Australiaâs Metal and Mining Sector

As a matter of luck, Australia has an abundance of raw minerals existing underneath its soil. The mining industry has remained a significant primary industry contributing towards the wealth of the nation. Australia produces about 19 minerals in considerable amounts from around 400 operating mines. It is among the worldâs top mineral producers, having a considerable resource inventory of key minerals commodities. The commodities produced in Australia include bauxite, iron ore, rutile, gold, lead, lithium, manganese ore, uranium, black coal and many others.

Performance of Australiaâs Resource Sector

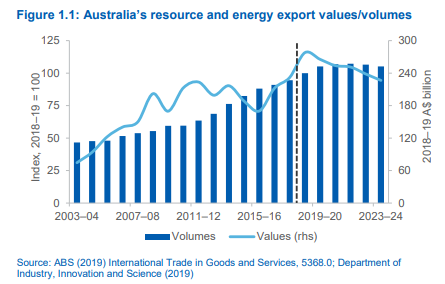

The Australian economy also generates a substantial amount of export income from mineral exports. The Department of Industry, Acknowledgements Innovation and Science, in its report âResources and Energy Quarterly March 2019â, mentioned that Australiaâs resource exports are expected to touch a new record of $278 billion in 2018â19. However, the resource and energy export values will fall back over the next five years after 2018â19, as indicated in the figure below:

The report stated that the investment in the mining sector is recovering after years of decline. The investment in Australiaâs mining industry fell by 6 per cent to $36 billion in 2017â18 relative to 2016â17. However, there was a potential recovery witnessed in investment in December 2018 quarter.

The expenditure on the total mineral exploration rose in March Quarter 2019, indicated a report released by the Australian Bureau of Statistics (ABS). The ABS announced the data on the Mineral and Petroleum Exploration for the March Quarter 2019 in June this year. The data indicated that the Australiaâs total mineral exploration expenditure rose 1.7 per cent to $573.9m during the period in trend terms. Western Australia was the largest contributor to the increase, where the expenditure rose 2.6 per cent. In seasonally adjusted terms, the overall mineral exploration expenditure rose 3.9 per cent to $581.7 million in the March quarter 2019.

ASX-Listed Metals and Mining Stocks

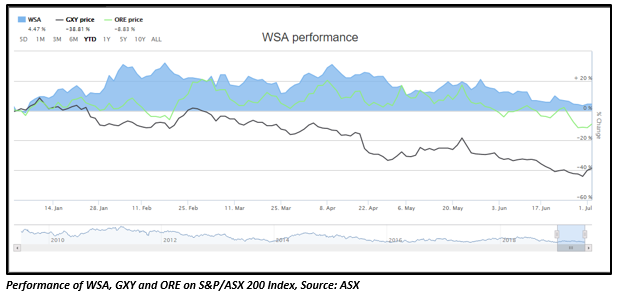

Let us now have a look at three of the Metals and Mining companies that are listed on the Australian Stock Exchange - Western Areas Limited (ASX: WSA), Galaxy Resources Limited (ASX: GXY) and Orocobre Limited (ASX: ORE).

But why are we focussing on only these three companies? The reason is that the stocks of these companies have followed an oscillating trend in 2019; neither rising nor falling continuously. Investors might be interested in knowing more about these stocks due to their differentiated pattern.

Take a look at the trend of these three stocks on a YTD basis:

Now, let us know more about each of these ASX-listed stocks:

Western Areas Limited

Australia's Class Leading Nickel Producer headquartered in Perth, Western Areas Limited (ASX:WSA) holds high-grade nickel production assets in Australia. Besides this, the company owns exploration and development projects of base metals across Australia. The company undertakes production around two of the worldâs highest-grade underground nickel mines, Flying Fox and Spotted Quoll. Both these mines are located in Western Australia within Western Areaâs Forrestania project area.

