Considered as one of the most interesting corners of the stock market, biotech stocks hold the ability to offer huge profits to investors in a very short span of time. The biotechnology companies are counted amongst those that can grow from a single product with small market capitalisations to the one having a worth of over billions overnight.

Although the biotech sector can be highly rewarding for an investor, one can also lose big due to the high risk levels associated with the sector. So, an investor can follow the below 10-point checklist before buying a biotechnology stock:

Let take a quick look at this 10-point checklist below:

Spectrum of Diseases Targeted

Although there are numerous diseases that are affecting the lives of people across the world, there are some whose cure has not met with effective treatment. An investor can look for such biotech companies that are meeting the high unmet demand of the patients.

Below are the examples of some biotechnology companies engaged in the treatment of rare diseases:

Amicus Therapeutics

Nasdaq-listed Amicus Therapeutics focuses on the development, discovery and delivery of high-quality medicines for patients suffering from rare metabolic diseases. The company is currently targeting diseases like Fabry disease, Pompe disease and Batten disease.

On 26th September 2019, the companyâs stock closed at USD 8.25, down by 5.01 per cent.

MyoKardia

The US-based company, MyoKardia, is innovating a precision medicine approach to commercialize, develop, discover targeted therapies for treating severe and overlooked rare cardiovascular diseases. Listed on NASDAQ with code âMYOKâ, the companyâs stock closed at USD 52.30 on 26th September 2019, down by 4.47 per cent.

Proprietary Technology Used

The biotech firms that have developed their proprietary technology platform are generally considered to have a competitive edge over the other companies that use borrowed technologies. Also, the firms that are capable of developing proprietary technologies in-house can generate profit by selling or licensing their technology to other companies. So, investors can look for such companies while choosing biotech stocks.

Below is an example of a biotechnology company that has developed its proprietary technology:

Chugai Pharmaceutical Co Ltd

Chugai is a Japan-headquartered company that has introduced the first therapeutic antibody in Japan, creating a consolidated drug discovery platform that uses its proprietary technologies like bispecific antibody manufacturing technology (ART-Ig®) and Recycling Antibody® technology (SMART-Ig®). The company is engaged in treating cancer and other intractable diseases that presently does not have an effective treatment.

The company is listed on the Tokyo Stock Exchange with code â4519â and has closed the trading session on 27th September 2019 at JPY 8,360, down by 0.36 per cent.

Market Opportunity in Global Biotech Space

In the present scenario, when the business models are constantly changing, and the new competitors keep on entering the market, it is important for a biotech firm to keep looking for new opportunities in the market to grow and stay ahead of the competition.

One such firm that is counted amongst the top 10 biotechnology firms of the world is Novartis. The company is based in Switzerland and focuses on eye care, pharmaceuticals and generics segments. The company is known for expanding its presence in countries where there is high demand for healthcare and medicines. Novartis is listed on NYSE with the code âNVSâ.

The companyâs stock closed the trading session higher at USD 86.88 on 26th September 2019, with a rise of 1.57 per cent.

Competitive Edge Over Others in the Industry

The biotech players that hold a competitive edge over other market players in the industry usually generate greater returns because of their certain strengths. Investors can eye for such biotech companies that are better than their competitors on some parameters.

For instance, multinational medical devices, pharmaceutical, and consumer packaged goods manufacturer, Johnson & Johnson has been enjoying a competitive advantage over others for last many years. Its baby segment products lead in the baby care industry with either less or no competition for some of its baby products. Although the company faces tough competition in the pharmaceutical segment, it has managed to become one of the most trusted brands across the world.

Johnson and Johnson is listed on the NYSE with code âJNJâ. The companyâs stock ended the trading session at USD 128.85 on 26th September 2019, with a fall of 1.63 per cent.

Are there any Approved Products in the Market?

Another thing that an investor might be interested in knowing before buying a biotech stock is âWhether the company has any approved products in the market or not?â If the biotech player does have certified products in the market, their reliability increases. A biotech firm has to take approval from some regulatory organisations before the commercialisation of products in the countries. The approval puts a tag of safety on the product before it reaches the market.

