Today, on June 17, 2019, S&P/ASX 200 is down by 0.35%. Stocks which drifted the market downward are McMillan Shakespeare Limited (ASX:MMS), Vocus Group Limited (ASX:VOC), and Afterpay Touch Group Limited (ASX:APT). Letâs look at the recent update of these companies:

McMillan Shakespeare Limited

GRS Division Facing Challenging Environment: McMillan Shakespeare Limited (ASX:MMS) is engages in the provision of vehicle leasing administration, salary packaging, retail financial services and fleet management. The Company recently announced updates during its June quarter-to-date, where it highlighted that its GRS division has faced challenging conditions in the retail car market, with lower than expected volume and revenue growth. Its end of the contract income was delayed as its Australian asset management business (AMB) witnessed an increase in its contract extensions. In the half-year period, the Companyâs UK asset management and broking businesses were impacted by soft market conditions and increased competition, which has reduced margins.

The Company expects to report an underlying net profit after tax in the range of $87-$89 Mn as compared to current broker consensus of around $92 Mn.

The companyâs UK asset management business has entered into short-term contracts which will allow the return of vehicles without the customary contract break fee, with a customer that has subsequently been placed into administration and many vehicles are being returned prematurely. Due to this, the Company expects to take a provision of approximately $3.7 Mn after-tax in FY19 financial result. The Board of Directors have decided to write-off the remaining goodwill of $18.2 Mn related to the business in FY19 financial results, due to the inherent uncertainty associated with the regulatory environment. Additionally, the Company has commenced a process to undertake an off-market share buyback during the second half of this calendar year, of up to $100 Mn.

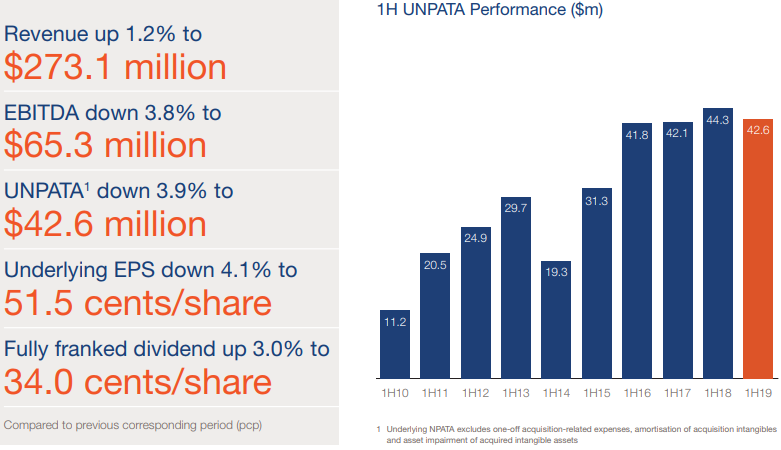

H1FY19 Key Metrics (Source: Company Reports)

As per a report released on January 30, 2019, McMillan Shakespeare Limited and Eclipx Group Limited (ASX:ECX) signed merger contract.

On the stock information front, as on June 17, 2019, the stock of McMillan Shakespeare was trading at $13.350, down 4.847% with the market capitalisation of ~$1.17 Bn. Its current PE multiple is at 23.230x, and its last EPS was noted at 0.604 AUD. Its annual dividend yield has been noted at 5.27%. Today, it made dayâs high at $13.530 and dayâs low at $13.040 with an average daily volume of 501,954. Its 52 weeks high was at $18.650 and 52 weeks low at $11.770, with an average volume of 347,508 (yearly). Its absolute return for the last 1 year, 6 months, and 3 months are -14.92%, -1.82%, and 10.73% respectively.

Vocus Group Limited

Integrated telecommunications service provider: Vocus Group Limited (ASX: VOC), as on 17 June 2019, announced that AGL Energy has decided to not move ahead with the transaction outlined in the Unsolicited Proposal, and hence, the discussions between both the companies in relation to the Unsolicited Proposal have now ceased.

On June 11, 2019, VOC had received an unsolicited proposal for the acquisition of all its shares from AGL Energy Limited (ASX:AGL) at a price of $4.85 per share in cash. The Company advised to the market participants that there was uncertainty regarding the Unsolicited proposal which would result in the binding offer for Vocus. In order to enable AGL Energy to potentially put forward a formal binding proposal, the Board of Directors of Vocus decided to grant exclusive due diligence to AGL Energy.

Mr. Kevin Russell, Chief Executive Officer of Vocus, has stated that they have confidence on their strategy, and they believe that in their potential to execute their business plan, which will deliver significant value to their shareholders in the medium to long run. The demand for their strategically valuable network assets is growing, and therefore they believe-in to have a substantial opportunity to gain additional market share. The Company has kept its FY19 guidance unchanged as mentioned on February 29, 2019, where the underlying EBITDA was anticipated to be in between the range of $350-$370 Mn.

