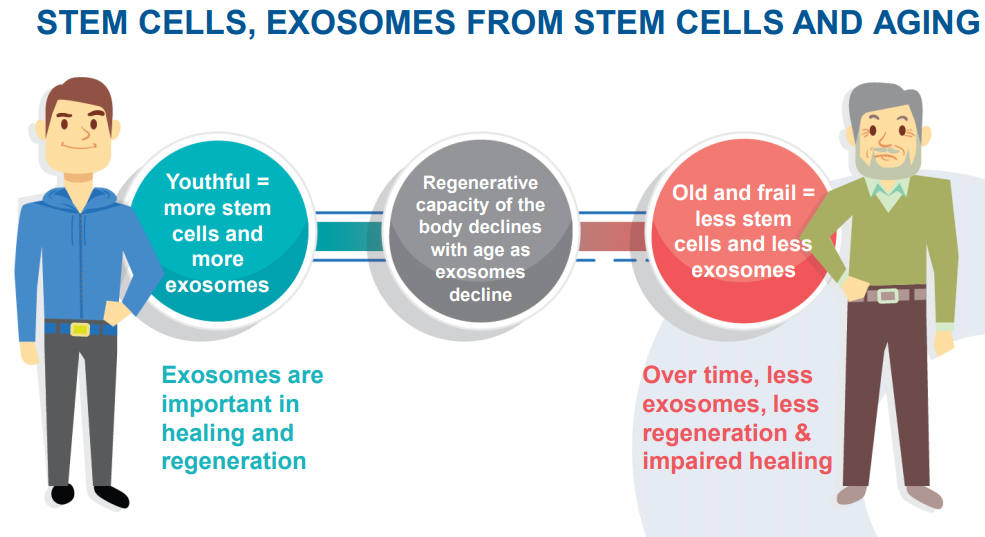

The science of Regenerative Medicine is a rapidly emerging field linking the medical technology, biotechnology and pharmaceutical sectors, and holds much potential to deliver better patient outcomes and drive economic growth. Regenerative Medicine Therapies use stem cells and engineered biomaterials combined with certain molecules to repair, regenerate or replace diseased or damaged cells, tissues and organs, enabling the body to regenerate and heal itself.

There are over 1,200 researchers across Australian universities and medical research institutes working to bring about advancement in this field, and around more than 30 Australian companies are active in this space.

Letâs look at whatâs happening with the following four healthcare sector players in Australia.

Exopharm Limited

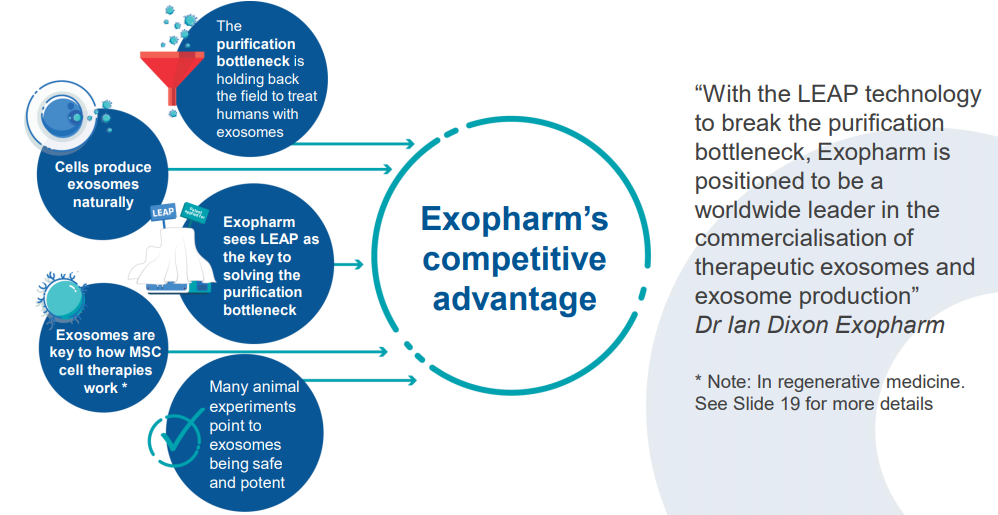

Australia-based Exopharm Limited (ASX: EX1) is a clinical-stage regenerative medicine company engaged in developing and commercialising exosomes, obtained from human platelets and purified using the LEAP Technology, as therapeutic products âPlexaris⢠and Exomeresâ¢.

Source: Investor Presentation

Exopharmâs market capitalisation is around AUD 38.15 million with approximately 95.37 million shares outstanding. On 30 August 2019, the EX1 stock price closed the trading session at AUD 0.400, with ~ 62,680 shares traded.

