Australian-headquartered technology giant, Appen Limited (ASX: APX) witnessed a massive decline in its share price on the ASX, following the release of its FY19 half-year results. The stock closed the trading session at AUD 24.270 (on 29th August 2019), 11.32 per cent down in comparison to the last closed price of AUD 27.370. Although the company delivered positive revenue figures and net profit for the half-year, its stock leads the list of top five worst-performing stocks on the ASX.

About Appen Limited

Appen Limited is an ASX-listed firm that labels and collects speech, image, text, video and audio data used to shape and steadily advance the most innovative artificial intelligence systems across the world. With expertise in the industryâs cutting-edge AI-assisted data annotation platform, a global crowd of more than 1m skilled contractors and over 180 languages, Appen solutions offer the security, quality, and speed needed by leaders in manufacturing, financial services, retail, technology, automotive and governments worldwide.

The company operates through two operating divisions:

- Speech & Image Division: This division provides annotated image and speech data used in speech synthesisers, machine translation, speech and image recognisers and other machine-learning technologies, leading to a more engaging and fluent devices including in-car automotive systems, internet-connected devices and speech-enabled consumer electronics.

- Relevance Division: This division provides annotated data used in search technology for improving accuracy and relevance of social media applications, search engines and e-commerce.

How Appen Performed in FY19 Half-Year?

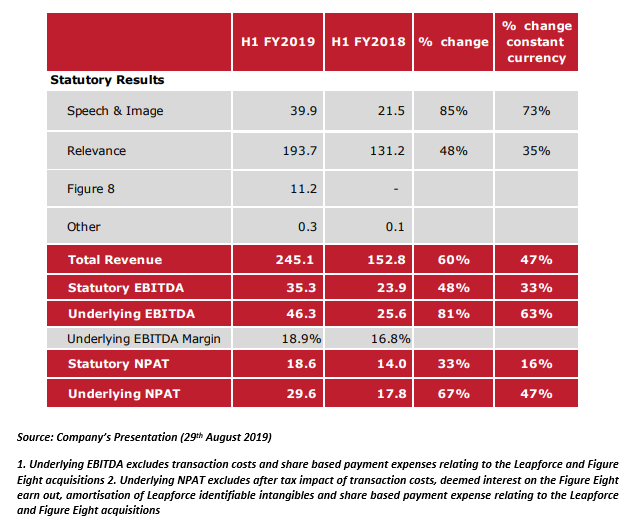

Appen has recently released its first-half results for the half-year ended 30th June 2019 that highlighted the companyâs strong core business performance during the period. Let us take a deep dive into the companyâs performance during the period:

Financial Performance

The company delivered a tremendous rise of 60 per cent in its revenue from AUD 152.8 million in HY2018 to AUD 245.1 million in HY2019. Most of the revenue was derived offshore in USD.

The following were the key drivers of revenue growth in HY2019:

- The Speech & Image division, whose revenue improved by 85 per cent over the prior year, driven by increased demand for speech and image annotation and data collection services for technology customers.

- The Relevance division, whose revenue rose by 56 per cent (including Figure Eight) over the prior yearâs revenue of AUD 131.1 million. This was largely driven by the organic growth in demand for human annotated data, primarily from prevailing customers.

Appenâs Underlying NPAT and statutory NPAT was 67 per cent and 33 per cent up in HY2019 to AUD 29.6 million and AUD 18.6 million, respectively. The effective tax rate rose from 21.2 per cent to 28.2 per cent, impacted by a large employee incentive share issue tax deduction in the prior year. The company mentioned that the normalised tax rate (excluding share-based payment expense related items) was at ~29 per cent.

The Underlying EBITDA margins of the company rose to 18.9 per cent in HY2019 from 16.8 per cent in HY2018. The Underlying EBITDA and the statutory EBITDA of the firm also improved by 81 per cent and 48 per cent to AUD 46.3 million and AUD 35 million, respectively. The increase in Underlying EBITDA was driven by a strong revenue increase in both Relevance and Speech & Image division.

The EBITDA in the Speech & Image division rose by 94 per cent to AUD 14.6 million from AUD 7.5 million in the prior comparative period, while the Relevance divisionâs EBITDA reported a significant organic increase of 92 per cent.

