The exploration company, Krakatoa Resources Limited (ASX:KTA) has aggressive acquisition-driven growth strategy with an emphasis on critical high-value raw materials crucial to the creation, storage, and transportation of electrical energy. The high value minerals upon which the company has been focusing on include Nickel, Lithium, Tantalum, Rare Earth Elements and many more.

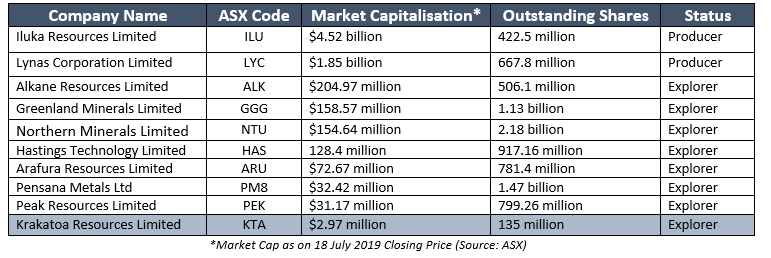

With its recently acquired Mt Clere Rare Earth Project, the company has created a lot of buzz among investors. Due to the expanding REE market opportunities and forecasted REE price hikes, some analysts believe that Krakatoa Resources has a good potential to capture the REE uprising. Moreover, the company has a market capitalisation of around $2.97 million, which is substantially lower than many of its closest peers like Hastings Technology Metals Ltd (ASX: HAS), which has a market cap of around $128.4 million, making Krakatoa an attractive proposition.

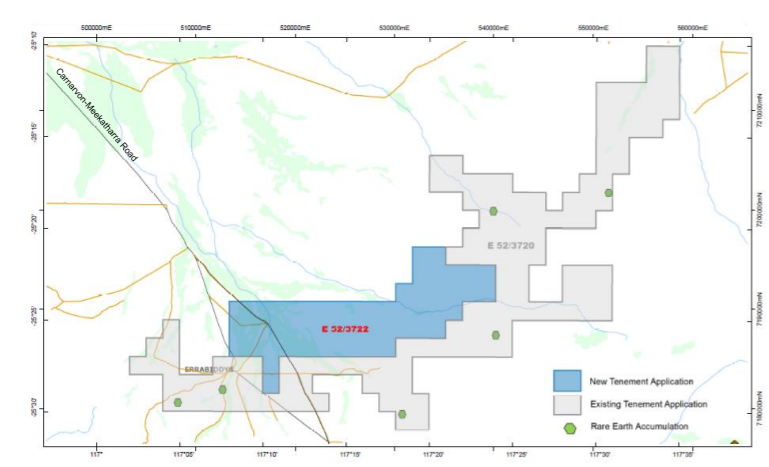

Considered as a highly prospective Rare Earth Project in Western Australia (WA), Mt Clere Project has the potential to take Krakatoa to new heights of achievement. With the new exploration license application (E52/3722), Mt Clere Rare Earth Project is currently covering 556km2 of the area within the Gascoyne Region of WA and is prospective for three Rare Earth Element (REE) deposit styles:

- Monazite sands in vast alluvial terraces

- Carbonatite dyke swarms

- Chinese-type ion adsorption clays in extensive laterite areas

Mt Clere REE Project - New Application Location (Source: Company Reports)

Mt Clere REE Project - New Application Location (Source: Company Reports)

The areas covered by the Mt Clere Rare Earth Project include broad zones with high tenor Th radiometric anomalies, many of which are associated with concentrations of monazite sands in the drainage networks and some of them are lying over deeply weathered terrain developed in the country rocks. This means that the project may have ion adsorption REE (Rare Earth Elements) clay-type deposits similar to those found in South China. If this turns out to be true, the company will most likely hold the only REE project of this type in the western world.

Since 1995, many companies including BHP, Astro Mining NL and All Star Minerals Plc have conducted exploration programs on this project and produced highly encouraging results. BHP sampling identified various highly prospective areas for thorium and REE mineralization and if BHP was looking for REEs at that time, arguably it would still be holding this ground. When BHP was conducting its exploration program, it was an era of pre-personal electronic gadgets, pre-EV revolution, pre-renewable energy revolution and pre-Chinaâs stunning rise.

REE Market: China currently produces around 90% of high-value rare earth elements. Recent changes within Chinaâs manufacturing sector suggests the period of low prices and oversupply is now over for rare earths as they are likely to be consumed by integrated Chinese domestic supply chains. Moreover, a recently announced US Defense law bans the purchase of rare earth magnets from China, creating new demand potential for companies like Krakatoa, which has REE projects outside China.

At present, China dominates the global rare earths market (US$3-5 billion) with 85-90% of supply. However, high growth rates for rare earth permanent magnets (REPMs) due to a surge in global demand for electric vehicles, coupled with reduced supply from China, are expected to lead to shortages by 2020.

Globally, demand is increasing for rare earth materials used in permanent magnets for future-facing technologies, such as electric vehicles and wind turbines. It is believed that Rare Earths will be critically important to the global agenda of energy efficient technologies, clean energy generation, and the electrification of transport systems.

With rare earths being a critical component of the future of renewable energy and the electric vehicles (EV) revolution, the US and other western nations realised that it is strategically important to diversify production and reduce Chinaâs dominance in the sector. Up until 2017, the focus for EVs was on the lithium-ion batteries that power them, however, since then, producers and investors have realised that the electric motors that drive them are just as critical. Electric motors used in EVâs use rare earth permanent magnets. Due to the above-mentioned reasons, the global demand for REEs is expected to rise.

Through its Mt Clere Rare Earth Project, Krakatoa Resources intends to cater to the growing global demand for REE. The company has already started the data compilation and non-invasive groundwork on the Project.

Along with EVs, REEs are widely used in high tech devices, like smart phones, Flat screen TVs, digital cameras, computer hard drives, in fluorescent and LED lighting, etc. Currently, the glass industry is the largest purchaser of REE raw materials and besides that REEs are also used in clean energy and defense technologies.

With such a bright addressable market, Krakatoa is setting itself up to capture the unfolding opportunity. The appetite for the companyâs shares was showcased during KTAâs recently concluded shares placement.

The placement was announced on 4th June 2019. Due to the additional demand for the Placement, the company accepted applications for an additional 5,000,000 fully paid ordinary shares. A total of 17,500,000 fully paid ordinary shares at an issue price of 2.2 cents were issued, to raise $385,000 (before costs), which will be used to conduct exploration activities on the companyâs existing projects, with a focus on the Mt Clere Rare Earth Project, evaluate further acquisition opportunities and for general working capital purposes.

At market close on 19th July 2019, KTAâs stock was trading at a price of $0.025, up 13.636% intra-day, with a market cap of $2.97 million.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.