PLEXOVAL Phase 1 Study Update - Recently on 26 August 2019, the company announced that it had commenced the PLEXOVAL Phase 1 study, the first human clinical trial using exosomes for wound healing, following the receipt of all regulatory and site approvals and sites currently being prepared for the initiation of recruitment and dosing. The Human Research Ethics Committee recently granted approval to Exopharm to proceed with the Phase 1 study with Plexaris⢠,which is approved under the Australian Clinical Trials Notification (CTN) scheme as well.

Source: Investor Presentation

This clinical trial would be executed at two sites- the Australian Red Cross Blood Service and the Royal Melbourne Hospital and involve evaluation of autologous (from the same person) Plexaris administered once by local injection. Participants would be tracked through 42 days from the time of dosing. There would be 2 cohorts- Cohort 1 with up to 15 participants and Cohort 2 with up to 5 participants. The inferences of the study would be based on wound closure, safety, and scarring.

Associate Professor Johannes Kern MD, PhD, FEBDV, FACD of the Dermatology Department, Royal Melbourne Hospital, is the principal investigator of the study, that is being facilitated by Accelagen, a Melbourne-based Contract Research Organisation (CRO).

Exopharm is expecting the study report to be provided by sometime before mid-2020.

Oventus Medical Limited

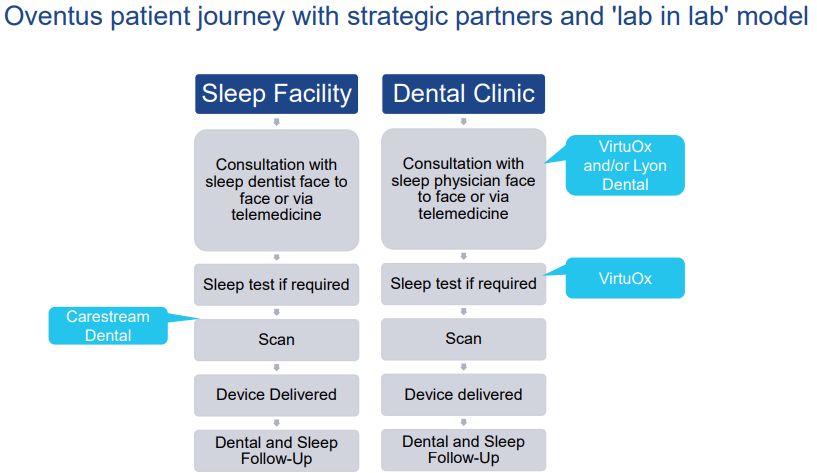

Brisbane, Australia-based Oventus Medical Limited (ASX:OVN) is engaged in driving commercialisation of its unique treatment platform that has been developed to target sleep apnoea and snoring in people. The company has developed a collaborative Sleep Physician/ Dental strategy that streamlines patientsâ access to treatment. Unlike other oral appliances or CPAP interfaces, Oventus O2Vent® devices manage the entire upper airway via a unique and patented built-in airway for patients experiencing nasal obstruction.

Oventus Medicalâs market capitalisation stands at around AUD 61.34 million with ~ 127 million shares outstanding. On 30 August 2019, the OVN stock traded flat at AUD 0.480, with ~ 194,716 shares traded.

Besides, OVN has delivered positive returns of 62.01% YTD and 102.53% in the last three months.

FY19 Results Update - Recently on 26 August 2019, Oventus Medical disclosed its financial results for the year to 30 June 2019 (FY19), posting 22% increases in its revenue to $ 331,837, while the loss from ordinary activities after tax totalled $ 7,848,255, up 34% on the prior year.

The company incurred development expenditures of $ 1,318,854 during FY19 (FY18: $ 1,737,286) and also reported the receipt of $1,039,988 as a credit rebate for FY18 R&D spend from the Australian Federal Government in November 2018. Throughout the last financial year, there has also been increased focus on training sleep physicians and dentists in the clinical application of Oventus Airway Technology.

Also, the company introduced the new âlab in labâ business model, to simplify patientsâ experience and build value for all stakeholders like sleep physicians and dentists. Some synergistic agreements concerning lab in labâ were also signed in July 2019 with Carestream Dental, VirtuOx and Lyon Dental.

Source: Companyâs Investor Presentation

On 15 August 2019, Oventus signed further material agreements with US sleep medicine groups, Delaware Sleep Disorder Centres and Reliable Respiratory that will adopt the O2Vent® Sleep Treatment Platform and âlab in labâ business model.

Bard1 Life Sciences Limited

An Aussie medical tech player, BARD1 Life Sciences Limited (ASX: BD1) if focussed on early detection of cancer, and develops and commercialises its non-invasive diagnostic tests to improve the lives of patients. The company has also developed a proprietary tumour marker platform that has potential diagnostic and therapeutic applications across different types of cancers. The pipeline includes BARD1 autoantibody tests in development for early detection of breast, ovarian and lung cancers.