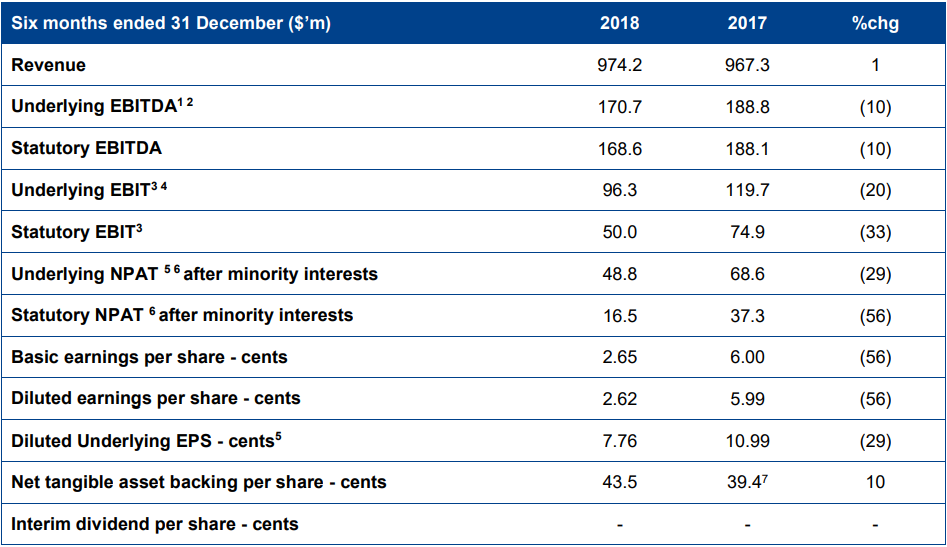

H1FY19 (ended on December 31, 2019) Financial Performance: Revenue for the period was reported at $974.2 Mn as compared to $967.3 Mn in the previous corresponding period. Its underlying net profit after tax and after minority interests decreased by 56% from $37.3 Mn in H1FY18 to $16.5 Mn in H1FY19. Its basic earnings per share decreased by 56% from 6 cents per share in H1FY18 to 2.65 cents per share in H1FY19. At the end of the period, net cash was reported at negative $1.5 Mn.

H1FY19 Key Metrics (Source: Company Reports)

On the stock information front, as on June 17, 2019, the stock of Vocus Group was trading at $3.290 down 24.541% with the market capitalisation of ~$2.71 Bn. Its current PE multiple is at 67.490x, and last EPS was noted at $0.065. Today, it made a high of $3.30 and a low of $2.940 with an average daily volume of 10,652,748. Its 52 weeks high was at $4.900 and 52 weeks low at $2.210, with an average volume of 3,454,363 (yearly). Its absolute return for the past 1 year, 6 months, and 3 months are 87.12%, 37.11%, and 20.11% respectively.

Afterpay Touch Group Limited

Multinational technology driven payment company: Afterpay Touch Group Limited (ASX:APT), recently made an announcement to the Australian Stock Exchange, that it has provided a notice under section 708A(5)(e) of the Corporations Act 2001. At the date of this notice, APT has complied with the provisions of Chapter 2M and section 674 of the Corporations Act. The Company announced on June 12, 2019, that it had undertaken a fully underwritten $317.2 Mn institutional placement. The Institutional Placement was settled on June 14, 2019, following which APT had issued 13,793,104 new fully paid ordinary shares in the market without disclosure under Part 6D.2 of the Corporations Act.

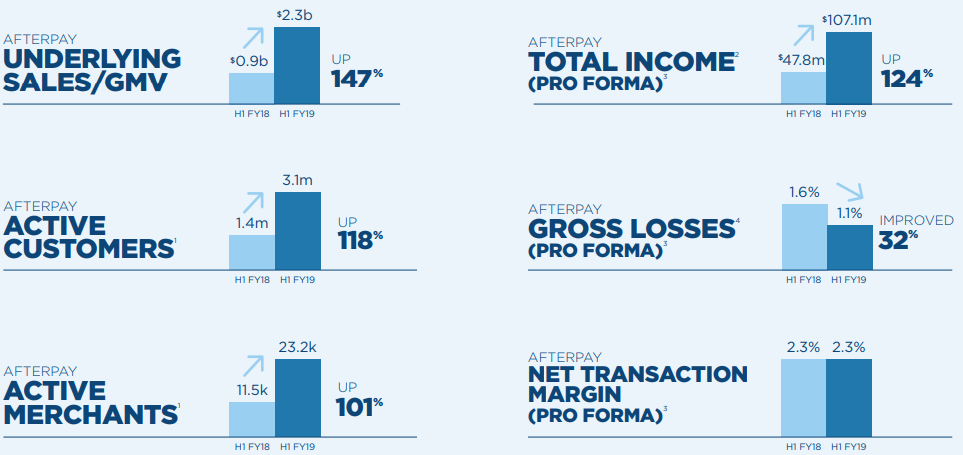

H1FY19 (ended on December 31, 2019) Performance highlights: Underlying Sales increased by 147% to $2.3 Bn as compared to the previous corresponding period. Total income increased by 91% to $116.1 Mn (pro forma), as compared to the previous corresponding period). At the end of the period, over 3.1 Mn active customers were reported which was an increase of 118% as compared to the previous corresponding period. The Company reported Gross losses (pro forma) of 1.1% of Afterpay underlying sales ($25.6 Mn), down from 1.6% in the previous corresponding period ($15.1Mn).

H1FY19 Key Metrics (Source: Company Reports)

On the stock information front, as on June 17, 2019, the stock of Afterpay Touch Group was trading at $20.270, down 6.114% with the market capitalisation of ~$5.16 Bn. Today, it made dayâs high at $21.290 and dayâs low at $19.980. Its 52 weeks high was at $28.700 and 52 weeks low at $8.375, with an average volume of 2,020,480 (yearly). Its absolute return for the past 1 year, 6 months, and 3 months are 137.78%, 75.53%, and 3.80% respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.