With gold surging on the backdrop of global economic worries and trade concerns, let us look at below mentioned gold stocks and their performance:

Ramelius Resources Limited

Ramelius Resources Limited (ASX: RMS) explores and develops mines and produces and sells gold in Australia. It has an interest in the Mt Magnet Gold Project, which is located within the Meekatharra-Mt Magnet greenstone belt of the Western Australian Murchison province and the Vivien gold deposit located in Western Australia. The company holds interest in few more deposits and projects in Western Australia.

The stock of Ramelius Resources Limited has been placed in a trading halt, pending it releasing an announcement. The announcement is related to the companyâs Life of Mine plan for its Western Australian operations and the outcome of its strategic review of the recently acquired Tampia Project.

The securities will remain in a trading halt until the earlier of the commencement of normal trading on Monday, 17th June 2019 or when the announcement is released to the market.

As per the latest presentation, the recent acquisitions provided additional mine life and maximised the value of existing infrastructure. The strong balance sheet and cash flow of the company allow the ability to consider a wide range of opportunities without compromising existing operations. Moreover, the company focuses on efficient mining practices despite growing business. In the recent past, Tampia Hill and Marda Projects are currently being integrated with an aim to achieve ore reserve position in excess of 1,000,000 oz.

(Sources: Company Reports)

As per the latest operations summary, the Western Australia-based gold producer is operating from two main production centres, i.e. Mt Magnet and Edna May. The Mt Magnet production centre consists of several open pit and underground operations. It is complemented by high grade ore hauled from the Vivien underground mine. The Mt Magnet guided the production of 115,000 oz Gold at an AISC of $1,150-1,200/oz for FY19. The Edna May production centre comprises of Greenfinch open pit project and stockpiles. The Edna May guided the production of 82,000oz Au at an AISC of $1,200-1,250/oz for FY19.

The stock of Ramelius Resources Limited last traded at a price of $0.870, with a market capitalisation of $572.35 million on 12th June 2019. The stock has yielded a YTD return of 77.55% and exhibited returns of 91.21%, 28.89% and 2.35% over the past six months, three months and one-month period, respectively. Its 52-week high price stands at $0.985, with an average volume of ~3.96 million. The stock is trading at a PE multiple of 20.860x, with an EPS of $0.042.

Resolute Mining Limited

Resolute Mining Limited (ASX: RSG) is a gold miner and explorer that has key projects at Ravenswood, Syama and Bibiani. The Ravenswood gold mine in Australia and Syama gold mine in Africa are two of the well-known assets of the company.

Additionally, the company announced that it has been granted mining lease applications for three mines by the Queensland Government over areas which support the Ravenswood Expansion Project. The new approvals are in addition to the nine new leases granted during May 2019.

The surface area of Resoluteâs existing tenure has been extended by the addition of the three new leases and include areas within the operational footprint of the proposed Buck Reef West open pit, noise bunding zone, and nearby land required for infrastructure, including roads and water management.

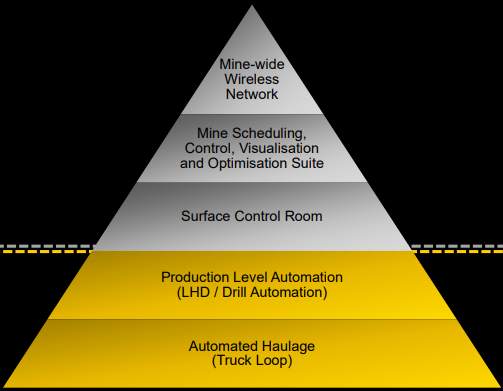

The company, in its latest Austmine 2019 Mining Innovation Conference Presentation, highlighted the Syama Automation project. The project includes two phases; Phase One consists of mine digitalisation and phase two consists of autonomous production and haulage. The Phase One capability delivers the completed control room with connection to the underground wireless network and the ability to schedule, control and monitor manual underground activities in real-time.

However, the phase capability delivers automated LHD and drill production on the levels and autonomous truck haulage from the 1055 level to the surface ROM.

Syama Automation Project (Source: Company Reports)

The automated Haulage Loop consists of three sections involving Haulage Level, Autonomous Decline and Boxcut and ROM.

Haulage level is where the autonomous trucks are loaded underground by the remotely operated LHDs. The ore is taken from the ore passes, which are fed by the production levels. The mine consists of a segregated autonomous decline with passing bays, where the autonomous trucks make their way to the surface. Finally, after leaving the underground mine, the trucks tram up the boxcut and to the ROM where they dump.

The stock of Resolute Mining Limited was trading at a price of $1.085, up 2.358% during the dayâs trade with a market capitalisation of $803.58 million on 13th June 2019. The stock has yielded a negative YTD return of 7.42% and exhibited returns of 0.95%, -9.40% and -6.19% over the past six months, three months and one-month period, respectively. Its 52-week high price stands at $1.440 and a 52-week low price at $0.910, with an average volume of ~5.95 million. The stock is trading at a PE multiple of 26.770x, with an EPS of $0.040. The stock has an annual dividend yield of 1.89%.

Westgold Resources Limited

Westgold Resources Limited (ASX: WGX) is involved in the production of gold and has been into commissioning, development and operation of four different production facilities in Western Australia.

The company recently informed about the sale completion of Higginsville Gold Operations to RNC Minerals. The total consideration for the sale is approximately $50 million with Westgold receiving around 50% of the total consideration in cash and 50% of the total consideration in RNC shares (56,916,019 common shares in RNC, approximate value $30.7 million). Westgold is currently the largest single shareholder of RNC holding approximately 10.3%.

Corporate Snapshot (Source: Company Reports)

The March 2019 quarter delivered significantly improved results as the company continued the ramp up of its Murchison operations. The company had a production of 74,004 ounces of gold. 6,836 ounces of the total production were attributable to the third-party ore processing. The gold operations cash costs of WGX were reduced by 18 per cent to $1,105/oz on a quarter on quarter(Q-o-Q) basis.

The group gold operations All In Sustaining Costs reduced by 15% to $1,269/oz on a Q-o-Q basis. The Mine Operating Cash Flow for the group stood at $25.5 million and the Net Mine Cash Flow was $28.5 million, representing an increase of 85% and 61% respectively on a Q-o-Q basis.

The Cue Gold Operations continued its expansion of production output by 37 per cent to 20,108 ounces on a Q-o-Q basis. The cash costs stood at $1,076/oz, a reduction of 37.0% and All in Sustaining Costs were reduced by 29% to $1,250/oz on a Q-o-Q basis.

The company entered in an agreement to divest/merge the Higginsville Gold Operations to RNC Minerals, which will see WGX receiving consideration of $50 million (half cash & half stock) which is due to settle before the end of FY 2019.

The stock of Westgold Resources was trading at a price of $1.590, with a market capitalisation of $620.63 million on 13th June 2019. The stock has yielded a substantial YTD return of 78.21% and exhibited returns of 82.29%, 38.70% and 19.03% over the past six months, three months and one-month period, respectively. Its 52-week high price stands at $1.855 and 52-week low price at $0.80, with an average volume of ~1.68 million.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.