Why Renewable Energy?

With the International Energy Agency (IEA) anticipating a rise in world electricity demand by 70 per cent by 2040, the requirement for clean and inexhaustible sources of energy has arisen. The renewable energies neither produce greenhouse gases nor polluting emissions. Such energies are created using renewable sources like hydro, wind, solar, landfill gas, etc.

Renewable Energy in Australia

Australia is continuously making efforts to assess and increase the use of renewable energy in the generation of electricity, in the form of thermal energy and fuel in transport. Australia's Renewable Energy Association, Clean Energy Council is committed to transforming Australiaâs energy system to one that is cleaner and smarter.

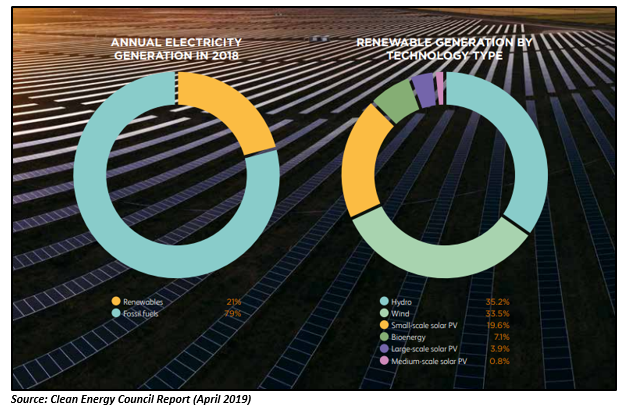

The Clean Energy Council recently released a report âClean Energy Australia Report 2019â which mentioned that 2018 was a remarkable year for the Australian clean energy industry. The investment in large-scale renewable energy projects increased from $10 billion in 2017 to $20 billion in 2018. The electricity generated by the renewables reached its highest level in 2018 by rising to 21 per cent of total power generation. It was reported that more than 10 million Australian homes are now powered by clean energy. By December, around 2 million households had hosted rooftop solar. The Clean Energy Council has anticipated the large-scale Renewable Energy Target of 33,000-gigawatt hours (GWh) by 2020.

According to few energy analysts, Australia is on track to achieve 50 per cent of renewable electricity by 2030. The analysts expect Australia to drive about 13GW of new renewable energy capacity by 2030 and 6GW of renewable capacity by the end of 2020.

Let us have a look at some of the renewable energy stocks trading on the Australian Stock Exchange (ASX):

New Energy Solar : Established in November 2015, New Energy Solar (ASX: NEW) is engaged in acquiring large-scale solar power plants with long-term contracted power purchase agreements. The company invests in a diversified portfolio of solar assets worldwide, supporting investorsâ benefit from the global shift to renewable energy. The companyâs strategy of acquiring solar power plants generates significant positive environmental impacts for investors.

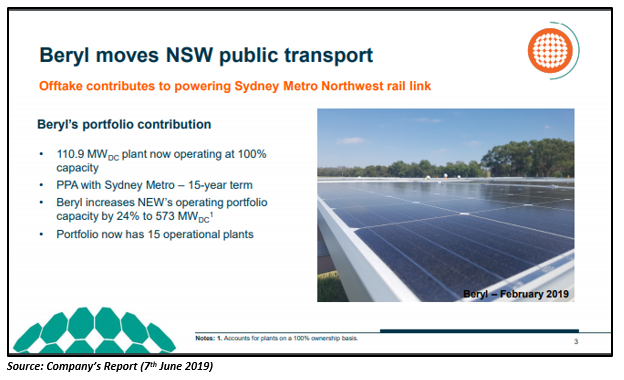

Operational Performance: On 7th June 2019, the company informed that its Beryl Solar Plant located in New South Wales, Australia, has commenced its commercial operations. The plant is selling electricity under its 15-year term power purchase agreement with Sydney Metro. The operational capacity of the New Energy Solar portfolio has improved by 24 per cent with the addition of Berylâs output.

On 29th May 2019, the Responsible Entity for the New Energy Solar Fund, Walsh & Company Investments Limited and New Energy Solar announced a distribution of 3.90 cents per stapled security for the six-month period ended 30th June 2019. The declared distribution has the record date of 28th June 2019 and the payment date of 15th August 2019.

Quarterly Performance: The company announced March 2019 quarter updates on 1st May 2019. The highlights of the quarter report included:

- Organ Church Solar Power Plant in North Carolina reached Commercial Operation.

- Beryl Solar Power Plant changed its module supplier, leading to an increase in the plantâs capacity and expected generation, project value and cash yield.

- Construction of Beryl and the Mount Signal 2 Solar Power Plant underway for completion during 2019.

- NEWâs 14 operational solar power plants generated approximately 152,000 MWh of electricity in March quarter.

Stock Performance: The companyâs stock is trading lower today on the ASX today at AUD 1.185, down by 5.95 per cent (As at 1:29 PM AEST, 11 June 2019) with a market capitalization of AUD 439.83 million.

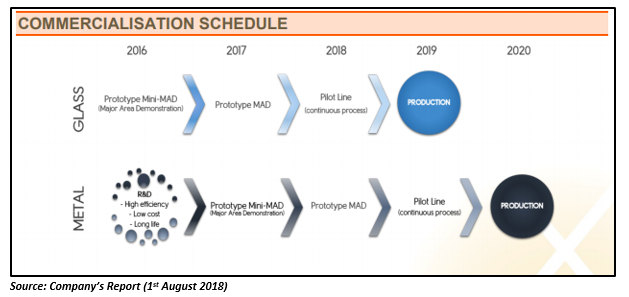

Greatcell Solar Limited : A global leader in the development and commercialisation of Perovskite Solar Cell (PSC) technology, Greatcell Solar Limited (ASX:GSL) was listed on the Australian Stock Exchange on 31st August 2005. The company focuses on the successful commercialisation of PSC photovoltaics and is engaged in the manufacturing and supply of high-performance materials.

