The two important stocks in the agriculture and real estate sectors are Elders Limited (ASX:ELD) and Estia Health Limited (ASX:EHE). Let's see how these stocks have performed based on their recent updates.

Elders Limited (ASX:ELD)

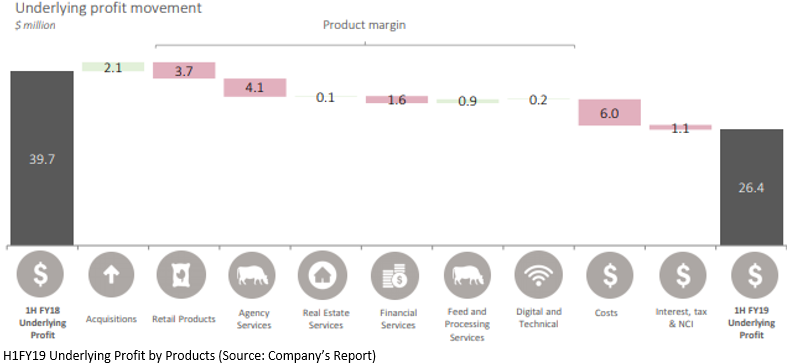

Elders Limited (ASX:ELD) offers the provision of livestock, real estate, and wool agency services, financial products and services to rural and regional customers, real estate operations in both rural and residential markets, including property management services, etc. The company recently published its H1 FY19 results, wherein ELD reported a statutory NPAT of $27.4 million as compared to $41.4 million in pcp. Its underlying net profit decreased by $13.3 million to $26.4 million. ELDâs underlying EBIT decreased from $45.8 million in H1 FY18 to $33.5 million in H1 FY19, majorly on the back of lower wool volumes, increased costs associated with footprint growth, and continued investment in digital and technology areas. Its operating cash outflow was reported at $13.1 million. ELDâs year-to-date (YTD) average net debt increased by $81 million to $224 million as a result of investment in Titan and increased retail balances carried due to the seasonal conditions.

ELD, for the 12 months to 30th September 2019, expects its underlying EBIT to be in the range of $72 million to $75 million and its underlying net profit after tax to be between $61 million to $65 million.

On the stock information front, the stock of Elders Limited was trading at $5.670, with a market capitalisation of ~$680.58 million as on 31st May 2019. Its current PE multiple stands at 11.750x, and its last EPS was noted at $0.496. Today, it reached dayâs high at $5.850 and dayâs low at $5.610, with a daily volume of 1,485,270. Its 52 weeks high and low price stands at $9.470 and $5.450, with an average volume of 646,058 (yearly). Its absolute returns for the past one year, six months and three months are -34.86%, -13.76%, and -7.75%, respectively.

Estia Health Limited (ASX:EHE)

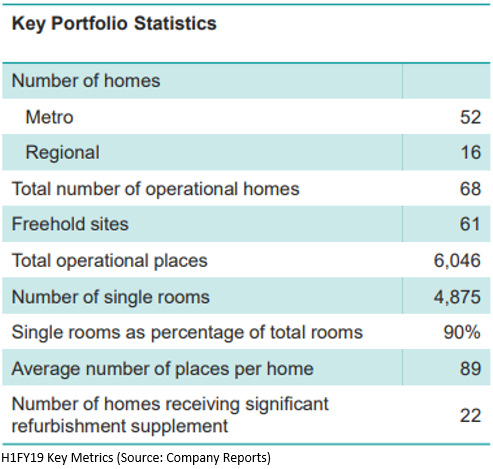

Estia Health Limited (ASX:EHE) is engaged in the operation and development of owned and leased residential aged care homes throughout Australia. The company recently announced that the Vanguard Group, Inc. and its controlled entities became a substantial holder in EHE with a voting power of 5.2%, effective from May 17, 2019. In another trading update, EHE highlighted that it expects FY19 EBITDA to be in the range of $92 million to $94 million, including Royal Commission costs, additional funding increase, home closure costs and costs of opening new homes.

EHEâs occupancy in the period was impacted by influenza in South Australia and continuing adverse publicity in the sector. Due to increased compliance activity, EBITDA generated by mature homes is now expected to fall between $86 million to $88 million in FY19 compared to $90.1 million reported in FY18.

On the stock information front, the stock of Estia Health was trading at $2.700, with a market capitalisation of ~$714.05 million as on 31st May 2019. Its current PE multiple stands at 17.010x, and its last EPS was noted at $0.161. Today, it reached dayâs high at $2.740 and dayâs low at $2.640, with a daily volume of 718,762. Its 52 weeks high and low price stands at $3.45 and $2.03, with an average volume of 1,209,877 (yearly). Its absolute returns for the past one year, six months and three months are -16.72%, 27.44%, and 16.10%, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.