By the end of the trading session, on 1st November 2019 on Australian Securities Exchange, the benchmark index S&P/ ASX 200 was at 6669.1 points, with a rise of 5.7 points or 0.1% from its last close. During the trading session, on 1 November 2019, some companies have witnessed a decent growth, filling the pocket of the investors. In this article, we would be discussing the recent updates of the stocks that closed the day in green zone.

Estia Health Limited (ASX: EHE)

Estia Health Limited (ASX: EHE) is involved in the provision of services in the residential aged care homes in Australia.

Change of Directorâs interest

Estia Health recently announced that one of its directors- Gary Weiss has acquired 1,364 fully paid ordinary shares on 2nd October 2019 at a consideration of $2.59, which led to change in his interest in the company. However, after the change in his interest, the director now possesses 46,676 fully paid ordinary shares in EHE.

2019 Annual General Meeting

In another update, EHE announced that it would be conducting its Annual General Meeting (Shareholders Meeting) on 6th November 2019 and a few key business items to be discussed are as follows:

- The company would be receiving and considering the Directorsâ Report, the Financial Report and the Auditorâs Report for FY19.

- EHE would be adopting the Remuneration report for the year closed on 30 June 2019.

Financial Statistics of EHE

- For a challenging 12 months (FY19), the company reported EBITDA amounting to $94.0 million, which witnessed a rise of 4.3% in comparison to the financial year 2018.

- The average occupancy rate stood at 93.6%, reflecting a rise of 94.1% in spot occupancy at 16th August 2019.

- During the year, the company made capital investment amounting to $93.8 million for expanding and enhancing the home portfolio.

- The company declared a full franked final dividend amounting to 7.8 cps, which brought the full year, fully franked dividend to 15.8 cents per share. This dividend represents a payout ratio of around 100% of Net Profit After Tax (NPAT) for FY19.

- As stated by the key personnel of the company, EHE strongly supports further reform as well as implementation of key recommendations from a numerous recent reviews in the sector, designed to deliver a sustainable, high quality aged care sector which meets societyâs expectations of care with what it was willing and able to pay.

Outlook

- EHE is prepared well for new quality standards, with investment in increasing resident amenity as well as improvements in quality and safety systems.

- It continues to refine its strategy and focus related to occupancy, which would become ever more crucial in an environment of heightened competition, and increased consumer anticipations.

The stock of EHE last traded at $2.89, up 2.847% from its prior close, as on 1st November 2019. The market capitalisation of the company stands at $733.66 million. The stock made a high and low of$2.990 and $2.030 during the last 52 weeks. EHE has generated return of 4.07% and -2.77% during the last three-month and six-month, respectively.

Gold Road Resources Limited (ASX: GOR)

Gold Road Resources Limited (ASX: GOR) is engaged with the exploration of gold prospects and other minerals, as well as the development of the Gruyere Project in Western Australia (WA).

Decent Numbers in Third Quarter

- Recently, the company updated the market with its operational and financial performance for the Q3 FY19 period closed 30 June 2019, wherein it reported production from Gruyere at 29,107 ounces during the quarter. It added that the ramp?up of Gruyere was progressing well, with commercial production attained at the end of Q3 FY19, which was marginally above the guidance.

- It was mentioned that diamond drilling at Gruyere was about to conclude to allow conversion of a substantial part of the existing Inferred Resource to indicated Resource status in favour of future optimisation of the mine plan as well as mine infrastructure.

- On the financial front, the companyâs cash and bullion in hand stood at $65.3 million and $5.8 million, respectively as at 30th September 2019.

- However, the net debt of the company amounted to $9.3 million. The company has withdrawn $80.4 million debt from its finance facilities of $150 million.

Guidance for FY19

- In the third quarter results, the company restated 2019 annual guidance range at the upper end of 75,000 - 100,000 ounces.

- It provided no change to AISC (All-in-sustained cost) for December 2019 quarter, which is in the range of $1,050-$1,150/ounce.

The stock of GOR last traded at $1.18, up 3.965% compared to its previous close, as on 1st November 2019. The market capitalisation of the company stands at $997.53 million. The stock made a low and high of $0.590 and $1.645 during the last 52 weeks period. GOR has generated return of -17.75% and 22.70% during the last three-month and six-month, respectively.

Regis Resources Limited (ASX: RRL)

Perth based, Regis Resources Limited (ASX: RRL) with its controlled entities is primarily involved with the gold production from the Duketon Gold (Project) within the NE Goldfields of WA region.

Welcomed FY20 with Decent Production Numbers

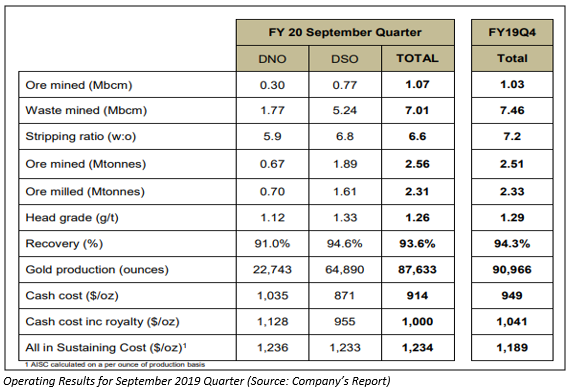

- Recently, the company through a release announced its results for the September quarter (Q1 FY20), wherein it stated that the team of Regis has witnessed a gold production of 87,633 ounces during the period.

- It experienced good progress on several future growth-related projects with a continuity to pay a dividend.

- For the quarter, the pre-royalty cash cost stood at $914/oz and AISC stood at$1,234/oz as compared to June 19 cash cost of $949/oz and AISC of $1,189/oz, respectively.

- The company experienced a major uplift in exploration, which was fueled by growth potential resulted from large strategic tenement holding acquisition in the Duketon Greenstone Belt in consideration of $20 million as cash and up to $5 million in contingent payments.

- RRL anticipates reliable performance from the current Duketon Operations, as well as a gradual introduction of new production coming from Rosemont Underground as well as new satellite pits. It added that the future of RRL is very exciting with Rosemont Underground and new satellite pits work and RRLâs transformational McPhillamys Gold Project in NSW, which is making steady progress.

- The company provided no change to full Year production guidance in the range of 340,000-370,000 oz at an AISC range of $1,125-$1,195/oz.

The stock of RRL last traded at $4.980, up 1.633% from its previous close, as on 1st November 2019. The market capitalisation of the company stands at $2.49 billion. The stock made a high and low of $6.720 and $4.030 during the last 52 weeks. RRL has generated return of -12.03% and 3.38% during the last three-months and six-months, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.