BARD1 Life Sciencesâ current market cap stands at around AUD 41.02 million with ~ 1.37 billion shares outstanding. On 30 August 2019, the BD1 stock price settled the dayâs trading at AUD 0.028 with approximately 2.7 million shares traded.

Besides, BD1 has delivered positive returns of 77.95% in the last six months and 37.50% YTD.

Quarterly Business Update - On 31 July 2019, BARD1 Life Sciences released its business update for the quarter ended 30 June 2019, reporting progress on Assay Development Program with the transfer of BARD1 technology to the Luminex platform on-track, phase 1 and 2 completed and pilot RUO BARD1 kits delivered for evaluation.

The company also informed that three new patents had been granted and/or validated in the USA, Europe and Hong Kong covering the BARD1 technology and pipeline products. During the quarter, two new healthcare industry experienced directors Philip Powell and Max Johnston were also appointed to guide the commercialisation and growth strategies.

BARD1 Life Sciences also commenced recruitment of additional staff for Geneva facility to accelerate research projects and implement technology transfer. The company also successfully raised capital during the period through a $ 7.5 million funding package including $ 5-million private Placement in June 2019 and $ 2.5 million- Entitlement Offer in July 2019 that would be directed to support the companyâs growth strategy. The cash balance stood at $ 7.55 million as at 30 June 2019.

Oncosil Medical Ltd

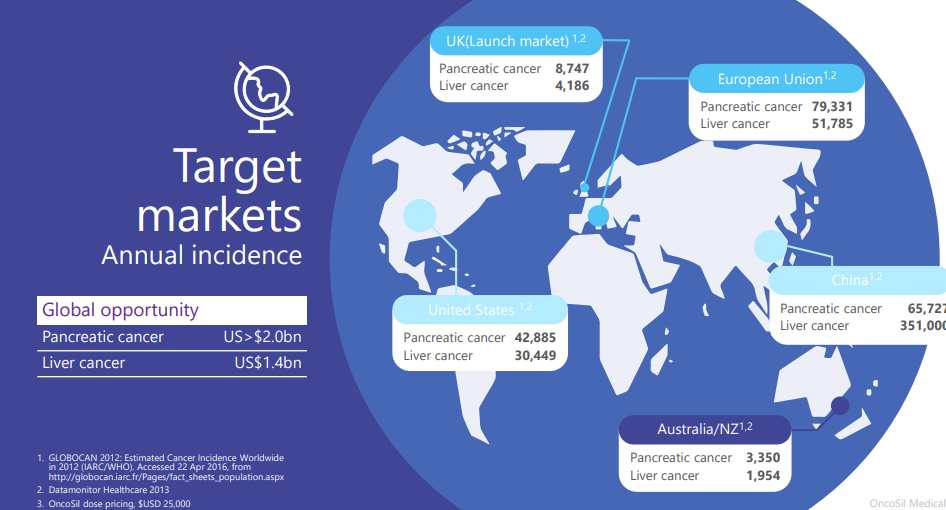

Sydney, Australia-based OncoSil Medical Limited (ASX:OSL) is a medical device company developing and commercializing medical products for the treatment of pancreatic and liver cancer. The company's flagship offering is OncoSil, a targeted radioactive isotope (Phosphorus-32), that is directly implanting into the cancerous tumour via an endoscopic ultrasound.

Source: 2018 AGM CEO Presentation

OncoSil has a market cap of ~ AUD 41.63 million and the OSL stock price settled the dayâs trading on 30 August 2019, at AUD 0.071, with ~ 1,853,566 shares traded.

FY19 Results â On 23 August 2019, OSL announced its FY19 results. Recently in March 2019, BSI and its Clinical Oversight Committee (COC) notified OncoSil of its initial unfavourable assessment of the companyâs CE Marking application, The company, in response, submitted on July 30th its formal response to the Notified Bodyâs assessment based on the results of the PanCo study.

During FY19, OncoSil Medical reported a couple of key clinical and operational milestones as it continues to bring the OncoSil⢠device to market. These inlcude-

· Presentation of positive Overall Survival data from the PanCo Study at the American Society of Clinical Oncology (ASCO) Annual Meeting in June 2019, explaining the promising survival estimates with mean overall survival of 16 months.

· Appointed IQVIA as OSLâs advisor for EU market access & reimbursement.

· The US Food and Drug Administration confirmed that PanCo (ex-US) clinical study safety data met the IDE (Investigational Device Exemption) requirements and gave OncoSil Medical a green signal to continue running its full US pivotal study without further US patient data. The companyâs US OnoPAC-1 clinical study has since completed patient recruitment, with 9 patients enrolled and implanted with the OncoSil⢠device.

As at 30 June 2019, the cash and cash equivalents amounted to $ 7.7 million and the R&D Tax income refund stood at $ 3.8 million (FY18: $ 4.3 million).

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.