Ora Banda Mining (ASX: OBM), formerly known as Eastern Goldfields Limited, is a metals and mining sector player based in Perth, Australia and involved in exploration and development of gold deposits.

The securities of the company were reinstated to quotation on the Australia Securities Exchange (ASX) on 28 June 2019 after a successful AUD 30-million recapitalisation process that was accompanied by a large marketing campaign across the UK, US, Hong Kong, Australia, Switzerland and Canada. This marked a new dawn for Ora Banda, which emerged in a significantly stronger position after months of planning and hard work to kickstart the work that its fantastic set of assets require, before going back into production.

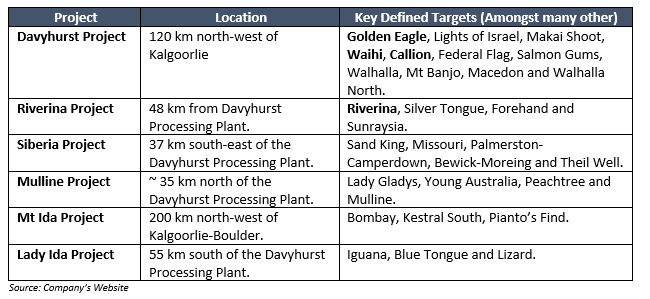

The company is presently focussed on unlocking significant value from its large, wholly-owned highly prospective tenure in the Eastern Goldfields of Western Australia. The companyâs total land package comprises six projects (detailed in the figure below) covering 112 tenements spanning across approximately 1,336 km2 and providing a continuous 200 km strike of the greenstone belt prospective for gold, nickel sulphide and base metal mineralisation.

So far, the company has estimated a total Mineral Resource of 21.0Mt @ 2.6g/t for 1.8Moz for its overall tenure at Eastern Goldfields. Initially, Ora Banda is progressing with resource development activities for five advanced deposits located close to the processing plant- Riverina, Waihi, Callion, Siberia and Golden Eagle, which host a high-grade Resource of 9.2 Mt @ 2.8 g/t for 840 koz in total.

Letâs look in detail at the companyâs major Davyhurst Project.

The Davyhurst Project

It is located ~ 120 km north west of Kalgoorlie, on a western branch of the Norseman Wiluna Greenstone Belt amidst WAâs Eastern Goldfields. The project straddles the border between the provinces of Eastern Goldfields and Southern Cross, characterised by the crustal scale Ida Lineament.

During 2002 and 2006, Ora Bandaâs predecessor Monarch Gold Mining Ltd consolidated the fractured tenement holding, but no exploration was carried out since then, thus offering Ora Banda an opportunity to establish a sustainable mining operation.

In Hindsight, the project history indicates that in the 1890s, gold was discovered by previous prospectors in the broader Davyhurst Project area along the greenstone belts northward from Coolgardie. Thereafter, mining towns were established at Davyhurst, Siberia, Mulline, Ularring, Callion, Copperfield and Mt Ida and mining operations of different scale were also executed during 1890 and 1950, with cumulative production of ~ 600,000 oz of gold. Later in 1980s, several companies started undertaking modern mining operations over the area covered by the current project area.

Mineralisation at Davyhurst Project area occurs along two principal trends. Along with the presence of existing large deposits, additional drill testing at several other advanced targets along the trend may reveal substantial results.