Operational Performance

Update on Mt Alexander Project

In a recent update, the company released the assay results for Phase 1 of the 2019 drill programme at the Mt Alexander Project. The assays confirmed the thick intersections of high-grade nickel-copper cobalt-PGE sulphide mineralisation at the project. The drill results are as follows:

- 10m @ 2.47% Ni, 0.07% Co, 2.52g/t PGEs and 1.06% Cu from 142m

- 3m @ 3.85% Ni, 0.11% Co, 4.22g/t PGEs and 2.12% Cu from 145m

- 2m @ 5.04% Ni, 0.16% Co, 2.12g/t PGEs and 1.47% Cu from 150m

The company owns 25 per cent interest in the Mt Alexander Project (situated near Leonora in the North Eastern Goldfields) which is held by the company in Joint Venture with St George Mining Limited.

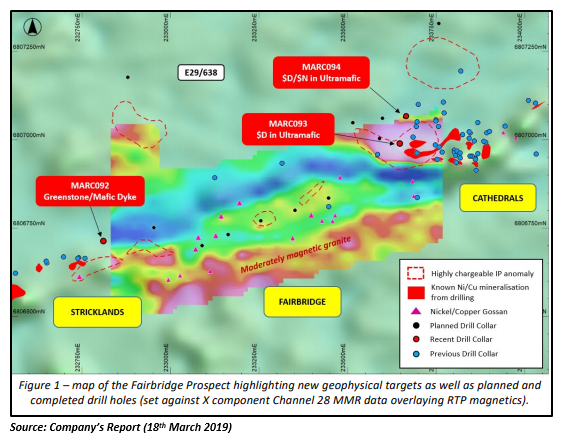

In March this year, the company informed about the continuation of strong results from the drill programme at the Mt Alexander Project. A new and wide zone of nickel sulphide mineralisation has been identified by the company through extensional drilling. Also, the two drill holes - MARC094 and MARC093 - have been completed at the new Fairbridge Prospect, as shown in the figure below:

Quarterly Activities Results

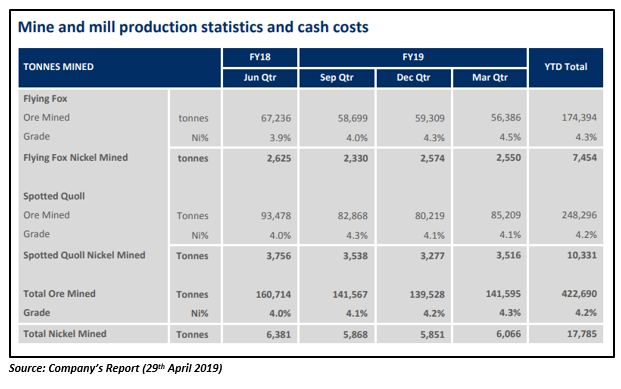

In its recently released quarter report for the March quarter 2019, the company reported significant improvements in both the cost of production and the grade of ore mined. The average mined grade across the Forrestania operation improved during the period, leading to a nickel production of 6,066 nickel tonnes in ore. The production from the Flying Fox and Spotted Quoll was reported at 56,386 tonnes of ore and 85,209 tonnes of ore, respectively.

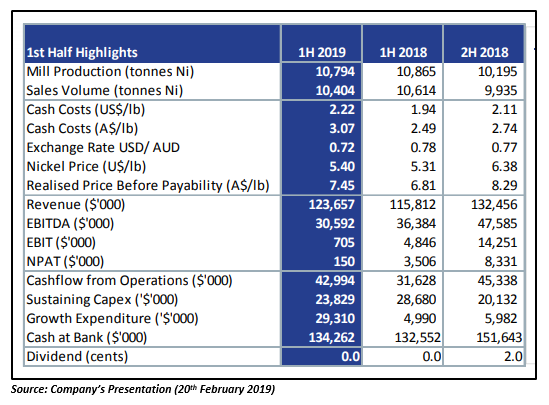

Financial Performance

On 20th February 2019, the company announced its financial results for the half year ended 31 December 2018. The company reported an increase in its sales revenue by 7 per cent to A$123.7 million due to higher realised nickel price (pre?payable) of A$7.45/lb. The balance sheet of the company stood strong with no debt and a cash balance of $134.3 million.

