Summary

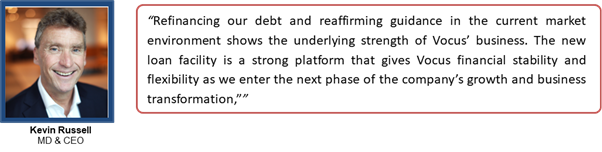

- Vocus positive announcement talks debt refinancing and reaffirming of FY20 guidance. In such difficult times, this depicts the underlying strength, financial stability and flexibility for future growth and transformation of its businesses.

- Tightening guidance range demonstrated financial discipline and resilience of Vocus amid economic disruption.

- Company’s varied portfolio supported customers’ requirements for high connectivity demand and maintained healthy cash balance.

- Vocus, with its robust balance sheet and strategic initiatives comfortably hold its position on ASX.

Telecommunication services are becoming ubiquitous, an integral part of personal lives, taking into consideration the way we work and do business. Since almost each one of us whether an individual, a company, or government, rely on the network of services which keep us connected.

Funnelling down to the communications sector across Australia; we cannot ignore the fact that, it is going through a phase of pivotal transformation and is experiencing significant structural changes, and consumer preferences, as the use of communications services are no longer steady.

Undoubtedly, innovative ecosystems and economic growth rest on the pillar of advanced communication networks. The technological development in the areas such as 5G, Artificial Intelligence and Internet of Things, etc. are integrated into the communications ecosystem, as the telecommunication players are relying more on these technologies for providing innovative solutions to the users.

There are various players prevalent in the Australian telecommunication sector such as Telstra Corporation Limited (ASX:TLS), TPG Telecom Limited (ASX:TPM) (TPG), Hutchison Telecommunications (Australia) Ltd. (ASX:HTA), Vocus Group Ltd. (ASX:VOC) to name few providing varieties of such services.

The merger of the two telecom players TPG and Vodafone Hutschison Australia (VHA) is keeping the investors occupied. Telstra’s developments are also looked upon, considering the impact of the TPG and VHA merger on the operators’ financials.

Now, Vocus secured the attention for a few minutes on 4 June 2020 with the announcement highlighting refinancing of its debt and reaffirmation of FY20 guidance.

Read on!

Vocus Group Limited (ASX:VOC) is a leading integrated player in telecommunications having a presence in the Asia-Pacific region, including Australia and New Zealand. The telecom operator focuses on offering specialist fibre and network solutions.

Retail business brands; Source: Company website

Let us enrich ourselves with the announcement by Vocus as on 4 June 2020

VOC announced that along with refinancing and extending the duration of its existing debt facilities, it has also reaffirmed its financial guidance for FY20 although the guidance range has been tightened.

- EBITDA for FY20 is expected to be in the range of AU$359 - AU$369 million which was earlier anticipated to be in the range of AU$359 - AU$379 million.

- The new syndicated debt facility comprises of AU$1,255 million and NZD 135 million with a weighted average term of 3.5 years, which in turn will provide ongoing financial stability and flexibility with the increase in the duration of the debt

- Net Leverage Ratio (Net Debt/EBITDA) covenant has been altered to a maximum of 3.25x at 30 June 2020 and 31 December 2020, reducing to 3.0x from 30 June 2021 and all subsequent periods

- Net Leverage Ratio reported at the most recent testing date was 2.8x, 31 December 2019 and is likely to reduce at 30 June 2020.

Source: Company announcement

Also, Read; Vocus Group Assures Shareholders with FY20 Guidance and Debt

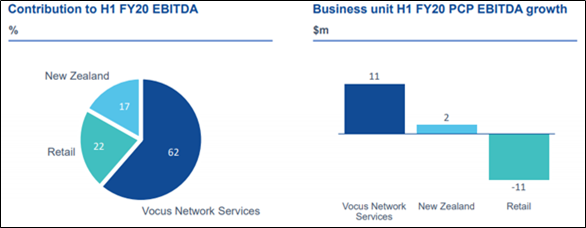

Let us have a look at the performance in the first half of FY 20 ending December 2019 (H1’20)

- VOC reported a 1.6 per cent increase in the underlying EBITDA on the back of strong cost control measures taken across all business units, which led to 7.9 per cent decline in overheads compared to the first half last year.

- The company reported a 7.5 per cent increase in the Statutory EBITDA to AU$181.2 million. However, there was a fall of 8.2 per cent in the Statutory EBIT to AU$45.9 million compared to the prior comparable period.

- Total revenues witnessed a fall of 6.9 per cent to AU$901.9 million with lower nonrecurring revenues in comparison with the previous corresponding period driven by the construction of the Coral Sea Cable which was completed in December 2019.

Vocus did not declare an interim dividend as it had signed an expanded Syndicated Facility Agreement with the lenders. Under this agreement, the company cannot pay dividends until the Net Leverage Ratio is less than 2.25x for two successive testing dates. Net Leverage Ratio was 2.81x as on 31 December 2019.

VOC had generated AU$121.1 million as net cash from the operating activities whereas net cash outflow from the investing activities decreased to AU$105.6 million in comparison with the previous compared period. The company’s net cash and cash equivalents at the end of 31 December 2019 was AU$89.290 million.

Growth in Vocus Network Services during H1 FY20 Source: Company's Report)

Did you read; Nasdaq index’s Tech Titans kicks off with Bold Performances

The company’s announcement of debt refinancing and FY20 guidance reaffirmation is reflected in the stock market wherein, on 4 June 2020, VOC traded at AU$3.210, increased by 2.855 per cent compared to the previous closing price. The company has a market cap of AU$1.94 billion.

_09_03_2024_01_03_36_873870.jpg)