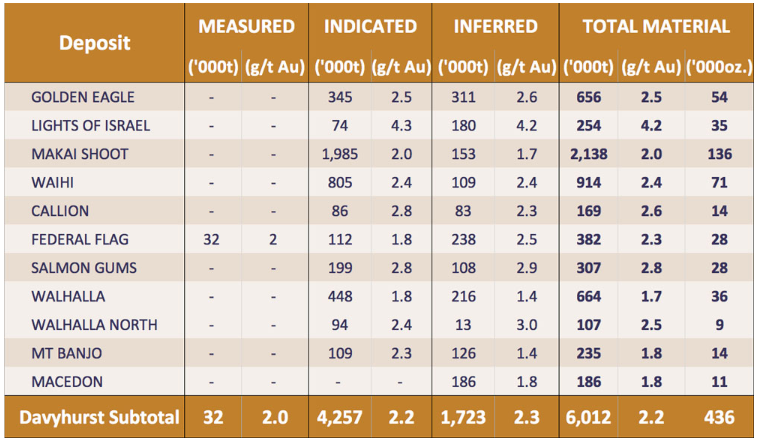

The last JORC (2004) resource estimate for all the deposits encompassed within the project was compiled in 2008 and tabulated below-

Source: Companyâs Website

Source: Companyâs Website

The Davyhurst Project also hosts three of the five advanced deposits under Ora Bandaâs purview of advancement. These inlcude Golden Eagle, Waihi, and Callion. More on these can be READ here.

Ora Banda has a 1.2Mtpa Davyhurst Processing Plant (conventional CIP processing facility) with relevant infrastructure, including a well-connected road network, a camp for 160 men, administration & workshop buildings and a big bore field in place. The configuration of the processing plant is suitable for the treatment of both oxide and fresh ores. Besides, airstrips are in proximity at the Callion prospect in Davyhurst and Bottle Creek prospect at Mt Ida.

As per a recent evaluation by GR Engineering Services Ltd, the capital cost required for remedial works and recommissioning of the processing plant has been estimated at $ 8.5 million, inclusive of $ 0.84-million contingency. This would lead to enhanced project returns for the company. Previously, around $ 34 million was spent on refurbishment in 2016 and 2017, and the plant was operated until Q3 2018. However, due to insufficient supply of critical spares during this period, the operations were stalled.

Ora Banda Mining is very well funded to expedite its Exploration and Resource Definition program at the broader Davyhurst project area that currently includes systematic program involving infill and extensional drilling to existing resources, a regional exploration program to test advanced exploration prospects, with the drilling program results expected to be announced as per headways achieved over the upcoming months.

Cash Position

As at 30 June 2019, the cash in hand was ~ $ 15 million. Recently on 16 August 2019, Ora Banda Mining finalised the placement of 100,000,000 fully paid ordinary shares to be issued at 18.5 cents each, to raise ~ 18.5 million for acceleration of its ongoing exploration and drill activities. The placement was led by Hartleys Limited and received strong support from both current shareholders and new sophisticated and professional investors, reinforcing the companyâs confidence to move forward with a robust balance sheet.

Recent Updates

- The company recently established a small shareholding sale facility for eligible shareholders, announced on 7 August 2019, with less than $ 500 worth of OBM shares, offering them to sell their shareholdings without bearing the incurring brokerage or handling costs (Record Date: 6 August 2019; Closing Date: 23 September 2019).

- On 8 July 2019, Ora Banda Mining informed to have commenced its planned exploration drilling program and high impact resource drill out program at its project tenure. Besides, the company has also forwarded ~ 2,568 diamond core samples to laboratories (SGS in Kalgoorlie & Nagrom in Perth) from eight previously drilled holes in the Waihi area that were not assayed due to the scarcity of funds. A further 2,684 diamond core, RC and auger samples (un-assayed) from previous exploration programs were also submitted for analysis. Subsequently on 29 July 2019, Ora Banda reported the first assays from these analyses, that demonstrated high-grade results including 23m @ 9.1g/t Au from significant extensional drilling down dip of the Waihi Orebody.

Stock Performance: Ora Banda Miningâs market capitalisation stands at around AUD 104.58 million, with approximately 486.42 million shares outstanding. On 22 August 2019, the OBM stock was trading at AUD 0.230, up by 6.977% as compared to its previous closing price. Further, the OBM has delivered positive returns of 34.38% in the last three months and 43.33% in the last one month.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.

_06_16_2025_01_53_42_112199.jpg)