it continues to build on its key competencies of coal seam gas appraisal and development, specifically focussing on activities in the Galilee Basin of Queensland. The companyâs market cap stands at around AUD 236.96 million with ~ 225.68 million shares traded. On 1 August 2019, GLL stock was trading at AUD 1.135, down by 0.873% by AUD 0.010 with ~624,796 shares traded (as at AEST: 11:39 AM).

In addition, the GLL stock has generated positive and high return yields of 84.68% in the last three months and 97.41% YTD.

Glenaras Gas Project Operations Update- Galilee Energy provided an update on its wholly-owned and operated Glenaras Multi-Lateral Pilot Programme in the Galilee Basin ATP 2019. Over the past two weeks, the surface facilities and lease flowlines were fully installed and all the five lateral Glenaras wells underwent initial flow production tests as part of the ESP commissioning process and the wells have now been brought online for continuous production.

The strong initial productivity observed in each of the wells during this testing phase combined with clear pressure responses in each of the wells, confirmed the excellent productivity and connectivity of the targeted R3 coal seam. This augurs well for achieving the Pilotâs intended objective of accelerating the depressurisation process and achieving commercial gas flow rates. The total programme was executed safely and within the budget of $ 8 million.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.