- Amidst the COVID-19 scenario, pioneer materials that channel the production of high-tech devices are also enjoying robust demand.

- HPA price and demand expected to improve, driven by boost in the growing high technology industries.

- PFS into King River Resources’ SSM project progressing well, with recent production of >4N (99.99% Al2O3) or HPA by a new refining process.

- Outcomes awaited from various tests to finalise the PFS.

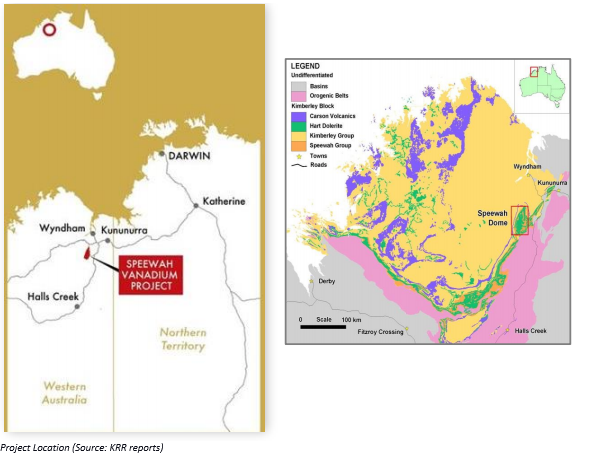

Transforming objectives into reality across its forward journey, Australian speciality metals explorer, King River Resources Limited (ASX:KRR) appears well placed in the current COVID-19 scenario. At its flagship Speewah Specialty Metals (SSM) Project, which is currently under prefeasibility study (PFS), the Company has made notable developments concerning the production of High Purity Alumina (HPA).

King River Resources Forging Ahead with Speewah PFS Compilation in Full Swing Must Read

SSM Project is wholly owned by King River Resources and sits on Western Australia-situated East Kimberley Region. Besides, the Company is also advancing its activities concerning other two projects, which include Mt Remarkable Gold Project and Treasure Creek Project.

During late-April 2020, KRR achieved the production of >4N (99.99% Al2O3) or HPA by a new refining process. The Company continues to advance its activities strategically in the PFS for initially scaling the SSM project to the production of HPA. At a later stage, the Company intends to produce co-products including V2O5, TiO2 and Fe oxide at the project; however, not part of the PFS.

Meanwhile, KRR Management Team believes that refocusing the PFS on a smaller project that produces high-value HPA has not only simplified the process flowsheet but also enhanced the prospects for improving the project economics.

Also Read: Victory for King River Resources: Greater than 99.99% HPA Produced; Stock Up 20%

With this backdrop, let us look at the growing market potential for HPA and the Company’s progress so far that has positioned KRR towards tapping these opportunities in the upcoming period.

Market Opportunities for High Purity Alumina

The paradigm shift driven by COVID-19 crisis has blossomed hopes in the digital landscape across the world. Technological innovations remain at the forefront to tackle varying impending challenges that came along with lockdown restrictions. Amidst such a scenario, pioneer materials that channel the production of high-tech devices also have been conspicuously enjoying the demand-pull.

Do Read: High Purity Alumina Bolstering King River Resources’ Endeavour

King River Resources, previously from highly respected global authority CRU International, commissioned a detailed marketing study for assessing the demand and price of the commodities which PFS targets, which noticeably include HPA. 4N HPA in the over the counter transactions attract a rate of approximately ~US$24,000/tonne.

High Purity Alumina (HPA) is basking in bright prospects for varying HPA-utilising products, which has been triggered by the demand boost in the technology and efficient energy sectors.

Two high technology markets- synthetic sapphire glass and HPA coated separators, which utilise HPA as the precursor material, are expected to show a growing demand in the coming years, thereby pushing the price and demand for HPA. Synthetic sapphire glass is used as substrates in light-emitting diode (LED) lights, laser markets and semiconductors. HPA coated separators find their application in the manufacturing of lithium batteries.

The market expects strong inclination towards the adoption of artificial intelligence, data processing, communication electronics and advance medical care, which are all facilitated by semiconductors. While lithium batteries enable a global shift to electric vehicles (EVs), LED lights adoption has been centric to energy efficiency.

PFS Centric to HPA Production Advancing Well

The new process by KRR’s metallurgical consultants, TSW Analytical Pty Ltd (TSW) has successfully led to the production of >4N HPA through sulphuric acid leaching-precipitation process on a smaller scale Beneficiation-Agitated Tank.

The Company plans on investigating vanadium pentoxide (>98% V2O5), iron oxide (>65% Fe2O3) and titanium dioxide (>99% TiO2) as co-products along with HPA, at a later stage. It would reduce the project size and heighten the potential for capex reduction and return maximisation.

Also Read: PFS Highlights into King River Resources’ Speewah Specialty Metals Project

Outlook

Final model validation and review are awaited after largely completed plant and infrastructure design and costings by Como Engineers and mining study by CSA Global. Meanwhile, KRR is conducting the following tests, post which the Company would finalise the Pre-Feasibility Study:

- On a larger sample involving the previously reported 4N HPA product, repeating the test for reiterating the >99.99% result and providing additional verification analyses product.

- Result of >99.99% Al2O3 undergoing an independent umpire assay

- For ensuring the HPA phase remains all alpha-alumina, KRR is working towards calcination temperature increase through new equipment trials, and an X-Ray Diffraction (XRD) analysis

- Boost the purification efficiency at Stage Two

The robust performance centric to HPA production and cost-efficient potential of the product is augmenting the SMM project potential to leverage the growing demand and price for HPA in the world market.

Stock Information – KRR stock closed the day’s trade at AU$0.060 on 25 May 2020. The Company has a market cap of AU$78.66 million, while its stock has delivered a return of 85.29% and 103.23% in the last one month and six months, respectively.