Diversification is a technique of decreasing risk by distributing investments among numerous industries, financial instruments and other asset groups. The primary purpose of diversification is to increase returns by making investments in diverse assets, considering that each industry or company would behave in a different way to the same event.

Investors encounter two major types of risk during investing - undiversifiable and diversifiable. The undiversifiable risk, also known as systematic or market risk, is not specific to any industry or company, and it cannot be diminished or eliminated via diversification, thus investors must acknowledge this risk. Common reasons comprise rate of inflation, interest & exchange rates, political instability and war.

The diversifiable or unsystematic risk is restricted to an industry, economy, company, market or country. Business and financial risks are the most common sources of diversifiable risk, and the investors are able to reduce these types of risk through diversification. Investors should always inject funds in a variety of assets, in order to ensure minimum impact on their investments due to market fluctuations. A combination of several asset classes would reduce the sensitivity of the portfolio to market instabilities.

Market sectors can be divided into three categories; Cyclical sectors that are impacted by economic cyclicals, Defensive sectors that are relatively immune to economic cycles; and Sensitive sectors that sit in between cyclical and defensive and flow with the overall economy, but not severely so.

In this article, we are discussing two ASX listed stocks, one from the financial sector and other from the energy sector.

Australia is a large exporter of energy, as a result energy sector is a major contributor to the economy. The country has widespread energy resources from renewable as well as non-renewable sources. The advances in technology, including advanced metering technologies, virtual power plants and battery storage, are changing the electricity industry.

Meanwhile, banking industry is the largest part of the Australian financial system and is a highly regulated space. The banks are required to fulfill all the regulatory requirements set by the financial regulatory authority, in any economy. The capital requirements are one of the regulatory requirements that a bank needs to comply. In any country, generally, Reserve Bank is the banking regulatory authority, which keeps a check on the capital requirement of banks, ensuring that they absorb the shock if there arises any credit or market risk.

Let us zoom the lens on ASX listed stocks - BOQ and WOR.

Bank of Queensland Limited (ASX:BOQ)

An ASX listed regional bank, Bank of Queensland Limited (ASX:BOQ) is the operator of retail branches, equipment finance centres and business banking centres all over New Zealand and Australia. In Australia, BOQ also operates an automated teller machine (ATM) network.

Bank of Queensland has several brands that provide a variety of services as well as products for personal and business customers, while most of the branches are operated by local owner-managers.

Bank of Queensland Completes Share Purchase Plan

On 30 December 2019, Bank of Queensland updated the market with the successful completion of the Share Purchase Plan (SPP) after the closing of the SPP on Friday, 20 December 2019. The SPP was announced by the bank on 25 November 2019 in conjunction with its fully underwritten AUD 250 million institutional placement.

A total of around AUD 89.7 million was raised under the Share Purchase Plan, with nearly 12.3 million ordinary shares to be issued at a per share price of AUD 7.27, representing a discount of 2 per cent to the VWAP of Bank of Queensland shares traded between 16 December 2019 and 20 December 2019 on ASX. The bank has decided to acknowledge all valid applications from eligible shareholders in full with no scale back.

Approximately 6,803 eligible shareholders lodged valid applications, and the bank anticipates the issue of shares on 2 January 2020 and to start trading on ASX on 3 January 2020.

Completion of AUD 250 Million Institutional Share Placement

Bank of Queensland, on 26 November 2019, unveiled the successful completion of the fully underwritten AUD 250 million institutional share placement. The institutional placement, which was conducted by bookbuild, would lead to the issue of nearly 32.1 million new fully paid ordinary shares in BOQ at a per share price of AUD 7.78. This placement signifies the top of the bookbuild price range.

Stock Information

BOQ’s market capitalisation stands at around AUD 3.2 billion, with nearly 442 million shares outstanding. On 2 January 2020 (AEDT 03:03 PM), the BOQ stock was trading at AUD 7.270, edging up by 0.276%. The BOQ’s stock has 52 weeks high and low price at AUD 10.770 and AUD 7.110, respectively. The P/E ratio of the stock stands at 9.770x, with an annual dividend yield of nearly 8.97%.

Worley Limited (ASX:WOR)

An ASX listed energy sector company, Worley Limited (ASX:WOR) offers customers with a variety of consulting as well as advisory services and deep technical expertise for numerous projects. Full asset management services and EPC (engineering, procurement and construction) capability are the integrated offerings of the company, delivered through four business lines- Major Projects, Advisian, Integrated Solutions and Services.

Contract for First Egyptian NPP

Worley has secured a consultation services contract for the first Egyptian nuclear power plant (NPP) from the Arab Republic of Egypt’s Nuclear Power Plants Authority (NPPA).

Worley would offer consultation services to the Nuclear Power Plants Authority to aid the implementation of the El Dabaa nuclear power plant project, which is on the Mediterranean coast, west of Alexandria. The NPP with four pressurised water reactors would have a nameplate capacity of 4,800 megawatts.

Worley would provide services related to NPPA technical support in engineering and design review, construction management, quality assurance, training, management of the project, procurement, procedure development, commissioning and other associated events. This agreement extends the relationship between Worley and NPPA until the end of 2030.

Renewal of Worley’s Services Contract by Imperial and Syncrude

Imperial Oil Limited and Syncrude Canada Limited have extended the contract for Worley’s long?term engineering as well as procurement services for a term of five years.

WOR would continue to offer both the companies a complete range of engineering, procurement and project delivery services for greenfields as well as brownfield projects in Canada. The services would be executed by the Canadian team of Worley and supported by its global business, including Global Integrated Delivery office in India.

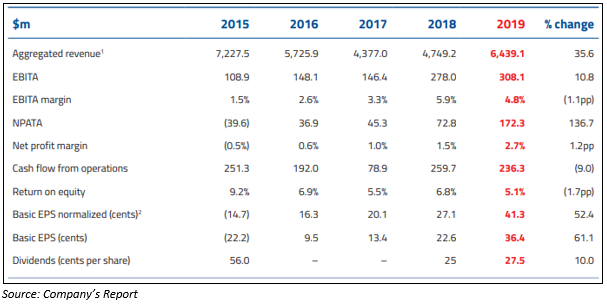

WOR’s five-year performance -

Stock Information

WOR’s market capitalisation stands at around AUD 7.97 billion, with nearly 520.36 million shares outstanding. On 2 January 2020 (AEDT 03:04 PM), the WOR stock was trading at AUD 15.395, edging up by 0.555%. The WOR’s stock has 52 weeks low and high price of AUD 11.320 and AUD 16.450, respectively. The P/E ratio of the stock stands at 42.060x, with an annual dividend yield of nearly 1.8%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

.jpg)