The recent trends in Australiaâs retail segments have been characterised by companies thriving towards growth through the delivery of exceptional personalised customer experience, the offering of a diverse range of products accompanied by speedy and reliable delivery. When it comes to putting money in retail stocks, the sector is known to be one of the most volatile investment sectors.

An investor must consider three factors while investing in retail stocks; (a) Evaluation of the digital presence of the retailer is crucial as growth in retail depends on how a company operates both offline and online. Investors should particularly look at the ease of transacting at the retailerâs platform. (b) The second factor to be considered is how the companyâs product is sold. Retailers that offer a personal experience to customers through the allowance of evaluating the product physically are generally in a better position (c) Lastly, an investor must look upon the long-term trends in the business and avoid relying on short-term trends.

Woolworths Group Limited (ASX:WOW)

Woolworths Group Limited (ASX:WOW) is primarily engaged in retail operations. As per the recent media reports, Woolworths has begun shutting down its loss-making Big W retail chain stores.

Woolworths Cutting-Off Big W Stores: The company has planned to shut down 30 Big W stores over the next three years. Recently, Woolworths has announced the shutting down of first three stores located in Fairfield, Auburn and Chullora by January 2020. The companyâs distribution centres in Queensland, Warwick and Monarto in South Australia have already been closed. The company is now focusing on its team associated with the Big W chain and is exploring redeployment opportunities for the members based on their career preferences. In FY18, Big W reported a loss amounting to $110 million and is expected to report an FY19 loss before interest and tax in the range of $80 million to $100 million.

Financial Impact: The closures were announced by the CEO in April 2019 and are anticipated to involve a one-off pre-tax charge of $370 million. Cash cost pertaining to closures is expected to be around $250 million. FY21 and FY22 will see the majority of cash outflows from store exits.

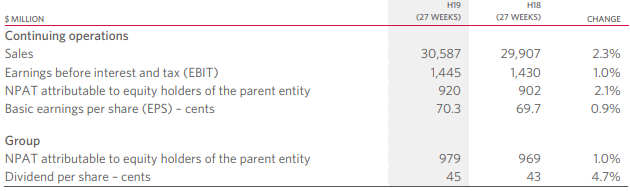

During the 27 weeks ended 30th December 2018, the company reported a 2.3% rise in sales and 2.1% rise in NPAT.

1HFY19 Highlights (Source: Company Reports)

The companyâs stock at market close was trading at a price of $34.080, down 0.641%, with a market cap of $43.17 billion on 18th July 2019.

Coles Group Limited (ASX:COL)

Coles Group Limited (ASX: COL) is a retail company, providing a variety of products through its store network.

Strategy Update: The company recently came up with a refreshed strategy, wherein it revealed the financial objectives for the next four years. Over the long term, the company expects the revenue growth to be at least in line with market growth. In addition, the company is targeting approximately $1 billion of cumulative cost savings by FY23. The cost reduction strategy will involve the use of technology to simplify above-store sales to remove duplication and automate manual tasks.

In addition, the company will work on optimising its store network to increase sales density and improve profitability, modifying up to 40% of the floor space in stores to cater to the needs of local customers.

The strategy is directly aligned with the creation of long-term shareholder value by growing revenues in line with the market, cost cutting and generation of enough cash to fund growth.

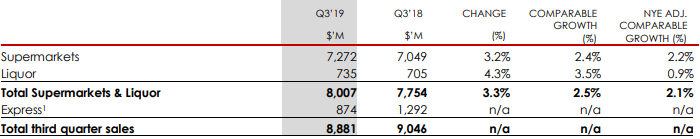

Trading Update: The company expects Q4 supermarket sales to be in the upper half of the range between the second and third quarter results. Sales in the third quarter amounted to $7,272 million. FY19 net CapEx is expected to be in the range of $700 million to $800 million.

Q3FY19 Sales (Source: Company Reports)

The stock of the company was trading at a price of $13.960, down 0.357% at market close on 18th July 2019. The stock is priced close to its 52 weeks high level of $14.120 and has a market capitalisation of $18.69 billion.

JB Hi-Fi Limited (ASX:JBH)

JB Hi-Fi Limited (ASX: JBH) is primarily engaged in retailing of consumer electronics, software, whitegoods and appliances. The company recently updated that UBS Group AG became a substantial shareholder with 5.78% of voting rights.

Sales and Guidance Update: During Q3 FY19, JB Hi-FI Australia reported total sales growth of 2.6% as compared to 7.5% in pcp. JB Hi-Fi New Zealand witnessed a 1.2% decline in total sales as compared to 4.4% in pcp. Sales from the Good Guys segment witnessed a growth of 2.2% as compared to a decline of 1.3% on pcp.

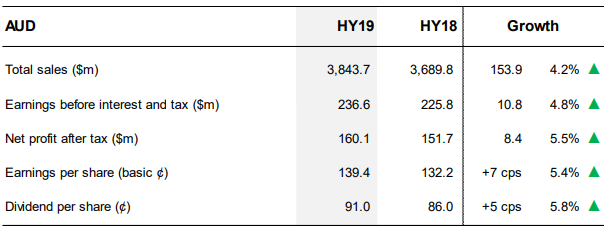

1H FY19 was a period of growth across all key metrics against pcp, with total sales growing by 4.2%, EBIT by 4.8% and NPAT by 5.5%.

1HFY19 Performance (Source: Company Presentation)

FY19 Guidance: The company expects total sales for FY19 to be approximately $7.1 billion, comprising $4.73 billion from JB Hi-Fi Australia, $0.24 billion from JB Hi-Fi New Zealand and $2.15 billion from the Good Guys. NPAT for the period is expected to be between $237 million to $245 million, with a growth in the region of 1.6% to 5.1% on pcp.

The stock of the company was trading at a price of $29.130, up 0.761%, with a market cap of $3.32 billion at market close on 18th July 2019.

Super Retail Group Limited (ASX:SUL)

Super Retail Group Limited (ASX: SUL) is engaged in retailing of a variety of products, including auto parts, tool and equipment, sporting equipment and apparel, etc.

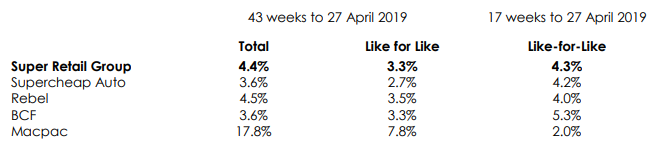

Trading Update: The company recently released its trading update for the first 17 weeks of the second half of FY19. The group reported like-for-like sales growth of 4.3% on pcp. Sales from BCF segment witnessed highest like-for-like growth of 5.3%, followed by Supercheap Auto and Rebel growing at a rate of 4.2% and 4.0%, respectively. Like-for-Like sales growth was least for Macpac at 2.0%.

Sales Growth on PCP (Source: Company Updates)

In 1HFY19, the company paid a fully franked dividend of $0.215.

The stock of the company at market close on 18th July 2019 was trading at a price of $9.380, down 1.263%, with a market cap of $1.88 billion.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.