Operational Performance: On 11th December 2018, the company declared the appointment of administrators due to its unsuccessful attempts to secure re-financing for its activities. The companyâs decision was backed by some unfortunate incidents including the untimely death of its Chief Scientist.

In November 2018, the company announced significant progress to its financial position. Greatcell informed about the payment of $425,000 to be received by the company under the funding agreement reached with the Australian Renewable Energy Agency (ARENA).

The company achieved strong technical results in 4QFY18 and established a number of new relationships in Australia and Europe during the period. Its Technical Advisory Board (TAB) milestone for 4QFY18 was approved, which was for achieving the MPPT conversion efficiency of 10 per cent on a steel module.

Stock Performance: The companyâs stock last traded at AUD 0.170 on 28th February 2018. Since it began trading on the Australian Stock Exchange, it has generated a negative return of 79.84 per cent. The stock performed poorly in the past as it had delivered a negative return of 5.56% on a YTD basis and 8.11% during the six months period to 28th Feb 2018.

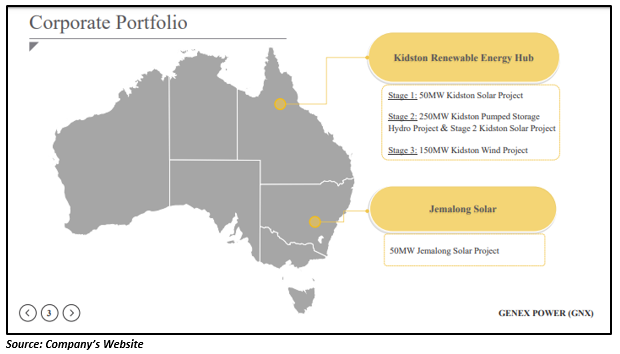

Genex Power Limited: A power generation development company, Genex Power Limited (ASX: GNX) focuses on generation and storage of renewable energy. The companyâs aim is to provide innovative electricity storage and clean energy generation solutions, providing lucrative commercial returns for stockholders. The companyâs core projects include 50MW Kidston Solar Project, 250MW Kidston Pumped Storage Hydro Project, 270MW Kidston Solar Project, 150MW Kidston Wind Project and 50MW Jemalong Solar Project.

Operational Performance: In its Corporate Presentation for June 2019, the company mentioned that it has generated strong and stable cash flows from 50MW Kidston Solar Project and its 50MW Jemalong Solar Project has the potential to double companyâs revenue from 2020.

The company recently announced the conclusion of a Share Subscription Agreement with Electric Power Development Co Ltd (J-Power). The agreement was planned for a conditional investment of up to a maximum of AUD 25 million through a subscription for ordinary shares in Genex.

In April this year, UGL Pty Limited was appointed as the preferred EPC contractor for the 50 Mega Watt Jemalong Solar Project in Australiaâs New South Wales. The appointment completed the strong project delivery team created by Genex for taking the project through to generation and completion. The company and Essential Energy entered into a connection agreement for the Jemalong Solar Project in April. The agreement confirmed the classification of the company as a committed generator in the National Electricity Market.

Stock Performance: The companyâs stock is trading lower today on the ASX today at AUD 0.225, down by 3.77 per cent (As at 1:29 PM AEST, 11 June 2019) with a market capitalization of AUD 82.79 million. The stockâs 52-week high and low value was recorded at AUD 0.320 and 0.215, respectively. The stock has performed quite well since it began trading on the ASX, delivering a return of 27.72 per cent. However, the stock has delivered a negative return of 3.64 per cent on a YTD basis.

Petratherm Limited: An ASX-listed mineral exploration company, Petratherm Limited (ASX:PTR) focuses on two world-class mining provinces â Victoria, Orogenic Gold and South Australia, Iron Oxide Copper Gold (IOCG). Currently, the company is actively seeking new mineral opportunities both in Australia and internationally. It is committed to creating a mineral exploration projectsâ portfolio that are prospective of high growth.

Operational Performance: On 30th April 2019, the company released its Quarterly Activities Statement for the March quarter 2019. Two tenements prospective for Olympic Dam style and copper-gold mineralisation totalling 1479km2 were granted in South Australia subsequent to the quarter. A second Victorian gold project, Silver Spoon, was secured by the company close to the Fosterville and Costerfield Gold Mines. The company had reported exploration and evaluation costs of $66,000 and administration costs of $64,000 during the quarter. Its cash balance at the end of the quarter stood at $4,051,696.

The company published its Interim Report for the half-year ended 31st December 2018 on 15th March 2019. The following are the highlights of the companyâs activities during the financial half-year:

- Created a portfolio of mineral exploration projects with high growth potential.

- Facilitated rehabilitation work of the Paralana 2 geothermal well.

- A wholly owned subsidiary company, Oberon Resources US Inc. was established in the United States.

- A new nickel prospective zone identified at Corunna Project.

- Secured an exploration licence in highly potential Bendigo Gold Zone in Victoria, Australia.

The company had cash and cash equivalents of $4.1 million at the end of 31st December 2018.

Stock Performance: The companyâs stock traded last on 6th June 2019 at AUD 0.037. The market capitalisation of the company stood at AUD 6.33 million; and 171 million shares were outstanding. The stock has delivered a YTD return of 2.78 per cent and has generated a return of 8.82 per cent, 5.71 per cent and 2.78 per cent during the last six months, three months and one month, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.