Below are the examples of some of the companies that have recently got approval for their respective products from the USFDA:

Celgene

The biotechnology firm headquartered in New Jersey, Celgene focuses on the commercialization, development and discovery of drugs for treating cancer and other serious immune, inflammatory conditions. The company has recently got an approval for its Otezla (apremilast) product, that can be used for treating adults with oral ulcers related to Behçetâs Disease.

Celgeneâs stock is listed on the NASDAQ with the code âCELGâ. The stock ended higher on 26th September 2019 at USD 98.59, with a rise of 0.03 per cent.

Novo Nordisk

Novo Nordisk is a Denmark-headquartered pharmaceutical company that is working on defeating diabetes and other dangerous chronic diseases. The USFDA has recently approved the companyâs Rybelsus (oral semaglutide) drug that targets the type 2 diabetes disease in adults.

The companyâs stock is listed on the Copenhagen Stock Exchange with the code âNOVO-Bâ. At 11:45 AM on 27th September 2019, the company stock was trading at DKK 355.20, with a fall of 0.8 per cent.

Ardelyx

The US-based biotech firm, Ardelyx is targeting the treatment of patients with cardiorenal diseases. In September 2019, the company got a USFDA approval for its product - Ibsrela (tenapanor) â which is used to treat constipation and irritable bowel syndrome in adults.

Ardelyx is listed on the NASDAQ with code âARDXâ. On 26th September 2019, the stock closed the dayâs session at USD 4.87, with a fall of 6.44 per cent.

Progress in Clinical Studies

There are multiple biotech firms that are currently in the clinical stage. So, an investor planning to invest in such companies can take a note of the companyâs progress in its clinical studies to-date. This could help an investor project the likelihood of the companyâs success in future.

One of the companies that is currently in its clinical development stage is Imugene Limited (ASX: IMU). Targeting at the treatment of cancer patients, the company is planning to develop a range of novel immunotherapies. The companyâs B cell peptide vaccines have so far shown encouraging results in their clinical trials.

Listed on the Australian Stock Exchange, IMU closed the dayâs trade at $0.021 on 27th September 2019.

Plans to Mitigate Existing Challenges

Different challenges faced by the biotech companies make biotech stocks a riskier form of investment. So, it is essential for investors to keep a check on the companyâs plans to mitigate the challenges they are facing currently. The biotech companies with effective risk management strategies are likely to prosper better in a complex environment. Some companies also prefer to appoint a Chief Risk Officer who manages, reports, evaluates and oversees the external as well as internal risks of the organisation.

Future Development Plans

Planning is the first step taken towards success. Before investing in a company, an investor evaluates its development plans to ensure the safety of his investment. An intelligent business plan amplifies the companyâs chances of success and helps attract investors. So, it is important for a company to frame an optimised strategy to help its business succeed.

Revenue Model

The revenue model (money-making process) of a company decides the long-term projections and feasibility of the business. Generally, investors are very much interested in knowing the companyâs revenue streams and the resources needed for each of its revenue streams. A biotech company with a well defined revenue model generally draws more investors, enabling them to easily evaluate their businesses. Also, an investor can assess the likelihood of success of a companyâs development plans from its revenue model.

Financial and Stock Performance

Another most important and an easy way to choose the right biotech stock is analysing the companyâs financial and stock performance.

The financial statements of a company allow prospective investors to gauge the viability of investing in a company. The financials act as a foundation for the investment decisions of potential investors. For instance, a company with fluctuating profits normally signify higher risk.

Similarly, the past performance of a biotech stock can help an investor predict the future performance of the stock.

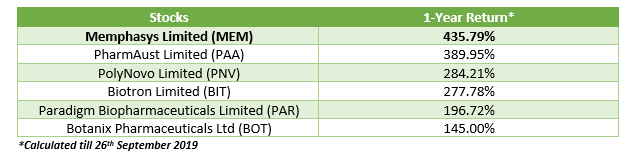

The below table summarises some ASX-listed biotech stocks that have delivered huge returns in the last one year:

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.