Agriculture sector contributes around 3% to Australiaâs GDP (Gross Domestic Product). The gross value of farm production in the country for the year 2016-17 stood at $60 Bn. In the year 2016-17, Australia exported around 77% of the produce, and earned up to $44.8 Bn, as compared to $32.5 Bn in the year 2010-11. As per the data from National Farmersâ Federation, around 85.68K farm businesses exist in the country, out of which 99% are Australian owned and operated. The produce by each farmer feed around 600 people (150 domestic and 450 overseas).

Two important stocks of this sector are Webster Limited (ASX:WBA) and Cleanaway Waste Management Limited (ASX:CWY). Letâs see how the recent developments in these companies are affecting their stock prices.

Webster Limited (ASX:WBA)

Webster Limited (ASX:WBA) is involved in the production, marketing and processing of cotton, walnuts and other annual livestock and crops. Recently, the company entered into a binding scheme implementation agreement (SIA) with PSP BidCo and Sooke Investment Inc, which are the indirect 100% owned subsidiaries of PSP Investments, which is one of the largest pension investment management firms in Canada.

Agreement Details

Under the agreement:

- PSP BidCo is expected to acquire all the ordinary shares (which PSP Investments does not already own) in WBA for a cash price of $2.00 per Webster Share by way of a court-approved scheme of arrangement.

- The Scheme and Preference Share Scheme (together the Proposed Transaction) imply a market capitalisation for Webster of around $724 Mn and an enterprise value of around $854 Mn.

- The Scheme Consideration represents a 57% premium over the closing share price of $1.27 of Webster on 2 October 2019; 60% premium to the 30 day volume weighted average price (VWAP) to 2 October 2019 of $1.2521; 47% premium to the net assets per share (including water rights) as at 31 March 2019 of $1.36 (being the last published balance date).

Implementation of the Scheme remains subject to certain other customary conditions, including approval by the Australian Competition and Consumer Commission (ACCC) and Foreign Investment Review Board (FIRB). Moreover, the scheme is dependent on no material adverse change, regulatory intervention, warranty breach or prescribed occurrence, in addition to court approval.

H1FY19 Key Highlights for the period ended March 31, 2019

Revenue and other income for the period was reported at $69.1 Mn, while reported net profit after tax for the period stood at $2.12 Mn. The companyâs acquisitions and development programme in the period continued to create a stronger asset base for future growth.

- It acquired shares (100%) in the Australian Rainforest Honey Pty Limited for a value consideration of $5.2 Mn. Australian Rainforest is a bee apiary business located in NSW, and the proceeds would be helpful in cross-pollinate almond trees and for honey production.

- The company also acquired cropping rights to walnut orchards in a deal worth $10 Mn. The rights cover 422 hectares.

- Under the development programmes, 259 hectares for almond plantings at Sandy Valley, 125 hectares for Walnut plantings at Leeton and 181 hectares for walnut planting at Avondale West would be developed.

- The company is finalising its development programme at Kooba and Hay, which would include boosting irrigable hectares and additional water storage capacity for better water resources utilisation.

For the six-month period, market value of water entitlements was estimated to be around $360 Mn as compared to carrying amount of $175.9 Mn. The company didnât pay ordinary dividend for the first half period and expects to record a near breakeven position for the full year to September 30, 2019. The Board of Directors declared an unfranked dividend of 9 cents per share for the preference shares with record date and payment date on June 7, 2019 and June 27, 2019, respectively.

On the stock information front

On October 4, 2019, WBA traded flat at $1.940, with a market cap of ~$702.76 Mn. Its current PE multiple is at 27.13x and annual dividend yield is 1.55%. Its 52 weeks high and 52 weeks low stand at $1.960 and $1.155, respectively. The stock has generated an absolute return of 10.54% for the last one year, 28.48% for the last six months, and 38.57% for the last three months.

Cleanaway Waste Management Limited (ASX:CWY)

Headquartered in Victoria, Australia, Cleanaway Waste Management Limited (ASX:CWY) is a waste management, industrial and environmental services company, which is involved in

- Collection services for sectors including commercial, industrial, municipal and residential. The company collects all types of solid waste streams, such as general waste and recyclables, in addition to providing construction and demolition waste and medical and washroom services;

- Owning and managing facilities like waste transfer stations, resource recovery and recycling facilities;

- Catering to domestic and international marketplaces through the sale of products such as recovered paper, cardboard, metals and plastics;

- Collecting, treating, processing as well as recycling of liquid and hazardous waste.

Recently, the company issued 2,526,988 new ordinary shares at a price of $2.0263 per share, with the purpose to satisfy its obligation under the Dividend Reinvestment Plan, operational during the FY2019 final dividend payment.

New Project

In another update, CWY announced plans regarding the development of an energy from waste project in Western Sydney (a joint venture with Macquarie Capitalâs Green Investment Group), which will utilise leading European technology to convert waste from households and local businesses into electricity for close to 65K Western Sydney homes.

Both the companies will be co-investing and co-developing the project but will be operated by CWY. The project, which is likely to target red bin waste that cannot be recycled, would have the capacity to cut the annual landfill volumes of Western Sydney by 500K tonnes, which is almost a third of the red bin waste generated every year in the local area.

FY19 Key Highlights for the period ended June 30, 2019

Key highlights for the reported period are:

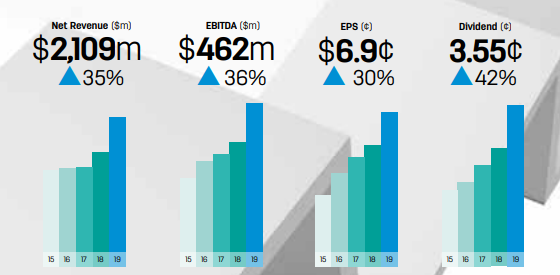

- Net revenue for the period was reported at $ 2,109.1 Mn, which represents an increase of 34.8% on the previous year.

- Gross revenue stood at $2,283.1 Mn, which is a 33.2% increase year-on-year.

- EBITDA was reported at $461.6 Mn, up 35.9% on previous year.

- EBIT for the period increased by 44.7% to $240.8 Mn.

- Net profit after tax for the period increased by 43.1% to $140 Mn.

- Earnings per share for the period increased by 30.2% to 6.9 cents per share.

- The Board of Directors declared a final dividend (fully franked) of 1.90 cents per share. The record date and payment date for the final dividend are September 10, 2019 and October 3, 2019, respectively.

FY19 Key Financial Metrics (Source: Company Reports)

On the stock information front

On October 4, 2019, the stock of CWY settled the dayâs trade at $1.890 with a market cap of ~$3.94 Bn. Its current PE multiple is at 32.00x. Its 52 weeks high and 52 weeks low stand at $2.525 and $1.535, respectively. It has generated an absolute return of 5.79% for the last one year, -15.42% for the last six months, and -20.99% for the last three months.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.