In the age of contemporary evolution, technological advancement and start-ups, there are robust companies which have made a mark in the industry. This article centers around one such giant, Salesforce.com, Inc. referred to as SF or SFDC, which was rightly ranked Number One in Fortune's 100 Best Companies to Work For last year. Let us dig in, understanding the company and its latest launch which is likely to transform the retail industry:

Salesforce.com

The global leader in Customer Relationship Management and a much-discussed tech-giant of the present digital age, Salesforce has been every tech-savvy enthusiastâs one stop solution for CRM related queries. It was founded in 1999, headquartered in San Francisco, and initially specialised in SaaS. SF conducted its IPO in June 2004, on the NYSE, and raised US$110 million. Interestingly, one of the founding members of the company was ex-Oracle employee, Marc Benioff and its early investor was one of Oracleâs founder, Larry Ellison.

SF aims to help companies benefit from powerful technologies like cloud, mobile, social, IoT, artificial intelligence, voice and blockchain. The major chunk of revenue, for the company comes from its CRM service, though it sells a complementary suite of enterprise applications concentrating on customer service, analytics, marketing automation and application development.

Salesforce makes a move towards open banking

A lot of publicly listed Australian companies use Salesforceâs offerings- including Westpac Banking Corporation (ASX:WBC), National Australia Bank Limited (ASX: NAB), Telstra Corporation Limited (ASX:TLS) and Australia and New Zealand Banking Group Limited (ASX:ANZ). It should be noted that these companies have been assessing ways to use financial data, which can be accessed by their consumers as per the Consumer Data Right. In return, consequently due to better exposure and knowledge, these companies would be able to sell more products and personalise user experiences.

This is when Basiq, an open banking platform comes into the picture. It is important to understand the concept of open banking, on this note. Open banking is deemed to be a regulatory compliance issue and strives towards ensuring, that when clients wish to make their data available, they are able to do so. It is hence an opportunity to enhance the clientsâ lives with data from outside the bankâs vaults.

Coming back to Basiq, it is the platform focused on easing the acquisition of financial data which enables the creation of innovative financial solutions such as: personal financial management software, account verification services, credit scoring, credit risk assessment, wealth management and other interesting ideas. Basiqâs core product is affordability assessment reports, which provide an insight regarding clientâs spending and their financial stance in real-time. The company recently announced that Salesforce has joined in as an investor, along with WBC and NAB.

Industry experts believe that Basiq can help provide a holistic, 360-degree view of customers and financial data, to further create more personalised products. Moreover, in the Australian context, the acknowledgement of Basiq would prove fruitful following the Royal commissionâs expectations regarding responsible lending.

Pacing things up, since with the arrival of neobanks, traditional banks need to up their game, Basiq has reportedly applied to the Australian Competition and Consumer Commission to test the open banking regime from next month to be tagged as an official data recipient in the country.

Salesforce has been heavily investing in its Australian expansion in recent years and has close to 1500 staff in ANZ region and considers financial services and fintech as a core focus to tap in the region. The Basiq investment is likely to aid SF in creating a financial services cloud and help banks simplify the complex legacy systems.

Salesforce launches manufacturing, consumer goods cloud platforms

Before leaping into the news, one should know that 95% of consumer goods products are sold in physical stores, hence retail execution is a success tune of every consumer goods company. Moreover, the US consumer goods players spend approximately $200 billion annually towards in-store marketing and merchandising. However, according to consumer goods leaders, 52 per cent of their merchandising and marketing plans cease to be executed as intended in stores, inferring that over $100 billion in annual trade spend is not optimised.

Pertaining to the same, on 16 September 2019, SF welcomed Consumer Goods Cloud, which is the latest industry product from the Salesforce, and part of SFâs Customer 360 Platform for every category of paced consumer goods firms. SF has been working to tailor its CRM system for more industries and the launch is looked upon as the companyâs ongoing efforts to take on SAP and Oracle. It would allow consumer goods businesses to propel revenue growth and boost their return on investment via better retail execution resources.

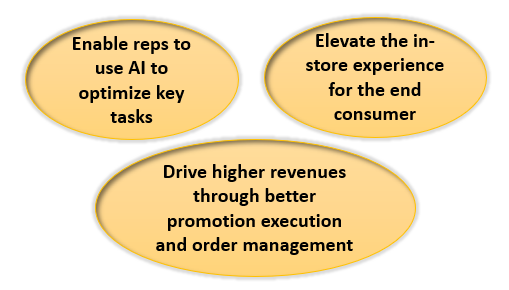

The below image expresses what Consumer Goods Cloud could possibly do:

The product is expected to provide a powerful and intelligent solution to field reps, and help them in improving visit planning, optimising visit execution, harnessing Einstein AI to optimise compliance and product placements and capturing orders and data. It would be available on 15 October 2019, while the Einstein Analytics for Consumer Goods would be available in February next year.

Salesforceâs Second Quarter Fiscal 2020 Results

In August 2019, the company announced its financial results for its fiscal second quarter ended 31 July 2019. The revenue was $4 billion, up 22 per cent y-o-y and the current remaining performance obligation was almost $12.1 billion, up 23 per cent y-o-y. The remaining performance obligation was almost $25.3 billion, up 20 per cent y-o-y.

SFâs subscription and support revenues were $3.75 billion, up by 22 per cent y-o-y and the professional services and other revenues amounted to $252 million, up by 14 per cent y-o-y.

The GAAP diluted earnings per share was reported to be $0.11, whereas the non-GAAP diluted earnings per share stood at $0.66. Cash generated from operations was $436 million, down by 5 per cent year-over-year. The total cash, its equivalents and the marketable securities amounted to $6.04 billion at the end of the period.

Given this outstanding quarter, the company edged up its FY20 revenue guidance to $16.9 billion, at the peak of the range. According to Chairman and co-CEO, Marc Benioff, SF is well-positioned for the future, based on its platforms - Customer 360 vision, Einstein AI and numerous Trailblazers innovating on its platform. More companies were turning towards SF, especially in this digital age, to propel their growth.

Share Performance

After the close of the trade session on the NYSE, on 19 September 2019, the SF stock traded under the code NYSE: CRM, quoted $153.60, up by 0.54 per cent, compared to its previous close. The market capitalisation of the company is $134.71 billion, and the stock has a P/E ratio of 127.54x.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.