Before investing in the market, every investor experiences a major conflict between choice of class of investment like large cap, mid cap and small cap. As small cap company possesses relatively more risk in comparison to large cap and mid cap. But investing in small cap also provides opportunities to grow the wealth with the growth in the company over long-term period.

In the below article, we would be discussion the three small payers on Australian Stock Exchange such as Cann Group Limited, CannPal Animal Therapeutics Limited and Exopharm Limited.

Cann Group Limited (ASX: CAN)

Cann Group Limited (ASX: CAN) is involved with growing cannabis for solving the purposes like medicinal and research work. The company is also in the manufacturing of medicinal cannabis products.

The company together with IDT Australia Limited (ASX: IDT) through a release announced that the first commercial medicinal cannabis product, which is to be produced from the cultivation operations of the CAN has been packed by IDT under cGMP conditions. It was also mentioned that this would undergo stability testing ahead of release in the Q1 CY20.

Agreement Between CAN and IDT

- The company and IDT Australia have entered into an agreement, where IDT would provide cGMP manufacturing services as well as support for converting medicinal cannabis produced by Cann into cGMP grade Active Pharmaceutical Ingredient.

- IDT would also provide product formulations for patients in Australia and globally.

In another update, the company announced the appointment Ms Geraldine Farrell as Company Secretary and Ms Reena Dahiya as Acting Chief Financial Officer, which became effective on 6th December 2019.

As per the key personnel of the company, during FY19, the company continued to make investment in important research which would support advancements in its genetics program. The company has also wrapped up 51 successful harvests at its Northern and Southern facilities.

The stock of CAN was trading at $0.860 per share on 7th January 2020 (at AEDT 1:02 PM), reflecting a fall of 13.568%. The company has a market capitalisation of $141.71 million as on 7th January 2020. The total outstanding shares of the company stood at 142.42 million, and its 52-week low and high is $0.375and $2.570, respectively. The company has given a total return of -33.22% and -52.39% in the time period of three months and six months, respectively.

CannPal Animal Therapeutics Limited (ASX: CP1)

CannPal Animal Therapeutics Limited (ASX: CP1) is involved in the research and development of the products related to animal health.

Exclusive Licencing Agreement

- The company recently announced that Commonwealth Scientific and Industrial Research Organisation (CSIRO) has awarded exclusive global rights to the company in order to commercialise patented MicroMAX® microencapsulation technology for use in the field of Animal Therapeutics after 18-month evaluation.

- It was also mentioned that CP1 has filed a patent application for the anti-inflammatory formulation and it would commence a small-scale commercial evaluation of a new product format in first quarter of 2020.

As per the key personnel of the company, CP1 has wrapped up phase 1 of its research for CPAT-01, which happens to be its leading pharmaceutical product. The company was also delighted to receive acknowledgement by its peers with the acceptance of its first research abstract for publication. The vision of the company revolves around being a leader in the development of therapeutic products for companion animals by using plant compounds derived from the hemp and cannabis plant.

For the quarter ended 30th September 2019, the cash balance of the company stood at $2.78 Mn with operating outflows amounting to $519,000 for the period, with $370,000 related to the costs associated with the research and development of the CP1’s lead pharmaceutical as well as nutraceutical drug candidates.

The stock of CP1 was trading at $0.160 per share on 7th January 2020, reflecting a fall of 11.111% (at AEDT 1:06 PM). The company has a market capitalisation of $16.76 million as on 7th January 2020. The total outstanding shares of the company stood at 93.13 million, and its 52-week low and high is $0.091 and $0.200, respectively. The company has given a total return of 24.14% and 50% in the time period of three months and YTD, respectively.

Exopharm Limited (ASX: EX1)

Exopharm Limited (ASX: EX1) is a biopharmaceutical research company having primary focus on developing and commercialising exosomes as therapeutic agents. The company recently announced, that it has extended the employment of Dr Ian Dixon on the role of Managing Director and Chief Executive Officer. The PLEXOVAL study of the company places EX1 in a leadership position in the exosome field internationally. This study of the company has been modified in order to prioritise Cohort 2 over Cohort 1, wherein Cohort 2 involves up to 5 participants.

Share Purchase Plan

- In the month of August 2019, the company closed its Share Purchase Plan and raised an amount of $1,099,640 and issued 2,972,000 fully paid ordinary at the price of $0.37 per share.

- The company would be utilising the funds in order to speed up the development related works of the company through manufacturing, testing as well as development of more intellectual asset. Every property is targeted at certifying the products and technologies of EX1 as well as drawing partnership agreements towards it.

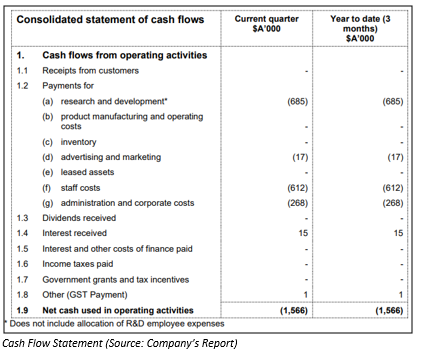

The net cash used in the operating activities of the company stood at $1.566 million after making major payments such as research and development and staff costs amounting to $0.685 million and $0.612 million, respectively.

The stock of EX1 was trading flat at $0.325 per share on 7th January 2020 (at AEDT 1:08 PM). The company has a market capitalisation of $31.03 million as on 7th January 2020. The total outstanding shares of the company stood at 95.47 million, and its 52-week low and high is $0.250 and $0.670, respectively. The company has given a total return of -16.67% and -25.29% in the time period of three months and six months, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.