Stock Performance

The companyâs stock is trading lower on the ASX as on 4th July 2019 (1:14 PM AEST) at A$1.910, down by 1.8 per cent relative to the last closed price. The market capitalisation of the stock at the time of writing the report valued at A$532.05 million. The stock has delivered a return of 2.37 per cent on a YTD basis. However, it has generated a negative return of 44.59 per cent in the last one year.

Galaxy Resources Limited

An international S&P/ASX 200 Index company, Galaxy Resources Limited (ASX: GXY) holds hard rock mines, brine assets and lithium production facilities in Canada, Argentina and Australia. The Mt Cattlin mine, located in Ravensthorpe Western Australia, is wholly owned and controlled by the company. The mine is currently producing tantalum concentrate and spodumene. The company has a diversified project portfolio that includes James Bay lithium pegmatite project situated in Quebec, Canada.

Operational Performance

Update on Mt Cattlin Shipment

Recently, the company provided an update on its Mt Cattlin shipment guidance for Q2 2019. The company informed that it has completed two shipments amounting to ~30,000 dry metric tonnes to date in Q2 2019. Also, the 3rd shipment of 15,000 dmt, that was likely to leave from Esperance port before the end of the 2nd quarter, has been delayed.

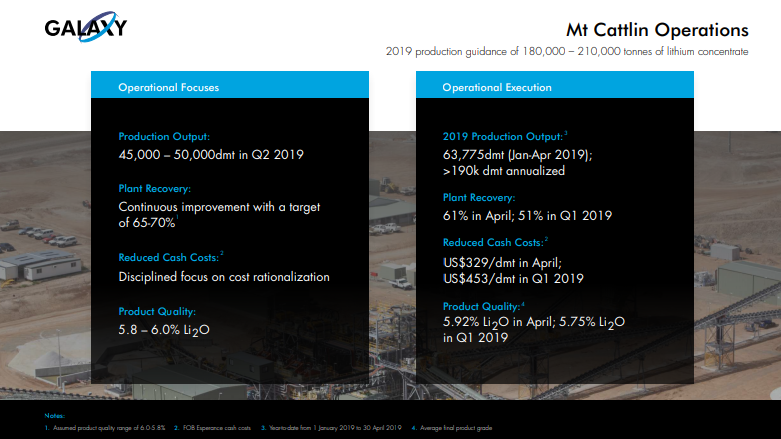

Production Update on Mt Cattlin

In an announcement on ASX, the company reported that the Mt Cattlin Project delivered a record monthly production volume of over 21,000 dry metric tonnes (dmt) of lithium concentrate for April 2019. The average final product grade also improved from 5.75 per cent Li2O in Q1 of 2019 to 5.92 per cent Li2O in April 2019. The strong production results indicated the robust operational execution and enhancement in performance post the completion of the Yield Optimization Circuits in Q1 2019.

Source: Companyâs Presentation (28th May 2019)

