The below-mentioned stocks have witnessed strong top-line growth in the recent past. Plus, these stock have made good operational progress and have witnessed good growth in their share prices as well. Letâs take a closer look at these stocks and their stock performances.

Dubber Corporation Limited (ASX: DUB)

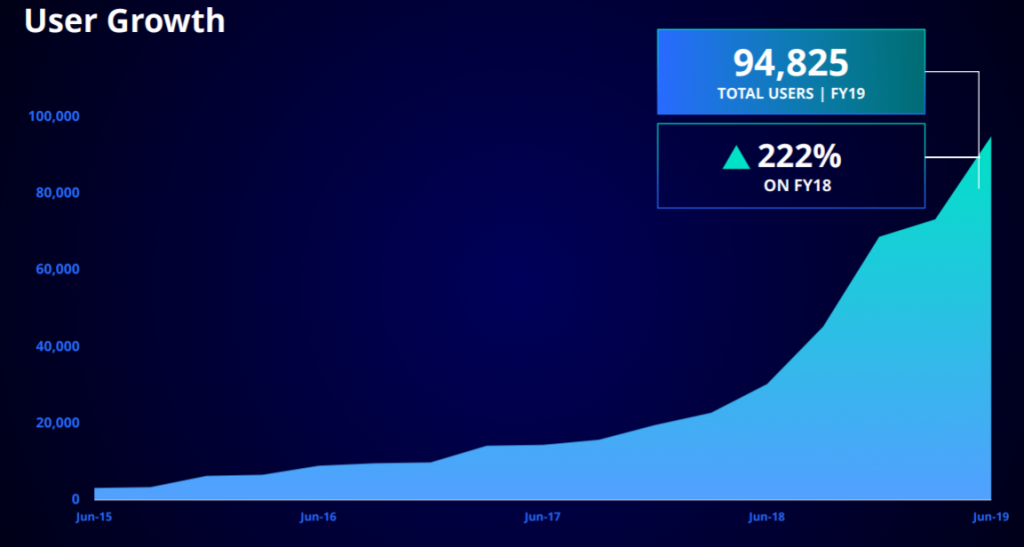

Leading provider of cloud-based call recording and voice services, Dubber Corporation Limited (ASX: DUB) reported an increase of 222% in its active users during FY19 (year ending 30 June 2019).

User Growth Graph (Source: Company Reports)

The companyâs operating revenue increased by 269% to $5.54 million in FY19 as compared to the prior year. During the year, the company kept its focus on driving end-user growth and associated revenues through its existing accounts while growing its global footprint.

The Dubber Platform and business plan are designed to:

- Disrupt the existing hardware-based, multi-billion-dollar call recording industry with a highly scalable, âOp-Exâ model;

- Expand the use case and revenue opportunities from âalways onâ compliance recording for every call, to a transactional âOn Demandâ opportunity with unlimited benefits for every business;

- Release the value from calls via voice data capture/ transcription to provide access to Artificial Intelligence (AI) for every phone.

Notably, in the last six months, DUB stock has provided a return of 62.37% as on 14 October 2019. At market close on 15 October 2019, DUBâs stock was trading at a price of $1.550, down 1.587% intraday, with a market cap of $298.38 million.

rhipe Limited (ASX: RHP)

Cloud channel company rhipe Limited (ASX: RHP) delivered an operating profit of $12.8 million and reported EBITDA of $10.0 million for 12 months ending 30 June 2019 (FY19). During the year, the companyâs total Group revenue increased by 36 per cent to $48.4 million mainly due to the strong momentum in public cloud through the Microsoft Cloud Solutions Provider program.

In FY20, the company intends to invest in a number of areas and countries including:

- Front office sales, marketing and technical staff to support increased customer numbers in all countries;

- Microsoft Dynamics channel staff, initially focusing on helping I.T. resellers with Dynamics sales and implementation opportunities in Australia;

- Continuous investment in the development of âSmartEncryptâ;

- An expansion in other rhipe solutions staff to capitalise on growth opportunities such as 24/7 Support and reseller focused lead generation.

Notably, in the last six months, RHPâs stock has provided a return of 23.58% as on 14 October 2019. At market close on 15 October 2019, RHPâs stock was trading at a price of $2.710, up 3.433% intraday with a market cap of $367.1 million.

To know more about RHP Click here

NetLinkz Limited (ASX: NET)

Cloud network solutions provider, NetLinkz Limited (ASX: NET) recently announced the commencement of its Australian rollout of the NetLinkz VIN with Omega Dev Group (ODG), a privately-owned procurement, R&D, training and consulting company.

James Tsiolis Executive Chairman and CEO commented:

âNetlinkz is pleased to welcome Omega Dev Group into the recently established Sydney IoT Lab. The highly secure collaboration services that ODG requires are well suited to the Netlinkz secure collaboration and VIN solutionâ

As part of its global strategy, the company is planning to establish an IoT Laboratory in Tokyo, Japan which will patent all code developed in Japan by the IoT Lab or in partnership with strategic customers.

For the year ended 30 June 2019, the company earned revenues from ordinary activities of $555k which was 340.5% higher than the prior year.

In the last six months, NETâs stock has provided a return of 119.51% as on 14 October 2019. At market close on 15 October 2019, NET stock was trading at $0.180 with a market cap of $308.23 million.

Serko Limited (ASX:SKO)

Travel management company, Serko Limited (ASX: SKO) aspire to be the world leader in corporate travel and expense management. The companyâs operating revenue in FY19 increased by 28% to $23.4 million mainly driven by the growth coming from the core Australasian markets. The companyâs recurring revenue increased by 26% to $20.7 million in FY19.

The company is executing on its business plan and remains on track to deliver within its FY20 guidance range of 20-40% year-on-year revenue increase and on its longer-term forecasts.

The company is transforming the way businesses manage travel and expenses by pursuing a three-pronged strategy of:

- Being a technology leader âBecoming world leader in corporate travel and expense management.

- Increasing Average Revenue Per Booking (ARPB) - By offering a broader range of content throughout the entire customer journey and cross selling expense.

- Growing its customer base - By expanding into new territories through strategic alliances as well as reaching the under-served small and medium sized enterprise (SME) market.

On year till date basis, NETâs stock has provided a return of 36.54% as on 14 October 2019. At market close on 15 October 2019, NET stock was trading at $3.600 with a market cap of $287.28 million.

GBST Holdings Limited (ASX:GBT)

Specialist financial technology company, GBST Holdings Limited (ASX: GBT) witnessed a revenue growth of 7% in FY19 (30 June 2019). During the year, the companyâs net assets increased by $12.8 million to $81.5 million. The company believes that its UK Wealth Management business is on a strong growth path.

Recently, the company was served with a claim by former CEO & Managing Director, Mr. Stephen Lake, alleging that GBST owed Mr. Lake $2.6 million in connection with the termination of his employment. The court has ruled that Mr Lake is entitled to his claim of $2,225,205.04 plus interest. Obviously, this is not in GBSTâs favour, hence the company is reviewing its options.

In the past six months, GBT stock has increased by 51.18% as on 14 October 2019. At market close on 15 October 2019, GBTâs stock was trading at $3.840 with a market cap of $260.78 million. The companyâs 52 weeks high price is $3.950 and 52-weeks low price of $1.195 with average volume of ~354,896.

To know more about GBT click here.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.