Forum: Forum is a medium or place where people discuss a topic/subject/problem that is of public interest or there is a buzz in the market.

Online Forum: Online forum is just like a normal forum, with the discussion over the internet via messages. The conversation occurs on a thread.

Types of Forum:

There are generally four types of forum.

- Question and Answer forum, where the users can ask their question online, and get a response (responses) from any of the forum members.

- The next is the Idea Forum, where the participants can share an idea and have a discussion on that.

- Another forum is the Problem Forum, where the participant can share the problem and discuss it with the community members.

- Forum could be of a general announcement from any source, where participants can share their view.

Pros and Cons of Online Forum:

Pros:

- The best part of the online forum is that people from different regions and backgrounds come together with a common discussion point.

- The participants can keep their identity safe.

- Multiple thoughts and views come from various participants.

- It adds information to the existing knowledge based on multiple inputs provided by participants.

- Ideas come from the experiences of the contributors.

Cons:

- The biggest disadvantage of an online forum is the threat of virus, trojans, etc.

- Members from diverse backgrounds participate. Sometimes, they go off track of the discussion.

- Participants cannot see others live.

- Intentions of the participants are not clear. They might send such links which could damage their system or can also lead to monetary losses.

In this article, we would be looking at two companies which provide an online platform where the users on similar interests come together. Let us have a look at the recent updates from these companies.

SportsHero Limited

About the company:

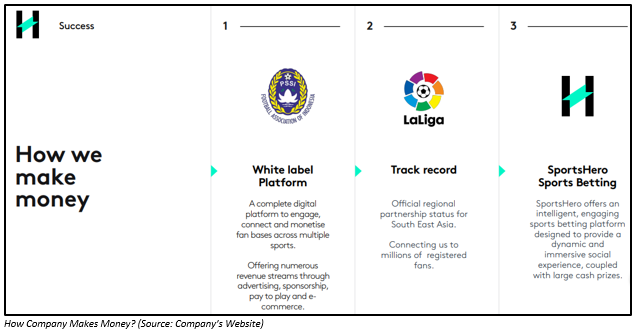

SportsHero Limited (ASX: SHO) is a company operating in the communication services domain, offering a sports gaming platform to its clients, where they can predict, interact and compete on major sports virtually and in real time. The company aims to create the largest social community dedicated to sports in the globe. As the worldâs leading sports prediction app, the company offers monetary and other prizes. SportsHero Limitedâs headquarters is located in Lota, Australia.

Recent Updates:

On 21 June 2019, the company made its app, âKita Garudaâ, live and available for download on Google Play. The company had unveiled its white label Mobile Application, âKita Garudaâ, on 18 June 2019 in an ASX announcement. The application, which was developed by the company for the Football Association of Indonesia (PSSI), went live and made available for download on Apple App Store on 18 June 2019. It is the first âwhite-labelâ bespoke branded platform of SHO.

On 25 March 2019, SportsHero Limited reached an exclusive agreement with PSSI or Football Association of Indonesia. PSSI, which is one of the largest sports federations in the world, has 80 million engaged fans, more than four leagues and 128 teams. PSSI is wholly owned and controlled by the Indonesian Government. Under this agreement, the company is the exclusive provider and partner for developing the first official platform for PSSI. The platform includes social media, merchandise/e-commerce and game highlights, in addition to live streaming, featured video stories and player access.

PSSI is set to boost the marketing spend and promote the Mobile App aggressively through giant scoreboard screens at games, billboards, advertisements on MAXstream and televisions as well as through press conferences. The advertisements will be played in giveaways and merchandise stores, as well as through social media. Meanwhile, as part of the agreement, SHO will provide advisory services to the federation related to marketing strategy. The federation will also take care of costs associated with the marketing of the mobile application.

Indonesia has 130 million social media users, 177 million mobile users and 120 million mobile social users. In the Asian country, out of the total smartphones, more than 88% are Android smartphones. Making âKita Garudaâ mobile app available through the Google Play forms an integral part of market penetration strategy of the company.

SportsHero Limited now focuses on building the PSSI user base. Post which, the company would be implementing paid digital advertising as a part of its monetization strategy. This platform launch might result in the company entering into similar agreements with other leading football as well as sports leagues across Asia and beyond Asia in the future.

Stock Performance:

SHO holds a market capitalization of A$18.11 million and has approximately 270.27 million outstanding shares. Its stock stood at A$0.063 on 24 June 2019 (ASET 03:33 PM), down 5.97% from its last close. Its six-month return stands at â 36.19%, while EPS is -A$0.023.

HotCopper Holdings Limited

About the company:

Incorporated in 2016, HotCopper Holdings Limited (ASX:HOT) provides the users with a stock trading as well as investment Internet discussion forum. Every stock that is listed on the Australian stock exchange has a dedicated forum on HotCopper, where the investors can share their views. Also, the corporate spotlight clients are provided with a dedicated column where they can share the sponsored company material. It has a registered member base of more than 315,000, with over 730,000 visitors a month. It is the largest ASX discussion forum of Australia and is based in Perth.

Recent Updates:

Recently on 14 June 2019, the company released an announcement related to the change in the interests of a substantial holder. The previous notice was given on 30 April 2019. On 11 June 2019, the change in the interest of the substantial holder, Somers Limited (and associates) was made. Earlier the holder was holding 24,056,728 shares of the company and had 22.49% voting power. Now, the holder is holding 25,367,352 shares and has the voting power of 23.71%.

According to the financial report released in February of 2019, by the company for 1H FY2019, the revenue of the company declined by 10% to $2,210,888 in the reported period as compared to its previous corresponding period (pcp). The profit before tax was down from $894,627 in 1H FY2018 to $494,601 in 1H FY2019. The net profit after tax attributable to the ordinary shareholders also declined by 46% to $361,333 in the first half of FY19 on pcp.

The balance sheet of the company witnessed a slight fall in the net asset, as a result of an increase in the total liabilities. The total shareholdersâ equity for the period was $3,422,858.

There was an increase in the operating cash inflow from $808,053 in 1H FY2018 to $1,534,584 in 1H FY2019, as a result of increase in the receipt from the customers. The company used $1,185,287 in its investing activities. The primary driver of cash outflow was in the form of purchase of other financial assets.

The company also paid a dividend during the period. By the end of 1H FY2019, HotCopper Holdings Limited had net cash and cash equivalents worth $2,825,724.

Stock Performance:

HOT holds a market capitalization of A$18.72 million with approximately 106.99 million outstanding shares and a PE ratio of 18.42x. The price of the shares of HOT was A$0.175 on 24 June 2019, while its one-month return stands at -2.78%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.