The Lachlan Fold Belt in the New South Wales has continued to bewitch the junior gold explorer as among the mining majors through the strong Au-Cu Porphyry mineralization. In fact, the fold belt is considered as Australia’s hottest porphyry address by many. Although the mining history in the region dates to centuries, the recent operations and new discoveries actually enthralls the explorers and miners.

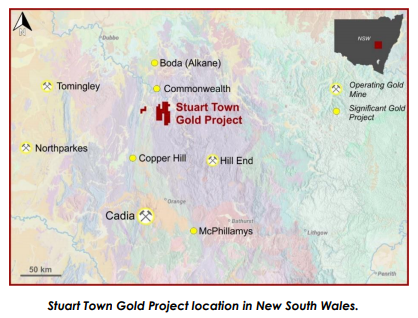

Kaiser Reef Limited (ASX: KAU) is one such enchanter, the flagship Stuart Town Gold project is located between the Alkane Resources’ Boda discovery and the Newcrest Mining’s Cadia valley gold copper operations. The Boda project registered an intercept of 1,167 metres with 0.55 grams per tonnes Gold and 0.25% Copper, 75 meters downhole during the latest diamond drilling program along the strike. Newcrest’s Cadia Ridgeway operations holds mineral resources of over 38 million ounces of gold producing 913,000 ounces of gold at an All-in sustaining cost (AISC) of $132 an ounce Gold, realizing a revenue in excess of $1 billion.

Kaiser Reef announces grant of Exploration License, aims bulk tonnage Gold Mineralisation: Read Here

Kaiser, no time to waste, Progressed on Exploration

Kaiser was listed on ASX on 28 February and soon after on 11 March, the Coronavirus outbreak was declared a pandemic by the World Health Organization. Fears and uncertainties wiped off major market values during March and April, but Kaiser showed resilience and held grounds during the headwinds. The rising uncertainties and market underperformance led the safe haven asset gold prices shoot up, the primary commodity that Kaiser is pursuing in the Lachlan Fold Belt.

Kaiser Reef closed at $0.25 a share on 13 May 2020, with a market capitalization of $8.86 million. The stock offers a return of over 25% against the listing price.

With market in doldrums, Kaiser immediately secured additional tenements (ELA 5937 and ELA 5921) in the vicinity of Stuart Town and utilised the time to conduct a high resolution airborne magnetic and radiometric survey, the data which will be processed by Kaiser and Resource Potentials for identifying and prioritising the drilling targets.

The auditing, recalibrating and reprocessing segments of the historic exploration data by CRA, presently a part if Rio Tinto Group, has been completed by KAU as per the 2012 JORC guidelines.

To check out the Recent Activities, Read: Kaiser releases Activities Report and continues on the Stuart Town ‘s Exploration Path

Additional Project along Macquarie Arc

Kaiser Reef secured tenements on the north end of the prospective and mineral rich, Macquarie Arc. The Macquarie North project includes two license applications namely, ELA 5948 and ELA 5949, with prospects of large-scale gold copper porphyry systems. The venture lies in vicinity of mineral projects by FMG Resources Pty Ltd and Kincora Copper Australia Pty Ltd. Kaiser remains highly prospective on the project and will continue to pursue its interests at the Stuart Town. As per USGS and other institutions, The Macquarie Arc includes 9 known deposits with over 13.5 million tonnes of copper and over 54.7 million ounces of Gold disseminated across 41,500 square kilometres.

The gold explorer now enjoys not one but two prospective mineral projects with probable high order mineralisation systems.

.jpg)