The company reported a strong balance sheet as the cash flow from operations remained strong, increasing by 98 per cent from AUD 14.5 million in HY2018 to AUD 31.8 million in HY2019. There was a significant improvement in debt leverage ratio from 0.26x in the prior year to net cash positive of AUD 59.2 million in the current period.

The company closed the balance sheet with a cash balance of AUD 70.8 million, representing an increase of AUD 39.9 million on pcp.

Operational Performance

In March 2019, Appen signed an agreement to acquire an industry leading machine learning software platform, Figure Eight Technologies, Inc. for an upfront consideration of USD 175 million and an earn-out of up to USD 125 million contingent on Figure Eightâs achievement of additional subscription software revenue targets for FY19, due in April 2020.

The company funded the upfront consideration via a fully underwritten equity placement of AUD 285 million at AUD 21.50 per share. Appen also raised additional funds of AUD 15 million by undertaking a non-underwritten Share Purchase Plan.

The acquired Figure Eight business contributed revenues of AUD 11.2 million and loss after tax of AUD 4.24 million to the Group for the period from 2 April 2019 (date of acquisition) to 30 June 2019.

Appenâs Chief Executive Officer, Mark Brayan mentioned that the acquisition of Figure Eight is delivering on its strategic thesis. He informed that the acquired business is accelerating the companyâs technology roadmap, diversifying its revenue and expanding its markets.

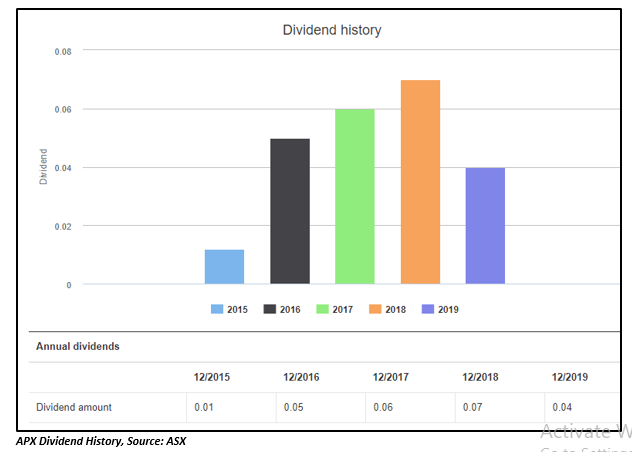

Dividend Announcement

Appen declared a dividend of 4 cents per share for the six months ending 30 June 2019. The company announced a partially franked half-year dividend for its ordinary fully paid securities, that was same as the dividend for the previous six months. The ex-date and record date of the dividend are 3rd and 4th September, respectively, while the payment date is 26th September 2019. The company notified that approximately 42.5 per cent of the announced ordinary dividend is franked with 30 per cent corporate tax rate for franking credit. The company did not offer a securities plan for the distributions on this security.

Outlook

Appen is strengthening its position in a high growth market through investments in sales & marketing, technology, government markets and China. As per the company, Chinaâs AI market is growing at 55 per cent annually, and it is forecasted to be at USD 14.3 billion in 2020. The company is currently reviewing its capital management priorities, including dividend policy.

The company expects its YTD revenue plus orders in hand for delivery in 2019 (including Figure Eight) to be at ~$380 million in mid-August 2019. Appenâs full-year underlying EBITDA for the year ending 31st Dec 2019 including Figure Eight, is trending to the upper end of AUD 85 million to AUD 90 million.

The company also notified that its outlook is susceptible to upside or downside from factors including Australian dollar fluctuations and timing of work from major customers. Appenâs continuing investment in technology exclusively positions it to meet the marketâs demand for large quantities of quality data at speed over multiple data types for a mounting number of use cases.

Stock Performance

Although the tech-giant has delivered an enormous return of 113.83 per cent on a YTD basis, the shares of the company saw a double-digit fall subsequent to their FY19 half-year results announcement on the ASX. In fact, the stock has generated a tremendous and exceptional four-digit return of 5113.33 per cent since it commenced trading on the ASX. On 29th August 2019, the stock opened the trading session at AUD 29.02, fluctuating between a dayâs high and low value of AUD 29.98 and AUD 23.85 during the intraday session.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.