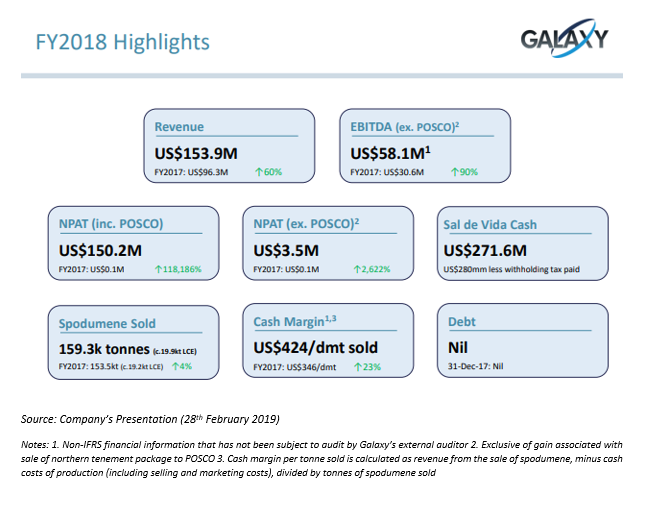

Financial Performance

On 28th February 2019, the company released its financial results for the full financial year ended 31 December 2018. The Revenue from operations reported a rise of 60 per cent to US$153.9 million during the period in comparison to FY2017. The Group EBITDA from operations also improved by 90 per cent compared to FY2017 to US$58.1 million. The âGroup net profit after taxâ and âGroup net profit after tax from operationsâ stood at US$150.2 million and US$3.5 million, respectively during FY2018.

Stock Performance

The companyâs stock is currently trading lower at A$1.310 on 4th July 2019 (as at 1:14 PM AEST). The stock has delivered a negative YTD return of 38.81 per cent. However, it has generated a return of 38.65 per cent since it commenced trading on the ASX.

Orocobre Limited

A dynamic global lithium carbonate supplier, Orocobre Limited (ASX: ORE) is an established producer of boron. Besides ASX, the company is also listed on Toronto Stock Exchanges as (TSE:ORL). The operations of the company include Advantage Lithium (33.5% interest), Salar de Olaroz Lithium Facility and Borax Argentina.

Operational Performance

Update on Cauchari JV Property

In April 2019, the company announced that Advantage Lithium Corp. would work with WorleyParsons Chile S.A. to complete the Pre-Feasibility Study of the Cauchari JV. Advantage Lithium would also be engaged in an independent NI 43-101 Technical Report on the Cauchari JV brine deposit in Jujuy, Argentina.

Approval of Naraha Lithium Hydroxide Plant

The company informed about the approval of Naraha Lithium Hydroxide Plant on 12th April 2019. It was reported that the Joint Venture boards, Orocobre and TTC (Toyota Tsusho Corporation) have approved the Final Investment Decision (FID) for the plant that was to be built in Japan. The company stated that it holds 75 per cent economic interest in the project, and the operations will be managed by Toyota Tsusho Corporation.

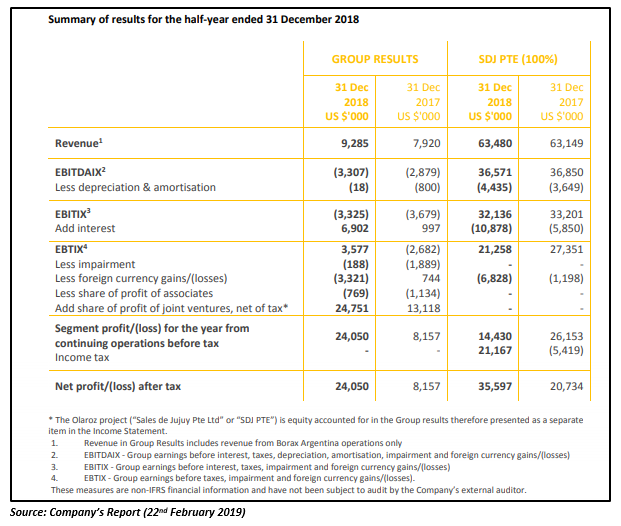

Financial Performance

The company released a consolidated financial report for the half-year ended 31 December 2018 on 22nd February 2019. Orocobre reported a net profit after tax of US$24 million in H1 FY19 against US$8.2 million declared in the previous corresponding period. The company informed that the total production of lithium carbonate was recorded at 6,075 tonnes during the period. The half-year revenue stood at US$63.5 million on sales of 5,163 tonnes of lithium carbonate.

Stock Performance

The companyâs stock is trading lower at A$2.760, down by 2.47 per cent (as at 1:29 PM AEST, 4 July 2019) with a market capitalisation of A$740.55 million The stock has delivered a negative return of 10.73 per cent on a YTD basis. However, it has generated an enormous return of 416.67 per cent since it began trading on the ASX.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.